The forex markets showed rather muted response to the latest batch of economic data released today. Euro has continued its near-term recovery, unaffected by Eurozone’s lower than expected CPI flash data coming. This lack of response likely stems from the understanding that a slight miss in CPI figures does not significantly alter ECB plans for a rate cut in June, supported by a growing consensus within the bank. Notably, even the more conservative members of ECB Governing Council have signaled openness to adjusting rates in June, further cementing expectations.

On the other side of the Atlantic, Dollar has also remained stable despite stronger than expected ADP private job data, with marked acceleration in annual wage growth for job-changers. This tepid response suggests that traders are likely waiting for the more comprehensive non-farm payroll report before making any decisive bets. With Fed fund futures currently indicating less a 60% chance of Fed rate cut in June at this point, a strong set of NFP numbers could easily sway the balance.

As the week progresses, Australian Dollar and Dollar are currently the frontrunners, followed by Euro. Meanwhile, Swiss Franc, Sterling, and Yen are lagging behind, with Canadian and New Zealand Dollars occupying the middle ground.

Technically, following Gold’s record run, Silver also broke out from the range established since last May. Current up trend from 17.54 is extended to target 61.8% projection of 17.54 to 26.12 from 21.92 at 27.22 first. Sustained break there will pave the way to 100% projection at 30.05 in medium term, which is close to 2021 high.

In Europe, at the time of writing, FTSE is down -0.28%. DAX is up 0.18%. CAC is up 0.15%. UK 10-year yield is down -0.0130 at 4.072. Germany 10-year yield is down -0.006 at 2.397. Earlier in Asia, Nikkei fell -0.97%. Hong Kong HSI fell -1.22%. China Shanghai SSE fell -0.18%. Singapore Strait Times fell -0.77%. Japan 10-year JGB yield rose 0.0143 to 0.767.

US ADP jobs rises 184k, pay growth heating up

US ADP private employment grew 184k in March, above expectation of 150k. By sector, goods-producing jobs increased 42k while service-providing jobs increased 142k. By establishment size, small companies added 16k jobs, medium companies added 93k, large companies added 87k.

For job-stayers, year-over-year pay gains was unchanged at 5.1%. Annual pay growth for job changes accelerated sharply from 7.6% to 10.0%.

Nela Richardson, Chief Economist at ADP, said: “March was surprising not just for the pay gains, but the sectors that recorded them. The three biggest increases for job-changers were in construction, financial services, and manufacturing. Inflation has been cooling, but our data shows pay is heating up in both goods and services.”

Eurozone CPI slows to 2.4% in Mar, core down to 2.9%, below expectations

Eurozone headline CPI slowed from 2.6% yoy to 2.4% yoy in March, below expectation of 2.5% yoy. CPI core (ex energy, food, alcohol & tobacco) slowed from 3.1% yoy to 2.9% yoy, below expectation of 3.0% yoy.

Looking at the main components services is expected to have the highest annual rate in March (4.0%, stable compared with February), followed by food, alcohol & tobacco (2.7%, down from 3.9%), non-energy industrial goods (1.1%, down from 1.6%) and energy (-1.8%, up from -3.7%).

ECB’s Holzmann: No fundamental objection to rate cut in Jun

In an interview with Reuters, ECB Governing Council member Robert Holzmann said that an interest rate cut in April is “not on my radar”. Instead, he highlighted June as a critical time for evaluating the bank’s next steps, emphasizing a commitment to data-driven decision-making regarding monetary easing.

“If the data allows it, a decision will be made,” he noted. “I don’t have an in-principle objection to easing in June, but I’d like to see the data first and I want to stay data-dependent.”

An intriguing aspect of Holzmann’s perspective is his consideration of Fed’s actions in relation to ECB’s. He mentioned, “If by June the data supports a strong case for a cut, and we’re a week before the Fed makes its decision, then it’s quite likely we’ll proceed, hoping the Fed follows suit.” However, if Fed doesn’t come along, “then it may reduce the economic impact of our move.”

Notably, Holzmann’s remarks signal a significant shift, especially considering his reputation as one of the more conservative voices within ECB, typically resistant to premature discussions of rate reductions. For him, the shift appears to be influenced by an increasingly benign inflation outlook. Also there were signs of economic fragility within Eurozone, which has been hovering on the brink of recession for multiple quarters.

Japan’s PMI services finalized at 54.1, marked increase in cost burdens

Japan’s PMI Services was finalized at 54.1 in March, a notable improvement from February’s 52.9 and marking the most significant growth for the past seven months. PMI Composite also rose to 51.7 from the previous month’s 50.6.

Usamah Bhatti, economist at S&P Global Market Intelligence, noted that near-term outlook for the service sector appears “robust”, as outstanding business, a key indicator of future work, continues to rise at “near-record rates”. Confidence regarding the 12-month future also remains strong among service providers.

However, the sector is not without its challenges, particularly on the price front. Businesses signaled “another marked increase in cost burdens,” underlining ongoing inflationary pressures. These pressures are mirrored in the broader Japanese private sector, where cost inflation has hit a “five-month high”.

Bhatti added that inflationary pressures, alongside BoJ’s recent shift away from negative interest rates, “will likely remain a downside risk to the Japanese private sector economy in the coming months.”

China’s Caixin PMI services edges up to 52.7, matches expectations

China’s Caixin PMI Services edged up slightly from 52.5 to 52.7 in March, matched expectations. PMI Composite, which tracks both manufacturing and service sectors, also increased from 52.5 to 52.7, indicating the most pronounced expansion of overall business activity since May 2023.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted the favorable economic performance in the early months of the year and the manufacturing sector’s five-month run in expansionary territory. He stated, “This indicates a generally stable and positive economic recovery”.

Despite these optimistic signs, the economist pointed out several challenges facing the Chinese economy. Wang Zhe identified persistent downward economic pressures, subdued employment levels, low prices, and insufficient effective demand as critical issues that have yet to be fully addressed.

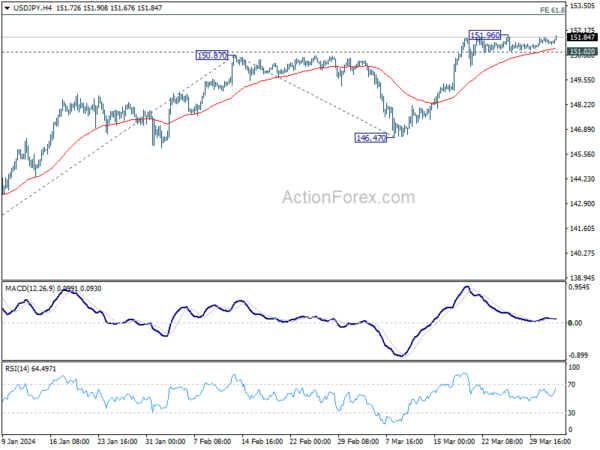

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 151.41; (P) 151.61; (R1) 151.75; More…

USD/JPY is staying in tight range below 151.96 and intraday bias remains neutral. On the downside, break of 151.02 support should confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 149.43). Nevertheless, sustained break of 151.93 key resistance will confirm long term up trend resumption. Next near term target will be 61.8% projection of 140.25 to 150.87 from 146.47 at 153.03.

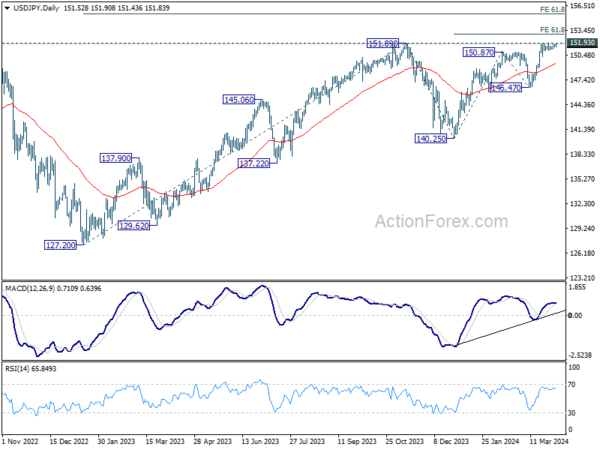

In the bigger picture, correction from 151.87 (2023) high could have completed at 140.25 already. Rise from 127.20 (2023 low), as part of the long term up trend, is probably ready to resume. Decisive break of 151.93 resistance (2022 high) will confirm this bullish case. Next medium term target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.20. This will remain the favored case as long as 146.47 support holds, in case of another pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Services PMI Mar F | 54.1 | 54.9 | 54.9 | |

| 01:45 | CNY | Caixin Services PMI Mar | 52.7 | 52.7 | 52.5 | |

| 08:00 | EUR | Italy Unemployment Feb | 7.50% | 7.20% | 7.20% | 7.30% |

| 09:00 | EUR | Eurozone CPI Y/Y Mar P | 2.40% | 2.50% | 2.60% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar P | 2.90% | 3.00% | 3.10% | |

| 09:00 | EUR | Eurozone Unemployment Rate Feb | 6.50% | 6.40% | 6.40% | 6.50% |

| 12:15 | USD | ADP Employment Change Mar | 184K | 150K | 140K | 155K |

| 13:45 | USD | Services PMI Mar F | 51.7 | 51.7 | ||

| 14:00 | USD | ISM Services PMI Mar | 52.8 | 52.6 | ||

| 14:30 | USD | Crude Oil Inventories | -0.3M | 3.2M |