Swiss Franc faced broad selling pressure in European session, driven by CPI lower than CPI data. Inflation in Switzerland slowed to its lowest since September 2021 at 1.0%, and remained within the SNB’s target range for the tenth consecutive month. This development sparked speculation among market participants about the possibility of further monetary easing by SNB, with some expecting a rate cut in each of June and September. SNB had already taken a lead among major central banks by cutting its key rate to 1.5% in March, and more could be in the queue.

On the other hand, Australian Dollar gained momentum from the continued rally in precious and industrial metals, with New Zealand and Canadian Dollars trailing behind. Japanese Yen is currently as the second weakest currency for the day, following Swiss Franc, while Dollar and Sterling showed relative weakness. Euro, however, saw a slight uplift due to upward revision in PMI Services data, coupled with the ECB’s meeting minutes, which reinforced expectations for a potential rate cut in. At the same time, ECB’s meeting accounts came in as expected, indicating that suitability for June for rate cut rather than April.

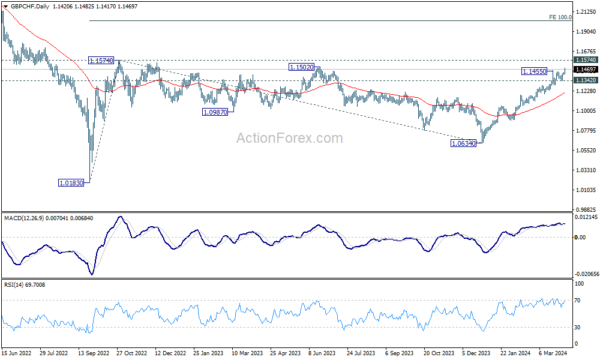

Technically, GBP/CHF’s rally from 1.0634 resumed by breaking through 1.1455 resistance today. Near term outlook will stay bullish as long as 1.1342 support holds. Decisive break of 1.1574 resistance will confirm resumption of whole medium term rise from 1.0183 (2022 low), and set the stage for 100% projection of 1.0183 to 1.1574 from 1.0634 at 1.2025.

In Europe, at the time of writing, FTSE is up 0.41%. DAX is up 0.06%. CAC is down -0.15%. UK 10-year yield is down -0.0508 at 4.010. Germany 10-year yield is down -0.029 at 2.372. Earlier in Asia, Nikkei rose 0.81%. Japan 10-year JGB yield rose 0.0114 to 0.778. Singapore Strait Times rose 0.38%. Hong Kong and China were on holiday.

ECB March meeting accounts: Consensus against immediate rate cut, eyes on June for Data

ECB’s March meeting accounts unveiled a unified stance among Governing Council members against discussing rate cuts at that time, citing it as “premature.” However, the narrative within the ECB is evolving, with increasing acknowledgment that “the case for considering rate cuts was strengthening,” pointing towards a strategic shift contingent on forthcoming economic data.

The meeting underscored a collective patience to assess more comprehensive data before making decisive moves on interest rates. Specifically, the council highlighted the importance of the June meeting, which will benefit from new staff projections and a broader array of data, particularly concerning “wage dynamics.” This contrasts with the April meeting, where available data would be “much more limited,” thus making it harder to be sufficiently confident in the ongoing disinflation process’s durability.

ECB’s deliberations reflect caution over the sustainability of disinflation, especially concerning “services and domestic inflation.” The uncertain prospects for wage growth, productivity, and profit margins are central to these concerns. For ECB to consider rate reductions with greater confidence, incoming data must align with March’s ECB staff projections, affirming that disinflation will consistently head towards the ECB’s target.

Eurozone PMI services finalized at 51.5, gradually finding its footing

Eurozone PMI Services was finalized at 51.5 in March, up from February’s 50.2, a 9-month high. PMI Composite was finalized at 50.3, up from prior month’s 49.2, a 10-month high.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said the service sector is “gradually finding its footing.” He further highlighted the importance of wage growth outpacing inflation, enhancing households’ purchasing power and supporting the service sector’s revival. However, he tempered expectations by noting, “a full-fledged boom is not on the horizon.”

Despite economic challenges, service providers have continued to expand their workforce. Moreover, business expectations within the service industry have soared to their highest in over two years, surpassing the long-term average.

Meanwhile, March witnessed a slight deceleration in inflation regarding both costs and sales prices, a development likely to be viewed favorably by ECB. Despite this positive sign, de la Rubia cautioned against premature conclusions about a turning trend in inflation, maintaining the forecast that interest rate cuts are more likely in June than in April.

UK PMI Services finalized at 53.1, inflation pressures persist

UK PMI Services was finalized at 53.1 in March, down from February’s 53.8. PMI Composite was finalized at 52.8, down from prior month’s 53.0.

Tim Moore, Economics Director at S&P Global Market Intelligence, said, “The solid growth rate achieved in March reinforces the view that a rebound in service sector performance is helping the UK economy to pull out of last year’s shallow recession.”

Meanwhile, Input prices have continued to rise sharply, with inflation rates only slightly below their six-month average. The primary factors contributing to the uptick in input costs include higher salary payments and increased transportation bills.

The rate at which prices charged by service providers have increased slowed to its lowest point since September 2023. Despite this deceleration, the index remains well above its long-term trend, signaling enduring inflationary pressures within the UK’s domestic economy.

Swiss CPI falls to 1% yoy in Mar, misses expectations

Swiss CPI was flat month-over-month in March, below expectation of 0.3% mom. Core CPI (excluding fresh and seasonal products, energy and fuel) rose 0.1% mom. Domestic products prices fell -0.2% mom. Imported products pries rose 0.7% mom.

Over the 12-month period, CPI slowed from 1.2% yoy to 1.0% yoy, below expectation of 1.4% yoy. Core CPI slowed from 1.1% yoy to 1.0% yoy. Domestic products prices slowed from 1.9% yoy to 1.8% yoy. Imported products prices fell from -1.0% yoy to -1.3% yoy.

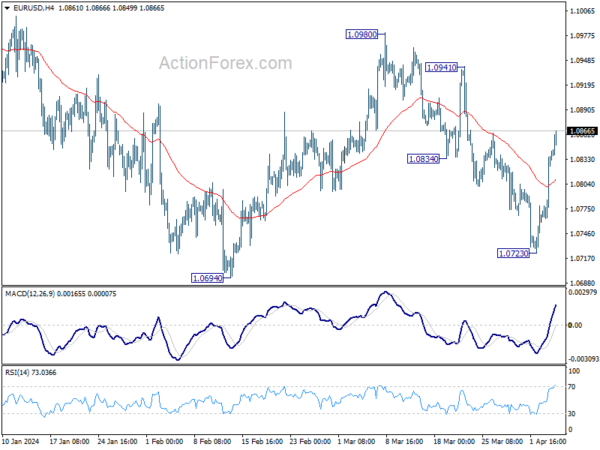

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0788; (P) 1.0812; (R1) 1.0861; More…

Intraday bias in EUR/USD remains on the upside at this point. Rise from 1.0723 is seen as the third leg of the corrective pattern from 1.0694. Further rally would be seen to 1.0941/0980 resistance zone. On the downside, though, below 55 4H EMA (now at 1.0807) will bring retest of 1.0694/0723 support zone instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Feb | 14.90% | -8.80% | -8.60% | |

| 00:30 | AUD | Building Permits M/M Feb | -1.90% | 3.20% | -1.00% | -2.50% |

| 06:30 | CHF | CPI M/M Mar | 0.00% | 0.30% | 0.60% | |

| 06:30 | CHF | CPI Y/Y Mar | 1.00% | 1.40% | 1.20% | |

| 07:45 | EUR | Italy Services PMI Mar | 54.6 | 53.2 | 52.2 | |

| 07:50 | EUR | France Services PMI Mar F | 48.3 | 47.8 | 47.8 | |

| 07:55 | EUR | Germany Services PMI Mar F | 50.1 | 49.8 | 49.8 | |

| 08:00 | EUR | Eurozone Services PMI Mar F | 51.5 | 51.1 | 51.1 | |

| 08:30 | GBP | Services PMI Mar | 53.1 | 53.4 | 53.4 | |

| 09:00 | EUR | Eurozone PPI M/M Feb | -1.00% | -0.70% | -0.90% | |

| 09:00 | EUR | Eurozone PPI Y/Y Feb | -8.30% | -8.60% | -8.60% | -8.00% |

| 11:30 | USD | Challenger Job Cuts Y/Y Mar | 0.70% | 8.80% | ||

| 11:30 | EUR | ECB Meeting Accounts | ||||

| 12:30 | CAD | Trade Balance (CAD) Feb | 1.4B | 0.5B | 0.5B | 0.6B |

| 12:30 | USD | Trade Balance (USD) Feb | -68.9B | -66.0B | -67.4B | -67.6B |

| 12:30 | USD | Initial Jobless Claims (Mar 29) | 221K | 212K | 210K | 212K |

| 14:30 | USD | Natural Gas Storage | -42B | -36B |