The Reserve Bank of India (RBI) on Friday announced its decision to allow Small Finance Banks (SFBs) to use permissible rupee interest derivative products.

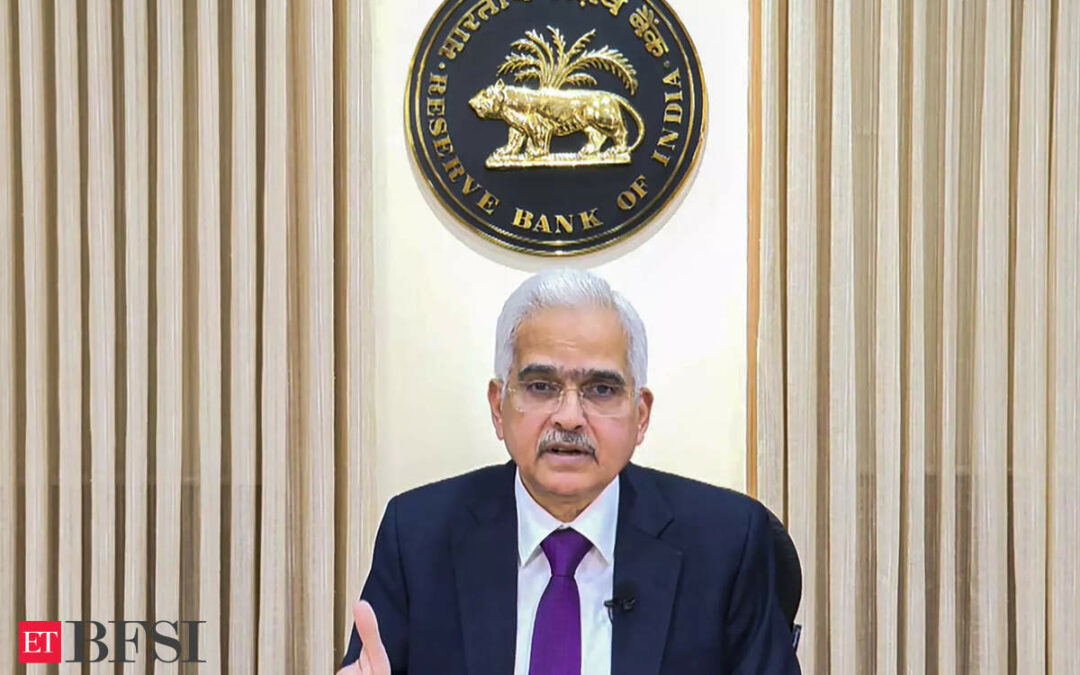

While announcing the key outcomes of the Monetary Policy Committee (MPC) decision, the RBI Governor Shaktikanta Das said this move will allow further flexibility to SFBs for hedging their interest rate risk and enhance their resilience.

As per the current establishment, the Small Finance Banks are permitted to use only Interest Rate Futures (IRFs) for proprietary hedging.

What is an interest rate derivative?

An interest rate derivative is a financial instrument with a value that is linked to the movements of an interest rate or rates. These may include futures, options, or swaps contracts.

Notably, the regulations on Interest Rate Derivatives have so far been issued separately for each product, including for products traded on exchanges. These regulations were framed with a view to guide the initial evolution of the market through prescriptive requirements.

| SFBs, as of now, were allowed to use IRFs only as a financial derivative that allows exposure to changes in interest rates. Interest rate futures prices move inversely to interest rates. |

The interest rate futures contract lets traders lock in the price of the interest-bearing asset for a future date.

It has now been decided to allow SFBs to use permissible rupee interest derivative products.

Boost the balance sheet resilience

The Small Finance Banks believed that the move by RBI will provide flexibility for hedging operations and help boost the balance sheet resilience.

Speaking on the development, Sanjay Agarwal, Founder, MD & CEO, AU Small Finance Bank said, “We welcome the regulatory announcement of allowing SFBs to utilize rupee interest derivative products for hedging interest rate risks. This will impart greater flexibility for our hedging operations and help boost the balance sheet resilience.”

“The decision to expand permissible rupee interest derivative products for small finance banks underscores the imperative for agility and proactive risk management. This will help the banking sector to enhance hedging strategies, fortify resilience and navigate market dynamics with confidence”Sarvjit Singh Samra, MD & CEO, Capital Small Finance Bank said.

ETBFSI now has its WhatsApp channel. Join for all the latest updates.