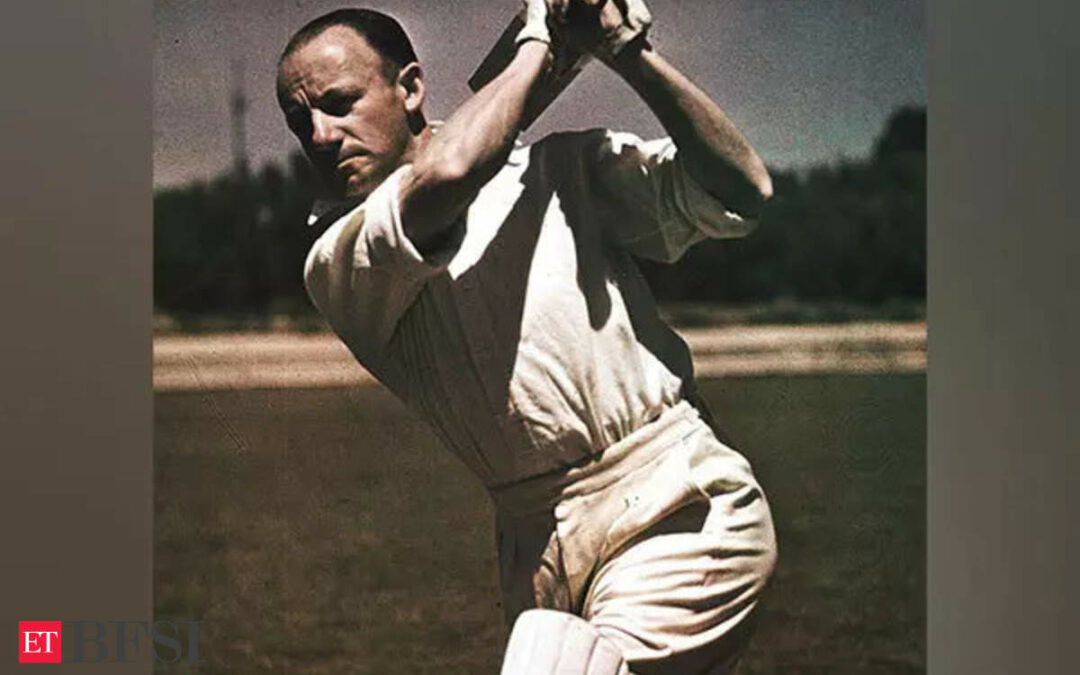

Donald Bradman averages a staggering 99.94 in test matches. The next batsman is in the 60s.

His record of six consecutive test centuries remains unbroken after 87 years. Like Bradman, the Sensex has set a record by giving positive returns and hitting all-time highs in the last eight calendar years and is going strong in the ninth year.

The market moves on the ‘Triveni Sangam’ of Flows, Sentiments, and Fundamentals.

Domestic flows are expected to remain firm, while global flows seem to be a bit apprehensive about higher valuations. They have a choice of buying ‘sundar’ (a market like India which has given better returns but is trading at expensive valuations) or ‘sasta’ (markets like China, Brazil, South Africa, and Russia which are trading at cheap valuations). It is a difficult choice.

They will likely be a buyer at lower levels if other peers continue to perform badly on the growth or governance side. They could also be a buyer at current levels if we can convince them that quality doesn’t come cheap.

Local as well as global sentiments are positive to neutral about India as not only are we doing well to emerge as the fastest-growing major economy in the world, but also our peers are scoring self-goals. In the BRICS, India stands out as Brazil, Russia, China, and South Africa are entangled in their challenges. The corporate profit-to-GDP ratio is well above the historical average and has grown in the high teens in the post-Covid period, supporting above-average equity valuations. Unlike past market rallies, the ‘Triveni Sangam’ of flows, sentiments, and fundamentals support the current rally.

There are pockets of exuberance. Low float counters have witnessed tremendous momentum, with prices and valuations reaching uncharted territories. It is unlikely that those companies will be able to raise fresh equity capital at current valuations. There is a sympathy momentum building up in some counters, benchmarking those lofty valuations. Social media-influenced trading, get-rich-quick mentality and greed are also adding fuel to the fire. These are the minefields that are worth avoiding. There may be short-term pain in not riding the momentum, but there will be long-term gain.

I do not doubt that India’s long-term return will tower over other peers like Donald Bradman. However, do remember that Bradman scored a duck in seven out of his 80 appearances. He scored no runs in 8.75% of all his appearances. Even the greatest of batters have scored a duck. It is the nature of the market to swing between Greed and Fear, between Teji and Mandi.

Nobody can predict the future. Investors must follow the dharma of asset allocation. Don’t invest based on past performance. Don’t invest with unreasonable expectations anchored on the last year’s return and for the short term. Be aware that if Bradman can occasionally score a duck, so can the market. Most importantly, keep faith that the Indian market will tower over peers like Bradman.

Maybe you will have to wait a little for the fun to begin. Undoubtedly, ‘Sitaron se aage jahan aur bhi hai, lekin market ke imtihan aur bhi hain’.

(The author is Managing Director at Kotak Mutual Fund)