Assembly lines around the world are starting to hum again, marking a turn in a years-long manufacturing slump.

The nascent industrial recovery is led by the world’s two biggest economies. Chinese manufacturing has made a strong start to the year, boosting the economic outlook, and US factory activity unexpectedly expanded last month for the first time since September 2022, buoyed by rising new orders and a jump in production.

JPMorgan/S&P Global’s manufacturing index notched a second month above expansionary territory in March and sits at the highest level since July 2022. If sustained, that’ll help catalyze a broader and stronger economic recovery that’s already spreading beyond the US.

“Manufacturing PMIs are back to expansion in key economies including China, the UK and the US,” said Janet Mui, head of market analysis at RBC Brewin Dolphin, referring to purchasing manager indexes. “The synchronized nature of the recovery tends to be good signal for a cyclical upturn in global growth.”

Greg Clement, who owns Milwaukee, Wisconsin-based Argon Industries, which makes high-end metal products used in everything from refrigerators and medical equipment to the defense sector, is among those benefiting.

“We are seeing an uptick in projects,” he said. “Six months ago it was not good and right now we have a really good pipeline of work for 2024.”

While it’s still early days — a surprise downturn in China’s exports suggests the recovery may be bumpy — the activity nonetheless marks a departure from the slowdown that took hold globally as consumer demand pivoted to spending more on services such as travel and dining out instead of buying more goods as pandemic-era restrictions ended.

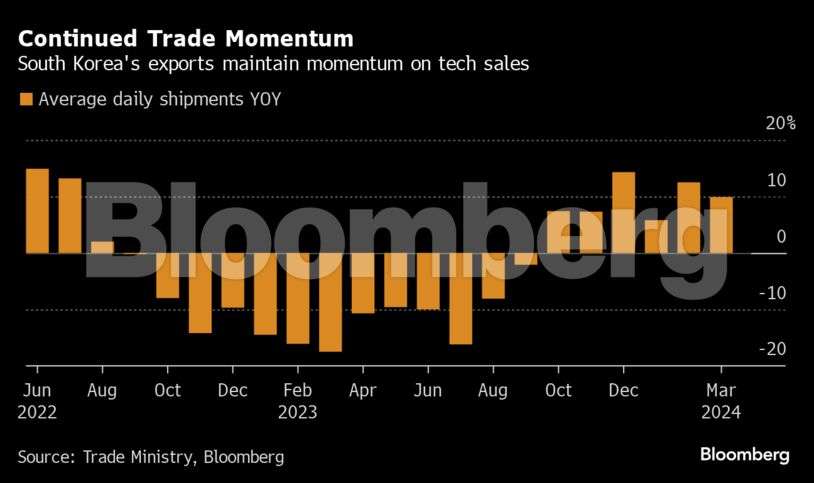

Adding to the optimism is German industrial production that started the year on a two-month roll, underpinning hopes that Europe’s biggest economy may emerge from a recession. Asian export powerhouses including South Korea and Japan are also showing improvement.

The Asian Development Bank expects a turnaround in merchandise exports starting around midyear will drive growth in Thailand, Vietnam, the Philippines and Malaysia. Leading the way for South Asia this year and next will be India, which wants to rival China as the world’s factory floor.

That manufacturing strength will ensure the world skirts a recession and grows closer to its potential, says Moody’s Analytics Chief Economist Mark Zandi.

“Global manufacturing activity appears to be slowly reviving,” Zandi said. “I don’t expect global manufacturing to come roaring back given continued high global interest rates, higher oil prices, and supply-chain disruptions, but I do expect continued improvement.”

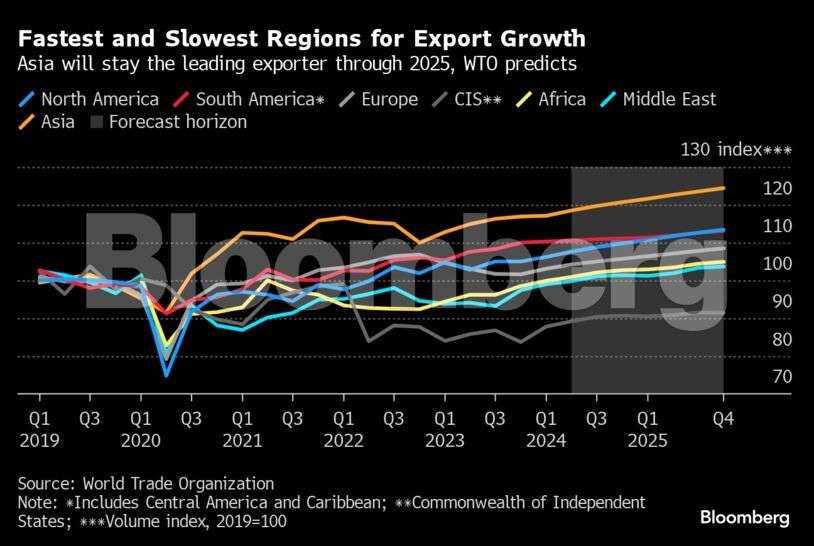

Such uncertainty is why the World Trade Organization predicted this week that the volume of global merchandise trade will rebound only modestly this year from a rare contraction last year. Total goods trade will increase 2.6% in 2024, the WTO said, a downgrade from its 3.3% growth projection in October and in line with the average pace since 2010.

“The lingering effects of high energy prices and inflation weighed especially heavily on demand for trade-intensive manufactured goods” in 2023, the WTO said in the report. “But this should recover gradually over the next two years as inflationary pressures ease and as real household incomes improve.”

Still, any talk of a cyclical upturn needs to be distinguished from longer-term realignments. ING economists called the latest report in Germany showing higher industrial production a “balm for the German economic soul.”

But they also warned that there’s still a way to go before declaring an end to the downturn. German factories are operating 8% below their pre-pandemic levels and industries are still undergoing strctural shifts in trade tied to geopolitical tensions.

In the UK, a report Friday showed manufacturing jumped 1.2% last month, a much stronger than expected showing, following a March reading on factory purchasing managers that was the best since July 2022.

Southern European economies are punching above their weight as growth drivers in the euro area. Business surveys by S&P Global released earlier this month showed Spain and Italy beat economists’ expectations with faster expansion in March.

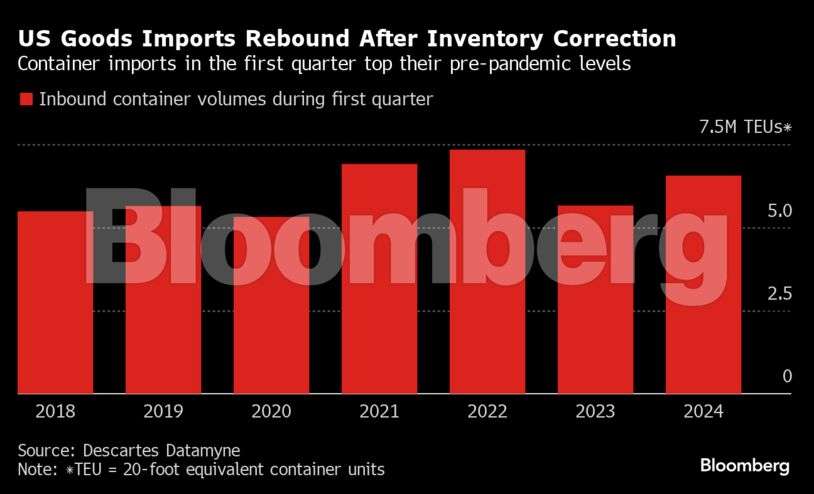

In the US, the consumption engine for foreign goods appears to be revving up again after companies let inventories run off last year and supply chains that got knotted up during Covid look normal again.

The volume of US container imports reached 6.56 million during the first quarter, up 16% from a year earlier and well above pre-pandemic levels in 2018 and 2019, according to Descartes Datamyne.

James Knightley, chief international economist at ING, described the improving outlook as more stabilization than rebound and the headwinds won’t be unwinding anytime soon — but it’s a turn nonetheless.

“I would say there is some cautious optimism that the worst is over,” he said.