The forex markets are primarily focused on Yen’s continued broad-based decline as another trading week commences. In particular, the Japanese currency has now reached a new 34-year low against Dollar. Despite frequent official warnings and the expressed readiness to intervene against speculative movements, Japanese authorities have yet to take concrete action. Finance Minister Shunichi Suzuki reiterated today that Japan is “closely monitoring developments” and remains prepared to “take all necessary steps,” yet the absence of intervention has left many market participants surprised and Yen’s weakness unabated.

In other areas of the global financial markets, reactions have been relatively subdued to geopolitical events in the Middle East over the weekend. For what it claimed to be retaliation to an attack on its Damascus consulate, Iran launched drone and missile attack to Israel, causing modest damage. Iran stated that it considered “the matter concluded.” This development, while significant, has not sparked substantial volatility in the broader markets.

In the currency spectrum, while most major pairs and crosses are trading within the ranges established last week, the USD/JPY stands out with its pronounced movements. Australian Dollar is showing mild strength with other commodity currencies. Dollar, Yen, and Swiss Franc are weaker. Euro and Sterling are positioned in the middle.

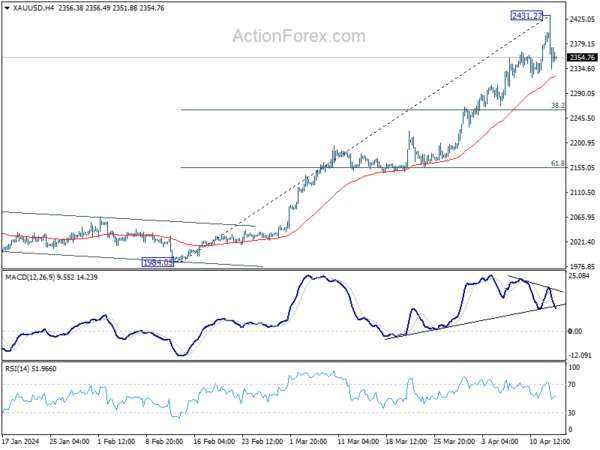

Technically, considering bearish divergence condition in 4H MACD, Gold has likely formed a short term top at 2431.27 already. Some consolidations should follow now, with risk of deeper pullback through 55 4H EMA (now at 2321.76). But strong support should be seen from 38.2% retracement of 1984.05 to 2431.27 at 2260.43) to bring rebound. Gold’s up trend is still expected to resume to 2500 handle before forming a major top around there.

In Asia, at the time of writing, Nikkei is down -0.93%. Hong Kong HSI is down -0.65%. China Shanghai SSE is up 1.27%. Singapore Strait Times is down -0.99%. Japan 10-year JGB yield is down -0.0085 at 0.858.

ECB’s Villeroy: June rate cut, then by gradualistic easing this year

ECB Governing Council member Francois Villeroy de Galhau indicated an interest rate cut is on the table at the next meeting in June. Onwards, there would be more policy loosening this year with a “gradualism” approach.

“Bar a surprise, we should decide on the first cut at our next meeting on June 6. We are indeed growing more and more confident in the disinflation path,” Villeroy said in an interview with Le Journal du Dimanche.

“The interest rate tool has been an effective weapon against inflation. We had to lift that rate to 4% but it is less than in the United States, where it stands at 5.5%,” he added.

Further elaborating on the future direction of ECB policy, Villeroy emphasized a cautious but flexible approach to further rate reductions: “The June rate cut should be followed by more rate cuts by the end of the year; I call for a pragmatic and yet adequately nimble gradualism, based on economic data.”

Moreover, Villeroy made it clear that while ECB is moving away from the high-interest rate environment of recent years, it does not intend to revert to the ultra-low or negative rates that characterized the period from 2015 to 2022.

NZ BNZ services plummets to 47.5, signaling over 2% GDP contraction

New Zealand’s service sector saw a significant downturn in March, as evidenced by BusinessNZ Performance of Services Index, which fell sharply from 52.6 to 47.5. This decline places the index back in contraction territory, and well below its long-term average of 53.4.

The components of the PSI painted a concerning picture: activity and sales saw a steep decline from 52.4 to 44.8. While employment showed a slight improvement, rising marginally from 49.4 to 50.1, new orders and business fell significantly from 55.5 to 48.3. Stocks and inventories also dropped from 52.2 to 46.9, and supplier deliveries was stagnant at 48.7.

Business sentiment mirrored these negative trends, with proportion of negative comments rising sharply to 63.0% in March, up from 57.3% in February and 53.0% in January. Respondents frequently cited ongoing recession and persistent inflationary pressures, including rising costs of living, as key factors impacting their operations.

BNZ Senior Economist Doug Steel stated, “Combining today’s weak PSI activity with last week’s similarly weak PMI activity, yields a composite reading that would be consistent with GDP falling by more than 2% compared to year-earlier levels. That is much weaker than what folk are forecasting.”

Inflation data from Japan, UK, Canada and New Zealand to highlight the week

A slew of important economic data are featured this week, with inflation figures from Japan, UK, Canada, and New Zealand being the main focuses.

Canadian CPI stands out as potentially the most impactful, given its direct implications on BoC’s rate decisions. Market participants are keenly watching this data as it could sway the likelihood of a June rate cut. While upside surprises might reduce the chances of such a cut, downside surprises could reinforce the case for the commencement of monetary easing.

For BoE, slower-than-expected decline in CPI would reinforce the likelihood of limiting rate cuts to just two for the year, beginning in September. For New Zealand, Q1 CPI data will be critical in shaping RBNZ’s economic projections due in May. Following the surprisingly hawkish statement last week, economists are maintaining the expectation that there will be no RBNZ rate cuts until 2025, although this outlook could shift depending on upcoming inflation trends. Japan’s CPI release, on the other hand, is expected to have a more subdued impact. With BoJ unlikely to consider another rate hike until the second half of the year, the immediate repercussions of this data may be limited.

Beyond these specific inflation-related releases, the week is also loaded with other significant data points that could affect global market sentiment. These include US retail sales, which will offer insights into consumer spending trends; Germany’s ZEW economic sentiment indicator, which gauges the six-month economic outlook among financial experts; employment and retail sales data from the UK; employment figures from Australia; and China’s GDP.

Here are some highlights for the week:

- Monday: New Zealand BNZ services; Japan machines orders; Swiss PPI; Eurozone industrial production; Canada housing starts, manufacturing sales, wholesale sales; US retail sales, Empire state manufacturing, business inventories, NAHB housing index.3

- Tuesday: China GDP, industrial production, retail sales, fixed asset investment; UK employment; Eurozone trade balance; Germany ZEW economic sentiment; Canada CPI; US building permits and housing starts, industrial production.

- Wednesday: New Zealand CPI; Japan trade balance; UK CPI, PPI; Eurozone CPI final; Fed’s Beige Book.

- Thursday: Australia employment, NAB quarterly business confidence; Japan tertiary industry index; Swiss trade balance; US jobless claim, Philly Fed survey, existing home sales.

- Friday: Japan CPI; Germany PPI; UK retail sales.

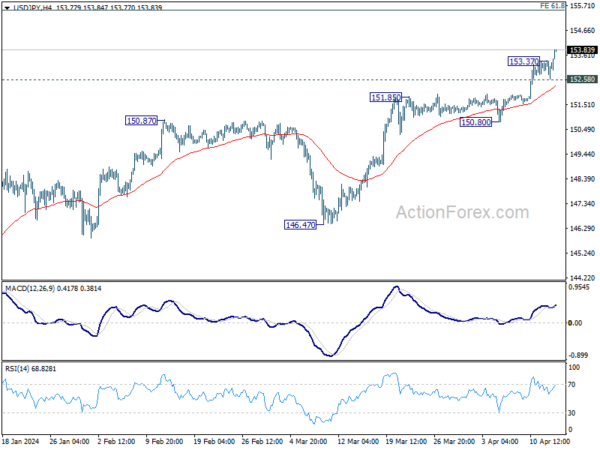

USD/JPY Daily Outlook

Daily Pivots: (S1) 152.78; (P) 153.08; (R1) 153.58; More…

Intraday bias in USD/JPY is back on the upside as USD/JPY’s up trend resumed through 153.37 temporary top. Further rally should be seen to 155.20 fibonacci projection level next. On the downside, below 152.58 will turn intraday bias neutral and bring consolidations again, before staging another rally.

In the bigger picture, current rise from 140.25 is seen as the third leg of the up trend from 127.20 (2023 low). Next target is 61.8% projection of 127.20 to 151.89 from 140.25 at 155.20. Outlook will now remain bullish as long as 146.47 support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Mar | 47.5 | 53.0 | 52.6 | |

| 23:50 | JPY | Machinery Orders M/M Feb | 7.70% | 0.80% | -1.70% | |

| 06:30 | CHF | Producer and Import Prices M/M Mar | 0.20% | 0.10% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Mar | -2.00% | |||

| 09:00 | EUR | Eurozone Industrial Production M/M Feb | 0.80% | -3.20% | ||

| 12:30 | CAD | Manufacturing Sales M/M Feb | 0.70% | 0.20% | ||

| 12:30 | CAD | Wholesale Sales M/M Feb | 0.80% | 0.10% | ||

| 12:30 | USD | Empire State Manufacturing Index Apr | -9 | -20.9 | ||

| 12:30 | USD | Retail Sales M/M Mar | 0.40% | 0.60% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Mar | 0.50% | 0.30% | ||

| 14:00 | USD | Business Inventories Feb | 0.30% | 0.00% | ||

| 14:00 | USD | NAHB Housing Market Index Apr | 52 | 51 |