Euro rises broadly today, lifted by significant improvement in economic sentiment indicators from Germany and the broader Eurozone. Despite these positive signals, current situation assessment remains subdued. While the worst may be over for Germany’s economy, in particular the manufacturing sector, recovery is still in its nascent stages and further nurturing is required. The uptick in Euro is more likely a corrective move rather than a definitive trend reversal, given the overall weak momentum of the common currency.

Sterling is ranking as the second strongest performer for the day, next to Euro. The Pound largely overlooks the uptick in UK unemployment rate. Market focus remains on the persistently high wage inflation. Current conditions suggest it is still premature for BoE to consider interest rate cuts, as wage pressures do not yet show signs of significant easing.

On the other hand, commodity currencies are trading lower across the board, with Canadian Dollar facing renewed selling pressure following reports of continued slowdown in core inflation measures. Meanwhile, Dollar, while maintaining strength against commodity currencies and Yen, is showing signs of fatigue against Europeans. Yen finds itself in a middling position, largely uninspired by Japan’s tepid verbal intervention.

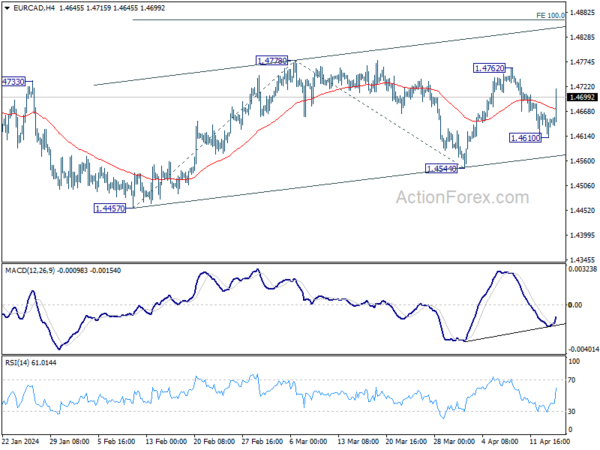

From a technical standpoint, EUR/CAD’s strong rebound today suggests that pull back from 1.4762 has completed at 1.4610 already. More importantly, rise from 1.4457 low is likely still in progress. Further rally should be seen to 1.4762/4778 resistance zone first. Decisive break there will target 100% projection of 1.4457 to 1.4778 from 1.4544 at 1.4865 next.

In Europe, at the time of writing, FTSE is down -1.33%. DAX is down -0.95%. CAC is down -0.96%. UK 10-year yield is up 0.0056 at 4.299. Germany 10-year yield is up 0.022 at 2.469. Earlier in Asia, Nikkei fell -1.94%. Hong Kong HSI fell -2.12%. China Shanghai SSE fell -1.65%. Singapore Strait Times fell -1.22%. Japan 10-year JGB yield rose 0.0064 to 0.872.

Canada’s CPI edges up to 2.9%, but core measures slow

In March, Canada’s CPI saw a slight increase, rising from 2.8% yoy to 2.9% yoy. However, when excluding gasoline, CPI actually slowed from 2.9% yoy to 2.8% yoy.

A closer look at the components reveals that services prices experienced a sharper increase, rising from 4.2% yoy to 4.5% yoy. This outpaced the change in goods prices, which decelerated slightly from 1.2% yoy to 1.1% .

Further dissecting the inflation data, the core inflation measures indicated a cooling trend. Median CPI decreased from 3.0% yoy to 2.8% yoy, while Trimmed CPI reduced slightly from 3.2% yoy to 3.1% yoy. Additionally, Common CPI, which tracks common price changes across categories, also slowed from 3.1% yoy to 2.9% yoy.

German ZEW jumps to 42.9, euro’s depreciation helps

German ZEW Economic Sentiment jumped from 31.7 to 42.9 in April, well above expectation of 35.1, and marks the highest level since March 2022. But Current Situation Index improved just slightly from -80.5 to -79.2.

Eurozone ZEW Economic Sentiment also surged from 33.5 to 43.9, above expectation of 37.2. Current Situation Index climbed 6.0 pts to -48.8.

ZEW President Achim Wambach noted, “A recovering global economy is boosting expectations for Germany, with half of the respondents anticipating the country’s economy to pick up over the next six months.”

This optimism is largely driven by improved assessments of the economic situations in Germany’s major export destinations. The positive outlook is further buoyed by the expected “appreciation of the US dollar against the euro”, which could benefit Eurozone exporters by making their goods more competitive in international markets.

ECB’s Rehn points to June rate cuts, but warns of geopolitical risks

ECB Governing Council member Olli Rehn highlighted in a statement that reduction in policy restrictions could commence in June as long as “inflation continues to fall as projected.”

But he also addressed the predominant risks, identifying “geopolitics” as the primary source of uncertainty. He specifically pointed to the “deteriorating situation in Ukraine” and the “possible escalation of the Middle East conflict” as critical factors with potential ramifications on the European economy, especially concerning energy prices and overall economic stability.

Looking ahead to ECB’s June meeting, the council will review an “updated assessment of the inflation outlook, the dynamics of underlying inflation, and the strength of monetary policy transmission.”

This upcoming analysis will be crucial in determining whether ECB has sufficient confidence that inflation is sustainably converging towards its target, leading to a decision to “start to ease the stance of monetary policy and cut interest rates.”

However, Rehn cautioned that this prospective easing is conditional on the absence of “further setbacks, for instance in the geopolitical situation and therefore in energy prices.”

UK payrolled employment falls -67k in Mar, unemployment rate rises to 4.2% in Feb

UK payrolled employment fell -67k or -0.2% mom in March. Median monthly pay rose 5.6% yoy, slowed from prior month’s 6.2% yoy. Claimant count rose 10.9k, below expectation of 17.2k.

In the three months to February, unemployment rate rose from 4.0% to 4.2%, above expectation of 4.0%. Average earnings including bonus rose 5.6% yoy, unchanged from prior month’s rate. Average earnings excluding bonus rose 6.0%, down slightly from January’s 6.1% yoy.

China’s GDP grows 5.3% yoy in Q1, but March data weak

China’s GDP grew 5.3% yoy in Q1, above expectation of 5.0% yoy. Comparing to Q4, GDP grew 1.6% yoy. By sector, primary industry was up 3.3% yoy, secondary industry rose 6.0% yoy, tertiary industry rose 5.0% yoy.

In March, retail sales rose 3.1% yoy, below expectation of 5.1% yoy. Industrial production rose 4.5% yoy, below expectation of 6.0% yoy. Fixed asset investment rose 4.5% ytd yoy, above expectation of 4.3%.

USD/CNH is steady after the release with focus on 7.2815 resistance. firm break there will resume whole rebound from 7.0870 and target 100% projection of 7.0870 to 7.2318 from 7.1715 at 7.3163. For now, outlook will stay bullish as long as 7.2354 support holds, in case of retreat.

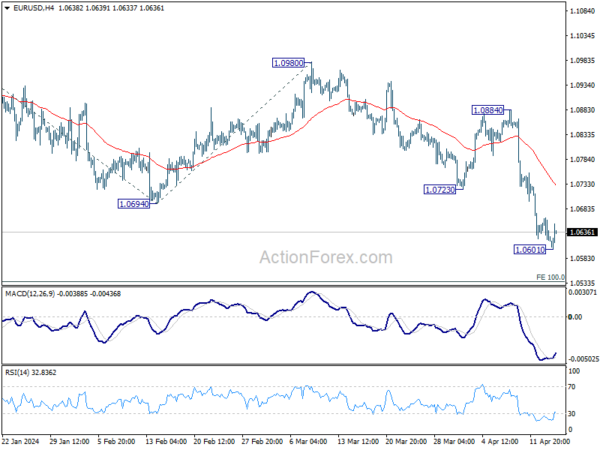

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0608; (P) 1.0636; (R1) 1.0653; More…

A temporary low is in place at 1.0601 in EUR/USD with 4H MACD crossed above signal line. Intraday bias is turned neutral for consolidations first. While stronger recovery cannot be ruled out, upside should be limited by 1.0723 support turned resistance. On the downside, break of 1.0601 will resume the decline from 1.1138 to 100% projection of 1.1138 to 1.0694 from 1.0980 at 1.0536 next.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Current fall from 1.1138 is seen as the third leg. While deeper decline is would be seen to 1.0447 and possibly below. Strong support should emerge from 61.8% retracement of 0.9534 to 1.1274 at 1.0199 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | CNY | GDP Y/Y Q1 | 5.30% | 5.00% | 5.20% | |

| 02:00 | CNY | Retail Sales Y/Y Mar | 3.10% | 5.10% | 5.50% | |

| 02:00 | CNY | Industrial Production Y/Y Mar | 4.50% | 6.00% | 7.00% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Mar | 4.50% | 4.30% | 4.20% | |

| 06:00 | GBP | Claimant Count Change Mar | 10.9K | 17.2K | 16.8K | 4.1K |

| 06:00 | GBP | ILO Unemployment Rate (3M) Feb | 4.20% | 4.00% | 3.90% | 4.00% |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Feb | 5.60% | 5.50% | 5.60% | |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Feb | 6.00% | 6.10% | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Feb | 17.9B | 27.3B | 28.1B | 27.1B |

| 09:00 | EUR | Germany ZEW Economic Sentiment Apr | 42.9 | 35.1 | 31.7 | |

| 09:00 | EUR | Germany ZEW Current Situation Apr | -79.2 | -80.5 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Apr | 43.9 | 37.2 | 33.5 | |

| 12:30 | CAD | CPI M/M Mar | 0.60% | 0.70% | 0.30% | |

| 12:30 | CAD | CPI Y/Y Mar | 2.90% | 2.80% | ||

| 12:30 | CAD | CPI Median Y/Y Mar | 2.80% | 3.00% | 3.10% | 3.00% |

| 12:30 | CAD | CPI Trimmed Y/Y Mar | 3.10% | 3.20% | 3.20% | |

| 12:30 | CAD | CPI Common Y/Y Mar | 2.90% | 3.10% | 3.10% | |

| 12:30 | USD | Building Permits Mar | 1.32M | 1.51M | 1.52M | 1.55M |

| 12:30 | USD | Housing Starts Mar | 1.46M | 1.48M | 1.52M | |

| 13:15 | USD | Industrial Production M/M Mar | 0.40% | 0.10% | ||

| 13:15 | USD | Capacity Utilization Mar | 78.50% | 78.30% |