Dollar’s rally appeared to be slowing a little despite extended rally in benchmark treasury yields, the selloff in US stocks could be stabilizing too. Fed Chair Jerome Powell’s comment that interest rate could stay at current level for longer if inflation persist triggered little reactions in the market. This is actually a given now considering recent strong consumption, inflation, and employment data. Fed’s Beige Book report today would likely reinforce the view that the economy remains robust while inflationary pressure is not gone.

New Zealand Dollar recovers broadly today after Q1 inflation data. While headline inflation slowed, it remained well above RBNZ’s target band. More importantly, domestic price pressure as seen in non-tradeable inflation remains elevated and made little progress down. It’s still a long way before RBNZ could start cutting interest rates.

Sterling is the main focus today as CPI data from UK is featured. BoE Governor Andrew Bailey acknowledged the “strong evidence” that disinflation is working its way through the economy. Continuing progress, if displayed by today’s data, would likely give more confidence to BoE for rate reductions later in the year.

Overall for the week, Swiss Franc is currently the best performer, followed by Dollar, and then Euro. Yen is the worst, followed by Aussie , and the Kiwi. Sterling and Canadian Dollar are positioned in the middle.

Technically, NZD/USD should have formed a temporary low at 0.5858 with today’s recovery. That came after drawing support from 100% projection of 0.6368 to 0.6037 from 0.6215 at 0.5884, as well as near term falling channel support. Some consolidations would be seen first. Further break of 0.5938 support turned resistance will indicate short term bottoming, and bring stronger rebound.

In Asia, at the time of writing, Nikkei is down -0.06%. Hong Kong HSI is down -0.07%. China Shanghai SSE is up 1.24%. Singapore Strait Times is up 0.49%. Japan 10-year JGB yield is up 0.0061 at 0.879. Overnight, DOW rose 0.17%. S&P 500 fell -0.21%. NASDAQ fell -0.12%. 10-year yield rose 0.031 to 4.659.

Powell asserts Fed will hold rates steady if inflation persists

Fed Chair Jerome Powell acknowledged that recent economic data have not bolstered confidence in disinflation. He signaled the readiness to keep rates elevated for an extended period if inflationary pressure persists.

“Recent data have clearly not given us greater confidence that inflation is coming fully under control. Instead, they indicate that it’s likely to take longer than expected to achieve that confidence,” Powell said at a conference overnight. .

“Given the strength of the labor market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work,” he added.

“If higher inflation does persist, we can maintain the current level of interest rates for as long as needed,” Powell noted.

At the same conference, BoC Governor Tiff Macklem said that March inflation data released yesterday suggests that underlying inflationary pressures in Canada continued to ease. He added that the bank is looking for sustained evidence of cooling inflation before starting to cut its interest rates.

BoE’s Bailey sees strong evidence of disinflation progress in UK

BoE Governor Andrew Bailey pointed to “strong evidence” that disinflation process is “working its way” through the UK economy, suggesting that the previous monetary tightening is having the intended effects.

“Our judgement with interest rates is how much do we need to see now to be confident of the process,” Bailey stated at an IMF conference overnight, indicating that BoE is looking for further signs of sustained disinflation before considering any reductions in interest rates.

Bailey also drew distinctions between the inflation dynamics in the UK and those observed in the US. The UK is still navigating the aftermath of “big supply shocks”, including those stemming from the global pandemic and geopolitical tensions, notably the war impacts. He contrasted this with the US, where there is a greater element of “demand-led inflation pressure”.

New Zealand’s CPI eases to 4.0% yet exceeds target, driven by housing costs

New Zealand CPI rose 0.6% qoq in Q1, while annual inflation rate decelerated from 4.7% yoy to 4.0% yoy. This marks the lowest annual inflation rate since Q2 2021 but still remains above RBNZ’s target band of 1-3%.

The most significant pressure on the annual inflation rate came from the housing and household utilities sector. Record increases in rent, which rose by 4.7% yoy, along with 3.3% yoy rise in the construction costs of new houses and 9.8% yoy hike in rates, were the primary drivers behind the sustained inflationary pressures.

In terms of inflation categories, there was a notable divergence between non-tradeable and tradeable inflation. Non-tradeable inflation, which includes goods and services that do not face foreign competition and thus reflect domestic supply and demand conditions, slightly decreased from 5.9% yoy to 5.8% yoy.

In contrast, tradeable inflation, which is influenced by foreign markets and includes goods and services that compete with foreign imports, experienced a more significant slowdown from 3.0% yoy to 1.6% yoy.

Australia’s Westpac leading index indicates sub-trend growth to continue

Australia’s economic outlook appears subdued for the remainder of 2024, according to the latest data from Westpac’s leading index, which fell from -0.03% to -0.23% in March. This decline signals continuation of “sub-trend” growth, as characterized by Westpac, suggesting that the economic performance may not reach the usual growth standards expected within the country.

Westpac projected that Australia’s GDP growth will remain modest at of 1.6% for 2024. This follows a similarly soft performance in 2023, where GDP grew only by 1.5%. Such figures are notably below the typical “trend” growth rate of around 2.5%.

Looking ahead, the focus shifts to the upcoming Q1 CPI data, set to be released on April 24. Westpac anticipates that this report will show deceleration in inflation to 3.5%, a development that could reinforce RBA confidence that inflation is on path back to target range of 2-3%.

However, the decision for RBA to shift to a more definitively “on hold” stance regarding interest rates will hinge on the specifics of the price updates and a broader assessment of risks.

Japan’s export rises 7.3% yoy in Mar, fourth month of growth

Japan’s exports marked the fourth consecutive month of growth with a 7.3% yoy increase to JPY 9470B in March, slightly surpassing expected 7.0%. This growth was largely fueled by robust performances in automotive and semiconductor & electronic parts, which reported gains of 7.1% yoy and 11.3% yoy respectively. T

Regionally, exports to China accelerated to 12.6% yoy, from just 2.5% yoy in the previous month. However, exports to the US and Europe saw a slowdown, growing at 8.5% and 3.0% respectively.

Import contracted -4.9% yoy to JPY 9103B, which was slightly better anticipated -5.1% yoy. Overall trade balance for March showed a surplus of JPY 366.5B.

In seasonally adjusted term, exports rose 2.6% mom to JPY 8768B. Imports rose 3.9% mom to JPY 9470B. Trade balance came in at JPY -701B.

EUR/GBP Daily Outlook

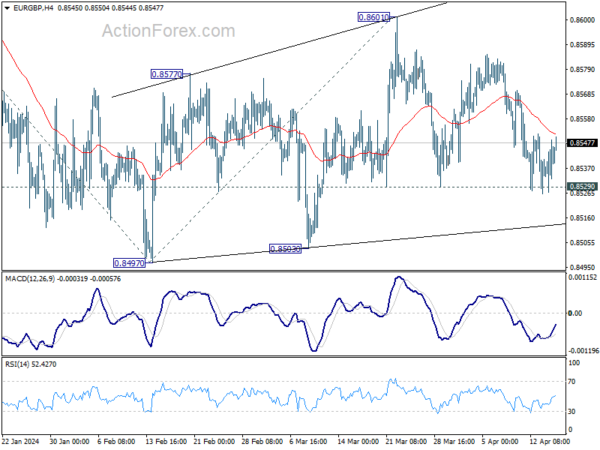

Daily Pivots: (S1) 0.8533; (P) 0.8541; (R1) 0.8555; More…

Intraday bias in EUR/GBP remains neutral at this point. On the downside, firm break of 0.8529 support will argue that the corrective recovery from 0.8497 has completed at 0.8601. Intraday bias will be back on the downside for retesting 0.8497 low next. On the upside, break of 0.8601 will resume the rebound instead.

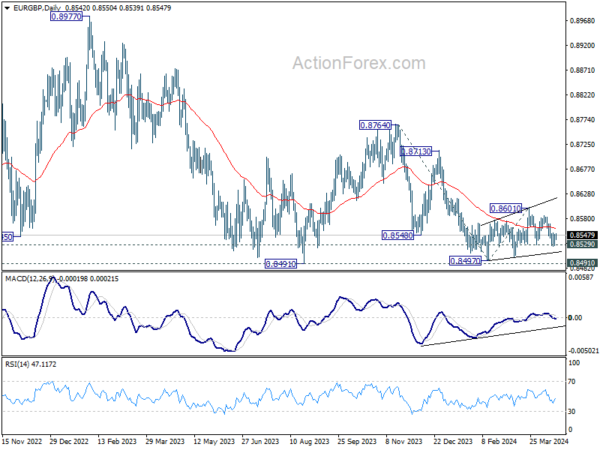

In the bigger picture, there is no clear sign that down trend from 0.9267 has completed, despite loss of downside momentum as seen in D MACD. As long as 0.8601 resistance holds, the down trend will remain in favor to resume through 0.8491 low at la later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q1 | 0.60% | 0.60% | 0.50% | |

| 22:45 | NZD | CPI Y/Y Q1 | 4.00% | 4.70% | ||

| 23:50 | JPY | Trade Balance (JPY) Mar | -0.70T | -0.28T | -0.45T | -0.57T |

| 01:00 | AUD | Westpac Leading Index M/M Mar | -0.10% | 0.10% | ||

| 06:00 | GBP | CPI M/M Mar | 0.60% | |||

| 06:00 | GBP | CPI Y/Y Mar | 3.10% | 3.40% | ||

| 06:00 | GBP | CPI Core Y/Y Mar | 4.10% | 4.50% | ||

| 06:00 | GBP | RPI M/M Mar | 0.80% | |||

| 06:00 | GBP | RPI Y/Y Mar | 4.20% | 4.50% | ||

| 06:00 | GBP | PPI Input M/M Mar | 0.00% | -0.40% | ||

| 06:00 | GBP | PPI Input Y/Y Mar | -2.70% | |||

| 06:00 | GBP | PPI Output M/M Mar | 0.20% | 0.30% | ||

| 06:00 | GBP | PPI Output Y/Y Mar | 0.40% | |||

| 06:00 | GBP | PPI Core Output M/M Mar | 0.20% | |||

| 06:00 | GBP | PPI Core Output Y/Y Mar | 0.20% | 0.30% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Mar F | 2.90% | 2.90% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar F | 2.40% | 2.40% | ||

| 14:30 | USD | Crude Oil Inventories | 1.6M | 5.8M | ||

| 18:00 | USD | Fed’s Beige Book |