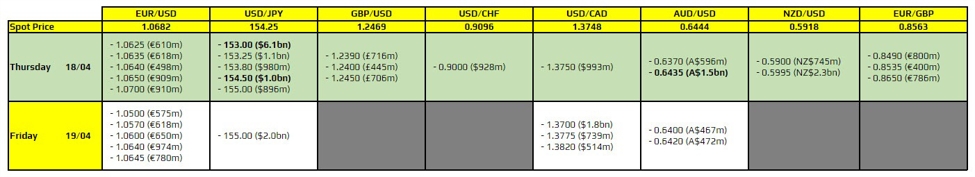

There are a couple to take note of, as highlighted in bold.

The first ones are for USD/JPY with the big one being a $6 billion set of expiries at 153.00. That is seen quite a distance away from the current spot price, but it is one to take note of given the size. That just in case price action moves to see it come into play, in which the expiries might help to limit any sudden and sharp downside drop in the pair.

Then, there is also one at 154.50 for USD/JPY. But I don’t see that as being too much of an important one in pulling price action. The 155.00 mark remains the more important psychological level at the moment, so that’s the more crucial topside level to watch.

And lastly, there is the one for AUD/USD at the 0.6435 mark. That could help to see price action in the pair be more sticky closer to that level before the expiries roll off later in the day. But as mentioned earlier this week, risk sentiment remains a far more important factor currently. So, if equity futures do push higher, one can expect the aussie to benefit as well with such sentiment overriding the expiries pull.

For more information on how to use this data, you may refer to this post here.