By RoboForex Analytical Department

The USD/JPY pair reached an all-time high on Thursday, touching the 155.50 level. This development comes as the Bank of Japan (BoJ) starts its two-day monetary policy meeting with widespread expectations that the interest rate will remain unchanged at zero. Investors are keenly watching for any aggressive signals from the BoJ, as further declines in the yen could prompt Tokyo to intervene in the currency market. However, any such intervention is expected to provide only a short-term respite for the yen.

The primary driver behind the yen’s weakness remains the significant disparity in monetary policies between the Bank of Japan and the US Federal Reserve, particularly regarding interest rates. The current situation will likely persist if there is no shift in these policies.

Last week, BoJ Governor Kazuo Ueda indicated at the G-20 summit that the regulator might consider raising rates if the yen’s weakness leads to a sustained increase in import prices. The BoJ is closely monitoring inflation trends, and should the consumer price index approach the 2% target, the bank may adopt a more decisive stance.

The yen has been on a consistent downward trajectory since 13 March this year, showing few signs of interruption.

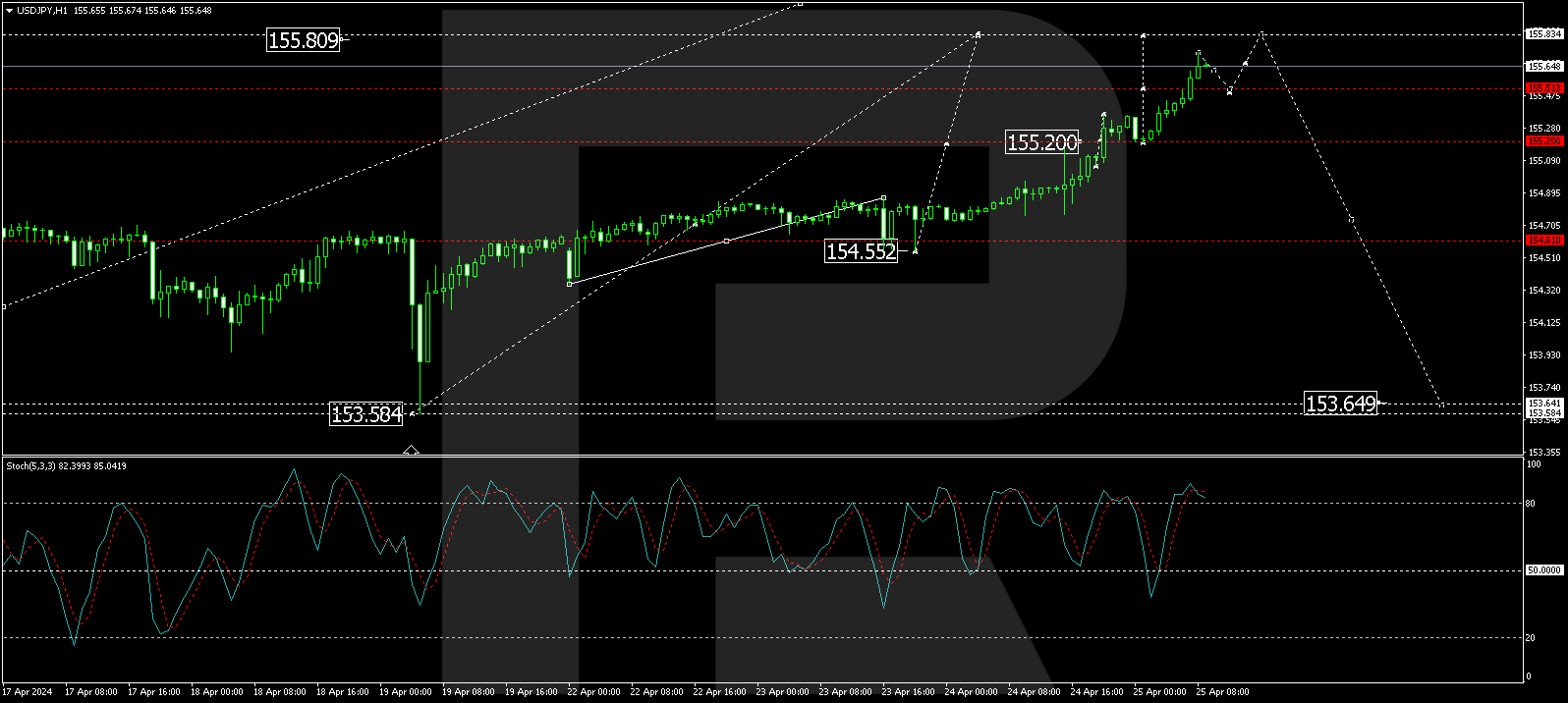

USD/JPY technical analysis

On the H4 chart, USD/JPY found support at 153.65, and the fifth wave of growth is unfolding. The pair is expected to reach 155.85 soon. Following this, a corrective move to at least 154.60 (testing from above) is anticipated, potentially followed by further growth towards 156.56. This target represents the primary objective of the growth wave. This bullish scenario is technically supported by the MACD oscillator, whose signal line is above zero and trending upwards.

On the H1 chart, USD/JPY has established support at 154.55, with the upward structure aiming for 155.85. Currently, the growth to 155.73 has been executed. A slight retracement to 155.20 (testing from above) may occur next. After reaching this level, the likelihood of an ascent to 155.85 will be reassessed. This technical outlook is confirmed by the Stochastic oscillator, whose signal line is currently above 80, poised for a drop to around 50.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Japanese yen hits all-time low as BoJ meeting commences Apr 25, 2024

- TSLA shares rose on a weak report. Inflationary pressures are easing in Australia Apr 24, 2024

- USDJPY: On intervention watch Apr 24, 2024

- Euro gains against the dollar amid mixed economic signals Apr 24, 2024

- PMI data is the focus of investors’ attention today. Turkey, Iraq, Qatar, and UAE signed a transportation agreement Apr 23, 2024

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024