U.S. Highlights

- There was no reprieve in U.S. data this week for those concerned the economy is running too hot for the Federal Reserve to deliver imminent interest rate relief. Expectations for multiple rate cuts have been greatly pared back since the start of the year and this week’s data will only reinforce that.

- This week’s release of U.S. Q1-GDP shows that U.S. consumers still exhibit resilience to higher interest rates.

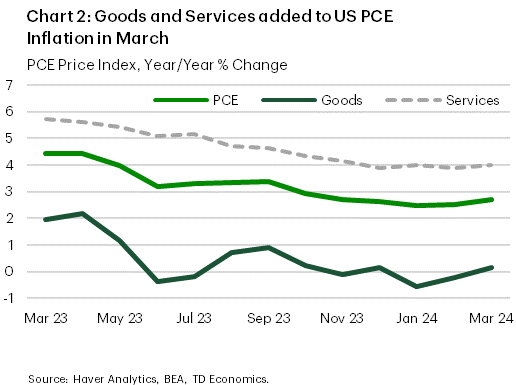

- Similarly, PCE inflation delivered two hawkish surprises: goods inflation eased less than expected and services inflation continued to trend up, for an overall uptick in the recent trend in prices.

Canadian Highlights

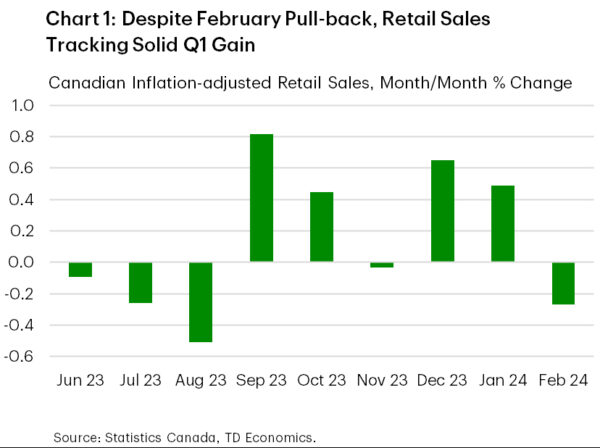

- Retail spending was subdued in February, although overall consumption was strong in the first quarter. Solid consumption underpinned what was likely robust Q1 growth for GDP.

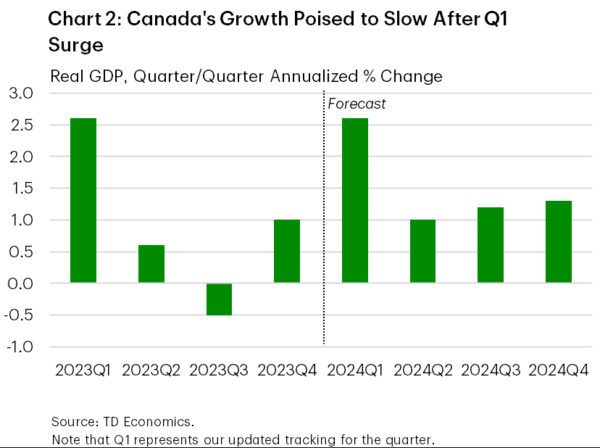

- However, we see economic growth easing in Q2 as consumer spending softens amid elevated borrowing costs and a rapidly cooling job market.

- The Bank of Canada’s Summary of Deliberations revealed a more dovish lean by policymakers, although “sustained” evidence of cooling inflation is required before pulling the trigger on cuts.

U.S. – Consumer Still Resilient

The big question for the U.S. economy is when inflation will subside or the economy will slow under the pressure of higher interest rates, especially on the side of consumer spending. Either development could be sufficient to bring forward expectations for Federal Reserve interest rate cuts, but this week both GDP and inflation remained stubbornly robust.

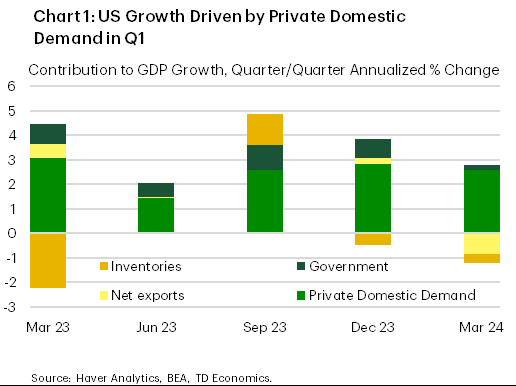

The advance estimate of real GDP for Q1-2024 came in at a seemingly sub-par 1.6% (q/q annualized), below the consensus forecast of 2.5%. This is a slowdown from the large expansion of 3.4% we saw in the previous quarter, but the softness in this quarter’s reading looks temporary, while the strength has momentum. The biggest drags on growth were imports and an inventory drawdown, which are more volatile in the quarterly data, and could be reversed in next quarter’s data (Chart 1). More to the point, they speak less to how consumers and U.S. businesses are reacting to high interest rates, the chief concern for the Federal Reserve when it asks whether its policy is cooling the economy. Consumer spending softened only a little, and growth generally continues to be supported by solid domestic demand. This is not yet an economy that looks overly burdened by high interest rates.

The latest inflation data has the same signals as the activity data. In the first quarter, core PCE inflation rose sharply from the average rate of inflation we saw in the second half of 2023. On a year-over-year basis, headline PCE inflation increased in March from February, maintaining roughly the same monthly increase as from February to January – that is, it looks like inflation has momentum in the first quarter. The March data showed an increase in both goods and services prices, whereas in previous months we had seen some declines in goods prices (Chart 2). Core PCE inflation, the Federal Reserve’s preferred metric, was essentially flat from February to March.

This morning’s personal income data also confirmed that the consumer is still resilient. Personal consumption increased in March, and increases were registered across goods and services, showing strong demand from households. And personal savings declined in absolute terms and as a share of disposable income, despite a strong increase in income – suggesting that consumers are not motivated to build up precautionary savings. Our tracking for Q2 would now point to consumer spending to increase 3.5% given the favourable increase in goods spending in March and continued momentum in services. That is a notable upgrade from the 1.9% we forecast in March.

Those hoping for the data to support interest rate cuts earlier rather than later would have been looking for a slowdown in consumer spending, inflation, or both, but this week we received the opposite. This complicates things for the Federal Reserve, which needs to ensure inflation keeps decelerating towards the 2% target. Given this week’s economic data, market pricing is solidifying around a delayed start to rate cuts.

Canada – Rate Cuts on the Horizon

Themes that have recently characterized Canadian financial markets generally held true again this week. The Canadian dollar was broadly unchanged, hanging at a low level of 73 U.S. cents which will do no favours for inflation. Meanwhile, the 10-year Canada yield moved somewhat higher (as of writing), as U.S. rate cut expectations continue to be pared back. Meanwhile, the WTI oil benchmark climbed by about $2, reflecting an unanticipated drawdown in inventories.

It was a quiet week for economic data releases, headlined by a consumer pulse check coming through retail sales. Spending was modest in February, with retail volumes, or sales adjusted for inflation, dipping 0.3% m/m (month-on-month). However, it didn’t change the narrative that the first quarter was a solid one for Canadian consumption, thanks in large part to a huge gain in the country’s population. Note that February’s data represented a partial retracement after two months of very strong gains (Chart 1). What’s more, our internal credit and debit card spending data (which captures both goods and services spending) suggests that a firm increase took place in March.

The February retail data will have some negative influence on next week’s February GDP report. However, if Statcan’s advance GDP estimate is to be believed, growth was healthy at 0.4% m/m. Even if there was no gain in March, industry-based GDP growth is tracking a robust 3.5% annualized pace in the first quarter (this is distinct from the national accounts GDP measure in our forecast). The question now becomes whether this momentum will last. In our view, the answer is no, as we expect economic growth to cool to a sub-trend pace starting in the second quarter (Chart 2). Underpinning our forecast is an anticipated slowdown in consumer spending, weighed down by elevated interest rates and a job market that is rapidly cooling.

The Bank of Canada’s latest Monetary Policy Report revealed a noteworthy upgrade to the Bank’s economic growth projections. Still, policymakers chose to hold the line on rates earlier in the month. This week featured the release of the Bank’s Summary of Deliberations, which more fully fleshed out the reasoning behind this decision. The summary struck a more dovish tone than in prior deliberations given recent favourable inflation readings.

That said, there was a desire by policymakers for this improvement to be “sustained” before rates could be cut, although what constitutes “sustained” was not defined. Some Governing Council members emphasized that domestic demand and solid U.S. growth could keep inflation from slowing further. Still, others focused on the progress made in bringing inflation down. All told, the minutes reinforced the view that easing will likely be coming in short order, with June/July still looking like a safe bet for the first move. We’ll hear more from Governor Macklem next week when he appears before the Senate banking committee on May 1st.