Leaders from prominent non-banking financial companies (NBFCs) stressed on the pivotal role of customer-centric innovation in preparing for the future amid rapid technological advancements and regulatory changes.

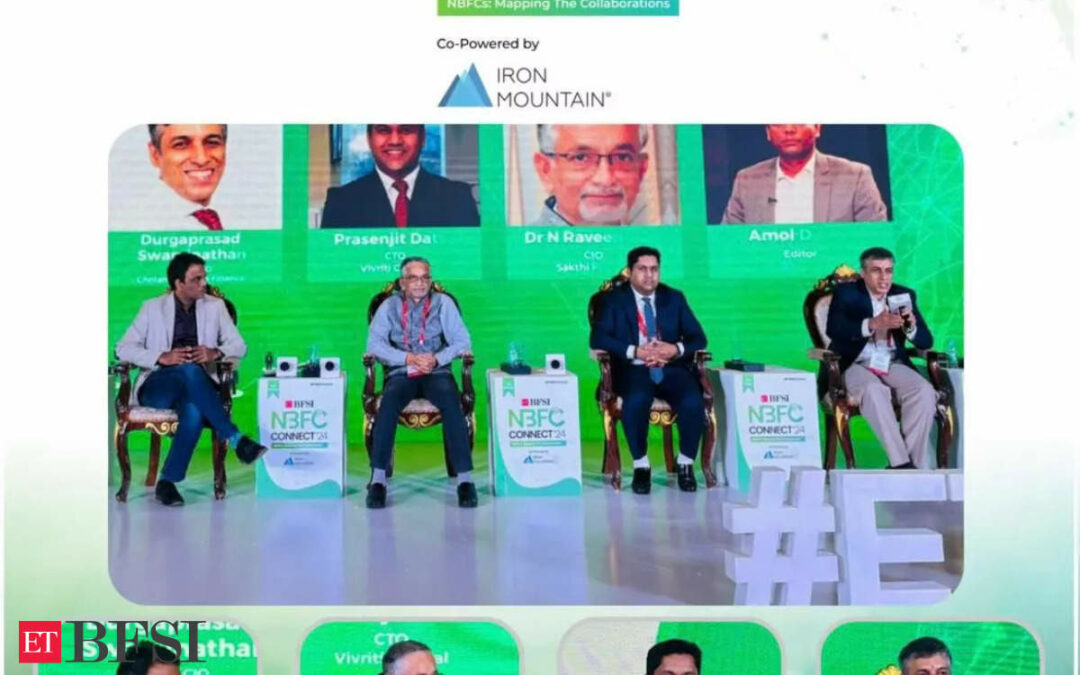

Speaking at the ETBFSI NBFC Connect’24 Summit, Durgaprasad Swaminathan, EVP & CIO of Cholamandalam Finance, emphasised the significance of cultural transformation within NBFCs: “If an NBFC has to be future-proof, the core needs to be a cultural aspect — culture of customer centricity, culture of innovation, and culture of compliance.”

Compliance may have innumerable checkpoints but it is not something impossible, he added.

The discussions underscored a shared commitment among NBFCs to embrace technological innovations that enhance customer experiences while navigating regulatory complexities. The adoption of customer-centric strategies, coupled with advanced technologies like Regtech, is poised to strengthen operational resilience and drive sustainable growth in the NBFC sector.

Regulatory alignment

Prasenjit Datta, CTO of Vivriti Capital, emphasized the importance of speed and regulatory alignment in today’s business environment: “What is changing today is the speed of doing business, credit assessment, and disbursals.” He highlighted the diminishing gap between regulatory requirements for banks and NBFCs, stressing the growing prominence of regulatory technology (Regtech).

“Regtech is the buzzword, regulatory technologies is going to dominate for next few years, every banks, NBFCs will need it as the way the regulatory asks are increasing, regtech will play an important role, the sooner the better,” he said

Dr. N Raveendran, CIO of Sakthi Finance, emphasized the dual focus on technology adoption and customer-centricity: “To make NBFCs future-ready, customer-centric achievements should be prioritised.” He highlighted the benefits of digitisation in lending, particularly in enhancing compliance and operational efficiency. “Future proofing NBFCs, making them resilient, technology is on one angle, we have to adopt, there’s no doubt but to make NBFCS future ready, the core purpose of customer centric achievement should be looked at, doing things so that customers are prioritised, this will help in the future readiness,” he said.