The Bank of Japan kept interest rates unchanged, driving the yen to a fresh 34-year low, while US inflation showed few signs of simmering down.

The Japanese yen slumped as BOJ Governor Kazuo Ueda played down the impact on inflation from a weakening currency. While he’s indicated a preference to proceed gradually with rate increases, Ueda is trying to avoid restraining the economy.

That’s becoming even more challenging after US data this week indicated inflation accelerated in the first quarter, reinforcing expectations the Federal Reserve is likely to keep interest rates higher for longer.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, geopolitics and markets:

World

Outside the BOJ, Paraguay, Turkey, Russia and Guatemala held rates steady. Hungary further slowed the pace of cuts. Indonesia defied expectations and boosted rates, while Ukraine lowered them. Argentina cut its key interest rate for the fourth time since President Javier Milei took office in December as officials bet on a sustained slowdown in inflation.

Beijing’s vast claims across the South China Sea — based on a vague 1947 map showing what’s become known as a “ten-dash line” through the waterway — were rejected by a United Nations-backed tribunal in 2016. But President Xi Jinping dismissed the ruling, and ever-growing tensions in the disputed waters all point to an uncomfortable truth for Southeast Asian nations, as well as the US: In this standoff, China is winning. China’s increasingly assertive stance has sparked a flurry of diplomatic and military efforts aimed at countering Beijing’s footprint.

AsiaThe BOJ kept the range for its benchmark rate between 0% and 0.1% as widely expected by economists at the conclusion of its meeting, according to a pared-back statement with only a few lines. The central bank didn’t signal a reduction of its bond purchases, saying instead it would buy them in line with its March decision.

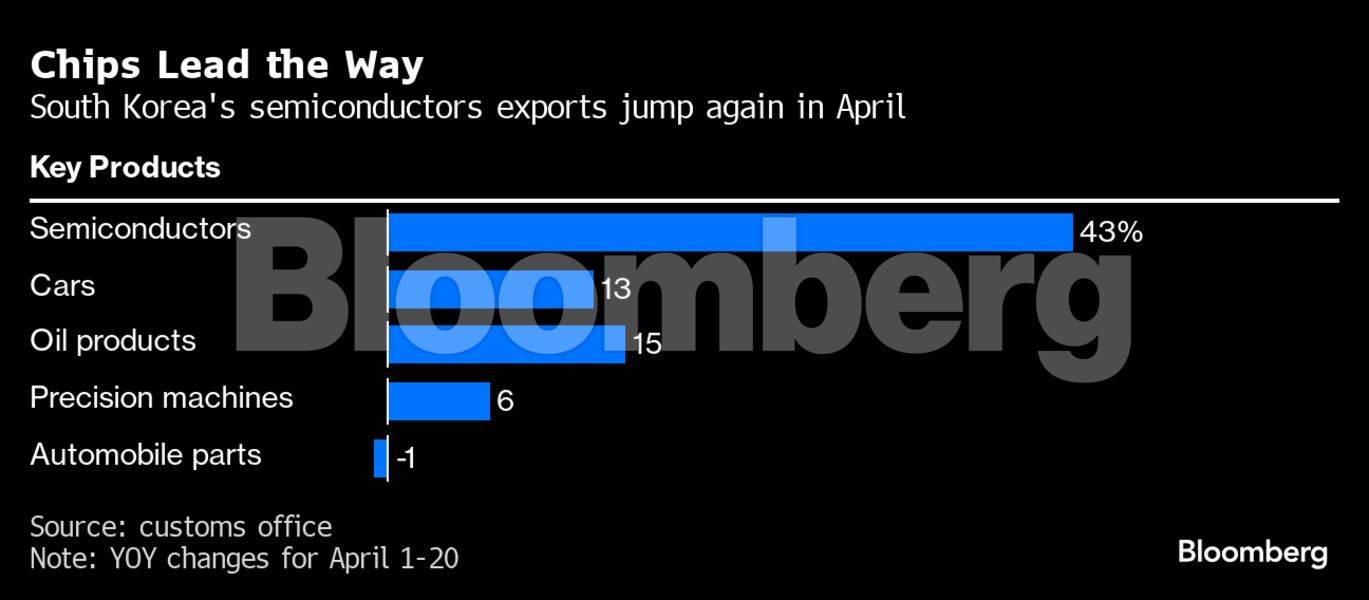

South Korea’s exports have made a brisk start to the second quarter based on early trade figures for April, brightening the outlook for economic growth. The value of shipments increased 11.1% from a year earlier in the first 20 days of April.

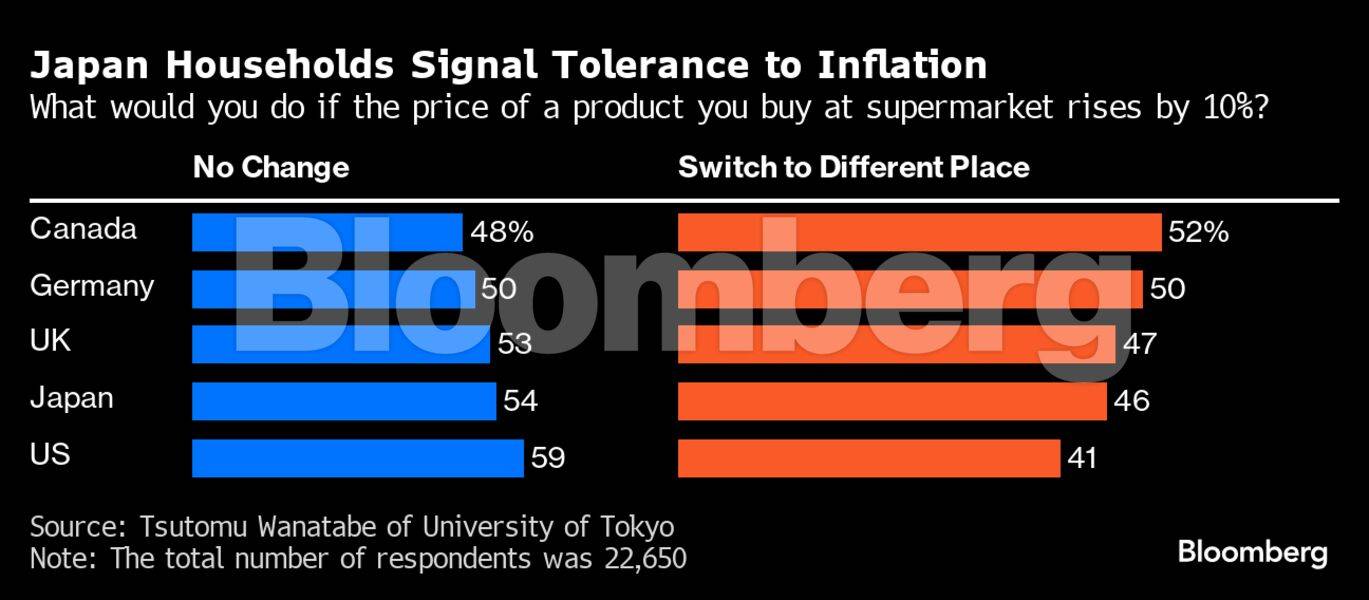

Higher inflationary expectations and price tolerance are taking root in Japan, a development that supports the central bank’s moves to normalize policy and raise interest rates further. A recent survey by Tsutomu Watanabe, a leading inflation expert in the nation, found that Japanese consumers’ tolerance of price changes is holding up and is higher than levels seen among shoppers in some other major economies.

US

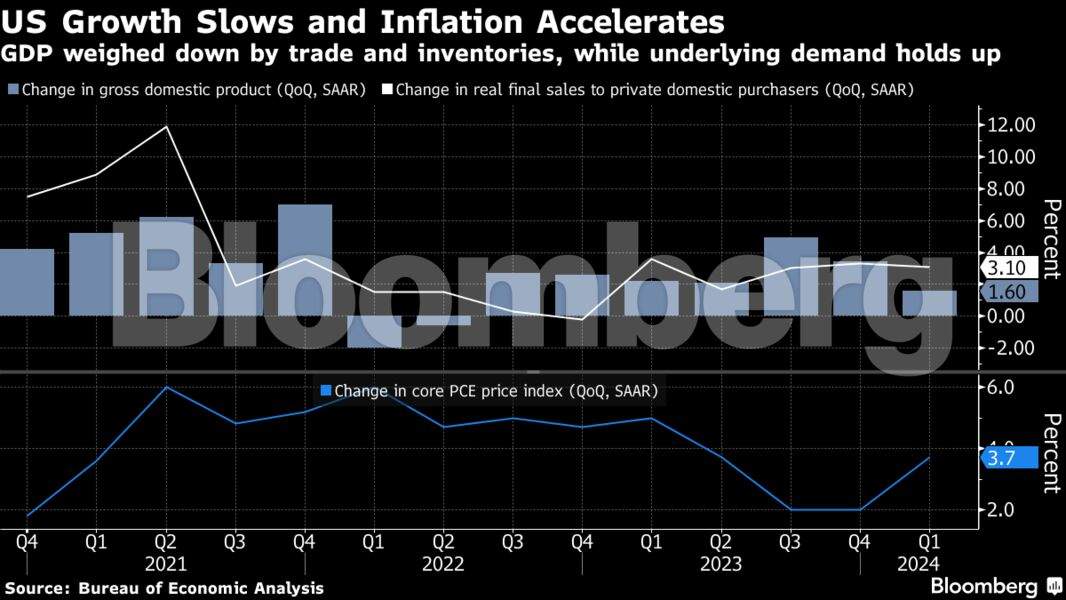

The surprisingly sharp downshift in US economic growth last quarter masked otherwise resilient household demand and business investment that helped generate faster inflation. While the 1.6% advance in gross domestic product missed all economists’ projections, so-called final sales to private domestic purchasers — which strips out inventories, trade and government spending — rose at a 3.1% rate after adjusting for inflation.

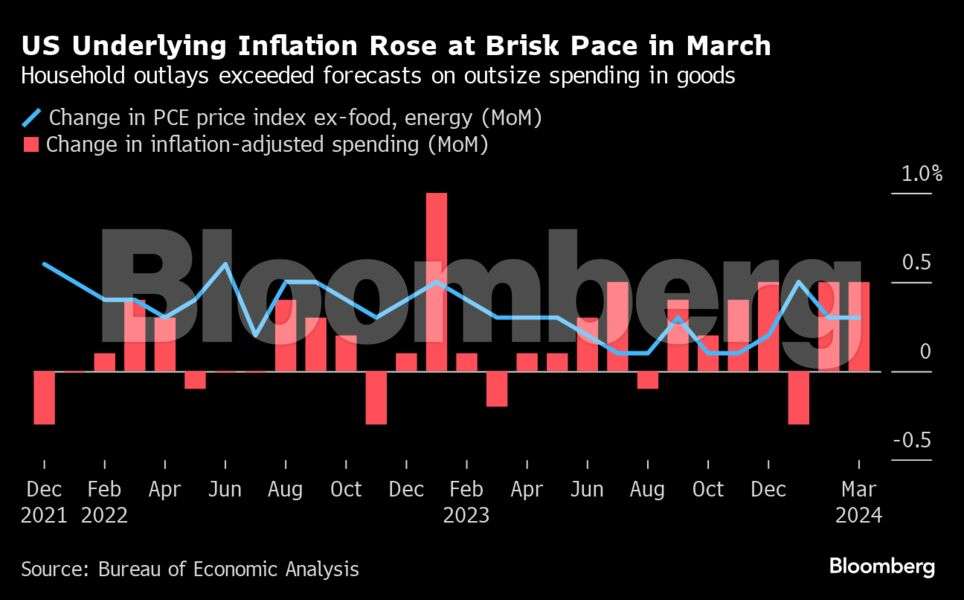

The Federal Reserve’s preferred gauge of underlying US inflation rose at a brisk pace in March, reinforcing concerns of persistent price pressures that are likely to delay any interest-rate cuts. Traders mostly reacted positively as investors took relief from in-line monthly inflation data after quarterly figures on Thursday suggested upside risk to March.

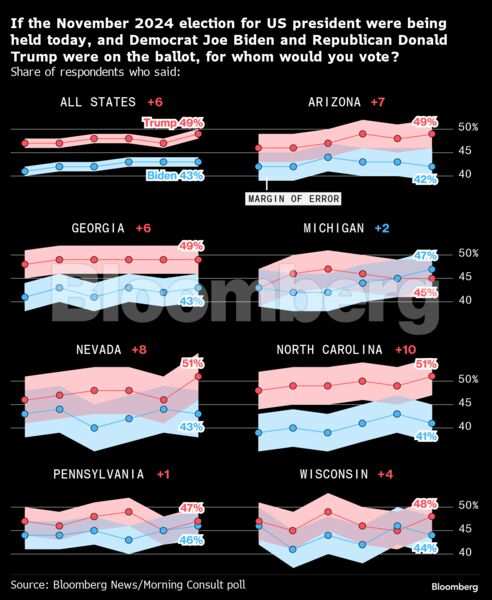

President Joe Biden’s recent polling bump in key battleground states has mostly evaporated as a deep current of pessimism about the trajectory of the US economy hurts his standing with voters. Biden trails the presumptive GOP nominee slightly in Pennsylvania and Wisconsin, and his deficit in Georgia, Arizona, Nevada and North Carolina is larger.

Europe

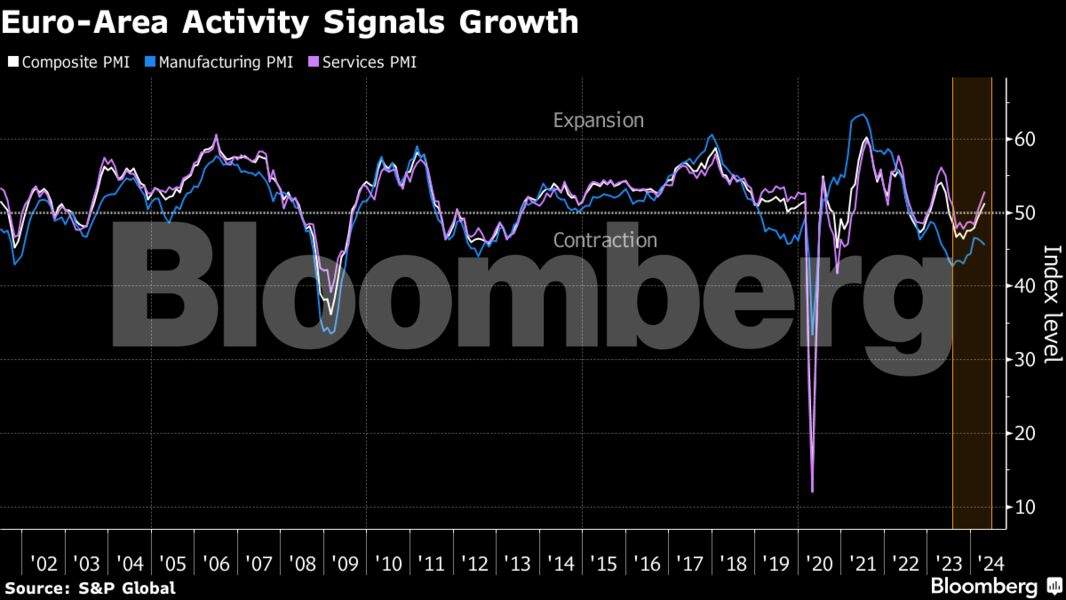

Euro-area private-sector activity advanced to the highest level in almost a year, driven by a buoyant services sector and Germany’s return to growth.

Emerging Markets

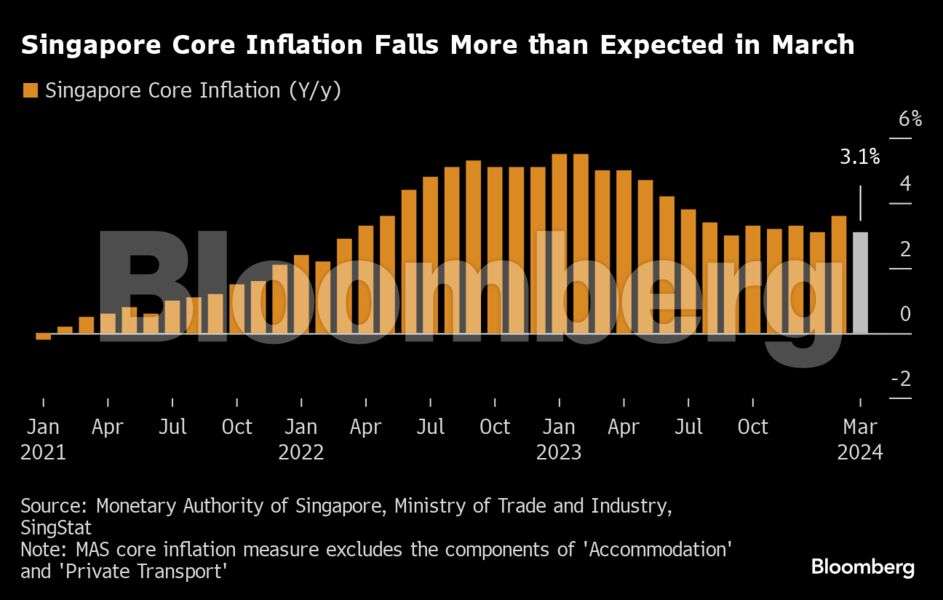

Singapore’s core inflation eased in March on lower food prices and costs of services, with the disinflationary trend expected to continue barring any supply shocks from geopolitical tensions.