Technical Analyst Clive Maund shares an update on Revolve Renewable Power Corp. to explain why he believes now might be the time to buy this clean energy stock.

Revolve Renewable Power Corp. (TSXV:REVV;OTCQB:REVVF) was the subject of an article on January 22, when it was thought that, following a clear breakout from a bullish Falling Wedge downtrend and a period of consolidation, it would continue higher.

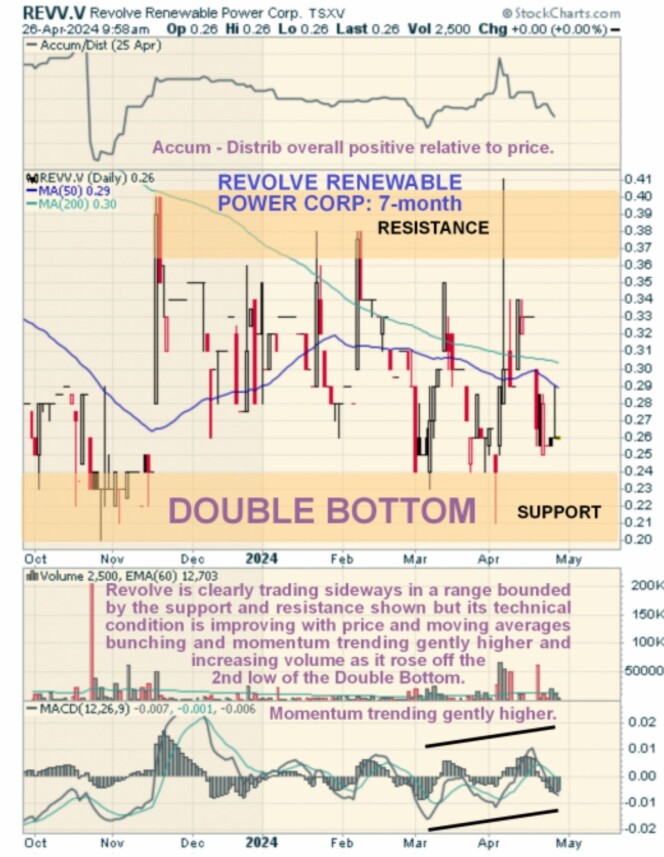

That didn’t happen, and it is now clear that the price wanted to mark out a larger base pattern, which it has now done by dipping early this month to form a Double Bottom with its lows of late last October.

Since it is now still close to the second low of the Double Bottom shown on the 18-month chart below this looks like another good point to buy or add to positions.

On the 7-month chart, we can see the entire period of the Double Bottom in much more detail. On this chart, we can see that although the stock hasn’t done much since we last looked at it and, in truth, is down a little, its technical condition has improved, with the price and its moving averages bunching more together in a manner that frequently precedes a new uptrend and momentum (MACD) trending gently higher.

The low early this month was marked by a prominent bull hammer, after which the price recovered off the second low of the Double Bottom on increased volume, which is bullish.

So, with the price still close to the second low of what is believed to be a Double Bottom, this is believed to be a good point to buy Revolve Renewable Power Corp. stock or add to positions.

Revolve Renewable Power Corp.’s website.

Revolve Renewable Power Corp. (TSXV:REVV;OTCQB:REVVF) closed for trading at CA$0.25 at 1.30 pm EDT on April 26, 2024.

Important Disclosures:

- Revolve Renewable Power Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Revolve Renewable Power Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.

- Expert Says Now Looks Like a Good Time To Buy This Renewable Energy Stock Apr 30, 2024

- Optimism over corporate earnings is fueling stock indices. The Hong Kong index reached a 5-month high Apr 30, 2024

- FXTM’s Copper: Hits fresh two-year high! Apr 30, 2024

- European indices grow on the ECB’s “dovish” position. Quarterly reports of mega-companies support the broad market Apr 29, 2024

- Japanese yen shows volatility amid speculation of intervention Apr 29, 2024

- COT Bonds Charts: Speculator Weekly Changes led by 5-Year & 10-Year Bonds Apr 28, 2024

- COT Stock Market Charts: Speculator Bets led by VIX & Russell-Mini Apr 28, 2024

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Apr 28, 2024

- Today, investors’ focus is on the PCE Price Index inflation report Apr 26, 2024

- Gold price recovers amid uncertain US economic outlook Apr 26, 2024