Dollar’s rally slowed slightly in early US session despite robust ADP job data, as traders adopt a cautious stance ahead of the highly anticipated FOMC statement and Chair Jerome Powell’s press conference. With a hawkish shift expected from Fed, the extent of Powell’s hawkish tone remains the primary focus. Market participants are speculating on whether Powell will merely dismiss a rate cut in June, suggest fewer rate cuts throughout the year, or even hint at the possibility of a rate hike.

In the broader currency market, Yen is currently the strongest performer for the week, followed by Dollar and Sterling. Aussie lags as the weakest, with Kiwi and Loonie also underperforming. Euro and Swiss Franc hold their ground in the middle of the pack. The upcoming reactions to Fed’s decisions are poised to be pivotal, influencing not just currencies but also the stock and bond markets, as well as their interactions.

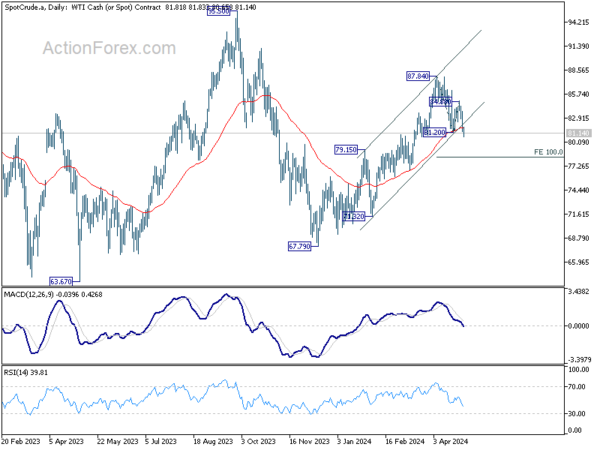

Technically, WTI crude oil’s fall from 87.84 resumed through 81.20 support today. More importantly, the break of medium term rising channel support argues that rally from 67.79 might have completed. If that’s true, WTI would now be in another falling leg of the sideway pattern from 63.67. Next that is 100% projection of 87.84 to 81.20 from 84.88 at 78.60. This potential decline in oil prices could have favorable implications for inflation, offering some relief from persistent price pressures.

US ADP employment rises 192k in Apr, vs exp 180k

US ADP private employment grew 192k in April, above expectation of 180k. By sector, goods-producing jobs rose 47k, service-providing jobs rose 145k. By establishment size, small companies added 38k jobs, medium companies added 62k, large companies added 98k.

Year-over-year pay gains for job-stayers were little changed in April at 5%. Pay growth for job- changers fell from 10.1% in March to 9.3%.

“Hiring was broad-based in April,” said Nela Richardson, chief economist, ADP. “Only the information sector – telecommunications, media, and information technology – showed weakness, posting job losses and the smallest pace of pay gains since August 2021.”

UK PMI manufacturing finalized at 49.1, sector faces multiple challenges

UK PMI Manufacturing was finalized at 49.1 in April, down from March’s 50.3. This decline was also reflected in four key areas: output, new orders, employment, and stocks of purchases. Furthermore, input price inflation hit a 14-month high, exacerbating cost pressures for manufacturers.

Rob Dobson, Director at S&P Global Market Intelligence, highlighted the renewed downturn, attributing the challenges to weak market confidence, client destocking, and disruptions caused by the ongoing Red Sea crisis. These factors have notably hindered the sector’s ability to secure new work from key international markets including Europe, the US, and Asia.

The manufacturing downturn is prompting firms to exercise “cost caution,” leading to reduced employment levels, lower stock holdings, and cutbacks in purchasing activity. Dobson expressed concern over the implications for consumer price inflation, noting that the ongoing cost pressures within the manufacturing sector are complicating efforts to return inflation to target levels.

Japan’s PMI manufacturing finalized at 49.6, moving towards stabilization

Japan’s PMI Manufacturing was finalized at 49.6 in April, marking an increase from March’s 48.2 and reaching its highest level in eight months. While the index remains below the pivotal 50.0 mark, which distinguishes expansion from contraction, the latest data suggests that the sector is moving towards stabilization in the near term.

Paul Smith from S&P Global Market Intelligence noted that the April PMI “continued to paint a fairly subdued picture of the Japanese manufacturing sector,” but also pointed out that “another rise in the headline PMI points to a sector heading towards at least stabilization in the near-term.”

The report also highlighted concerns about inflation, with a broad-based increase in input prices contributing to heightened cost pressures for manufacturers. Notably, the strength of market demand is allowing firms to pass these increased costs onto consumers, with the extent of charge hikes reaching the steepest level in nearly a year.

New Zealand employment falls -0.2% qoq in Q1, unemployment rate jumps to 4.3%

New Zealand employment fell -0.2% qoq in Q1, much worse than expectation of 0.3% qoq growth. Unemployment rate rose from 4.0% to 4.3%, above expectation of 4.0%. Underutilization rate rose 0.5% to 11.2%. Employment rate fell -0.6% to 68.4%. Labor force participation rate fell -0.3% to 71.5%.

For wages, average ordinary time hourly earnings growth slowed from 6.9% yoy to 5.2% yoy. All sector unadjusted labor cost index slowed slightly from 4.3% yoy to 4.1% yoy.

“Although wage cost inflation eased and average hourly earnings growth started to slow this quarter, annual growth remained high for the two surveys,” business employment insights manager Sue Chapman said.

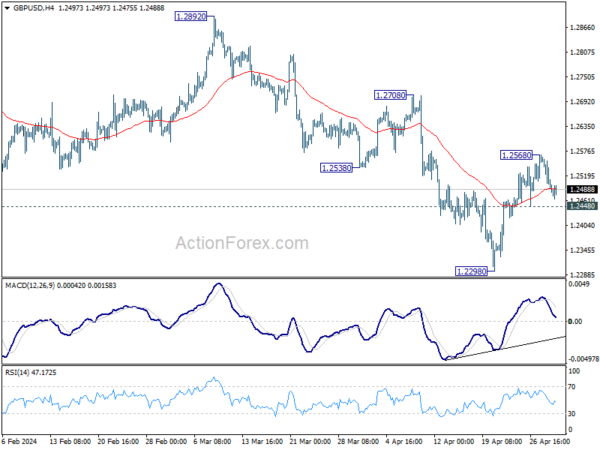

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2465; (P) 1.2517; (R1) 1.2544; More…

Intraday bias in GBP/USD remains neutral for the moment and outlook is unchanged. On the upside, above 1.2568 will resume the rebound from 1.2298 to 55 D EMA (now at 1.2578). Sustained break there will argue that fall from 1.2892 has completed already, and bring further rise to this resistance. Nevertheless, on the downside, break of 1.2448 minor support will indicate that rebound from 1.2298 has completed, and turn bias back to the downside for this low.

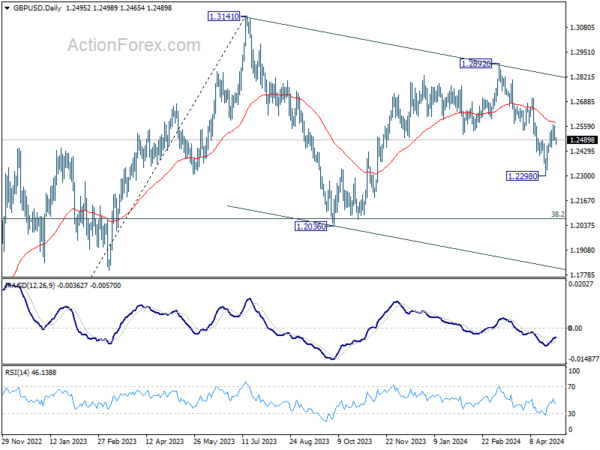

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Fall from 1.2892 is seen as the third leg. Deeper decline would be seen to 1.2036 support and possibly below. But strong support should emerge from 61.8% retracement of 1.0351 to 1.2452 at 1.1417 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Employment Change Q1 | -0.20% | 0.30% | 0.40% | |

| 22:45 | NZD | Unemployment Rate Q1 | 4.30% | 4.30% | 4.00% | |

| 22:45 | NZD | Labour Cost Index Q/Q Q1 | 0.80% | 0.80% | 1.00% | |

| 00:30 | JPY | Manufacturing PMI Apr F | 49.6 | 49.9 | 49.9 | |

| 08:30 | GBP | Manufacturing PMI Apr F | 49.1 | 48.7 | 48.7 | |

| 12:15 | USD | ADP Employment Change Apr | 192K | 180K | 184K | 208K |

| 13:30 | CAD | Manufacturing PMI Apr | 50.2 | 49.8 | ||

| 13:45 | USD | Manufacturing PMI Apr F | 49.9 | 49.9 | ||

| 14:00 | USD | ISM Manufacturing PMI Apr | 50.1 | 50.3 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Apr | 55.6 | 55.8 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Apr | 47.4 | |||

| 14:00 | USD | Construction Spending M/M Mar | 0.30% | -0.30% | ||

| 14:30 | USD | Crude Oil Inventories | -2.3M | -6.4M | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 18:30 | USD | FOMC Press Conference |