Markets sentiment in the US stabilized overnight, responding positively to Fed Chair Jerome Powell’s less hawkish-than-anticipated remarks in the post-FOMC press conference. DOW closed slightly up, while S&P 500 and NASDAQ saw mild losses only. Treasury yields and Dollar both fell in response to these developments. Key takeaways from Powell’s address include a clear stance against further policy tightening, soothing market fears of another rate hike. The focus remains firmly set on the timing and pace of rate cuts, which would be heavily dependent on incoming economic data.

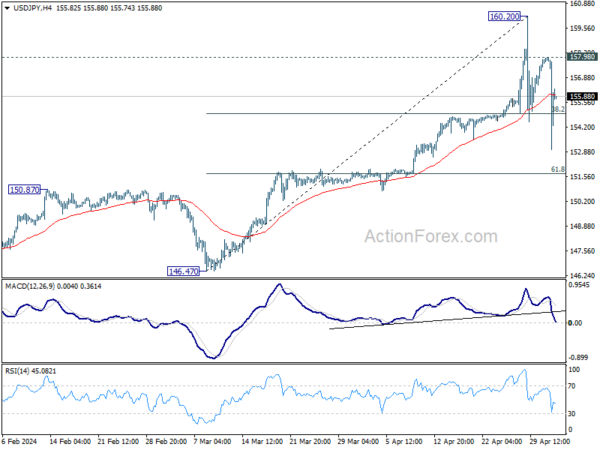

Japanese Yen surged dramatically again, purportedly due to intervention by Japanese authorities. This move was strategically timed to capitalize on Dollar’s weakness post-FOMC, during a period of low liquidity. Japan’s chief currency diplomat, Masato Kanda, remained tight-lipped about the intervention, stating that details would be released at the end of the month. While this intervention has not reversed Yen’s downtrend, it seems to be setting the stage for prolonged range trading, with 160 against Dollar acting as a strong psychological floor.

Overall in the forex markets, Canadian Dollar is currently the week’s weakest performer, followed by New Zealand Dollar and Swiss Franc. In contrast, Yen leads as the strongest, followed by Sterling and the Euro. Dollar is mixed, caught between post-FOMC sell-off pressures and market readjustments, while Australian Dollar has shown recovery, buoyed by the broader risk sentiment improvement.

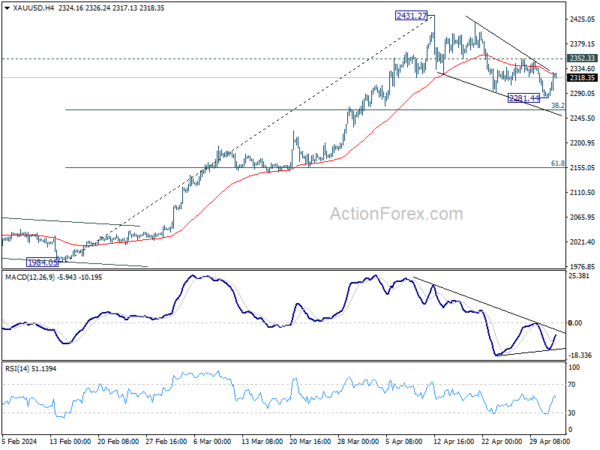

Technically, Gold’s corrective fall from 2431.27 extended to 2281.44 but quickly recovered. It’s possible that this correction has completed as a five-wave descending triangle pattern. Also, considering bullish convergence condition in 4H MACD, break of 2352.33 resistance will strengthen this case, and bring stronger rally through 2431.27 high to resume the larger up trend.

In Asia, at the time of writing, Nikkei is down -0.09%. Hong Kong HSI is up 2.21%. China is on holiday. Singapore Strait Times is up 0.27%. Japan 10-year JGB yield is down -0.0003 at 0.896. Overnight, DOW rose 0.23%. S&P 500 fell -0.34%. NASDAQ fell -0.33%. 10-year yield fell -0.091 to 4.595.

10-year yield dips as Fed Powell rules out rate hike

US markets expressed a sign of relief overnight followed as Fed Chair Jerome Powell’s less hawkish than feared stance at the post-FOMC press conference. Major stock indexes closed mixed while treasury yields dipped with Dollar.

Most importantly, Powell characterized the current interest rate level as “sufficiently restrictive,” and indicated that it is “unlikely that the next rate move will be a hike.” Instead, Powell delineated the future monetary policy path as a decision between “cutting” and “not cutting” interest rates, depending on economic data.

This stance comes in the wake of stronger-than-expected inflation data since the beginning of the year, leading Powell to acknowledge that it would “take longer than previously expected” for Fed to be confident that inflation is on a steady decline toward the 2% target. policymakers to become comfortable that inflation will resume the decline towards 2%.”

“If we did have a path where inflation proves more persistent than expected, and where the labor market remains strong but inflation is moving sideways and we’re not gaining greater confidence, well, that would be a case in which it could be appropriate to hold off on rate cuts,” Powell said. “There are paths to not cutting and there are paths to cutting. It’s really going to depend on the data.”

More on FOMC:

10-year yield closed down -0.0910 at 4.595 in reaction to FOMC. Technically, another rise could still be seen as long as 4.568 support holds. But even in this case, TNX should continue to lose upside momentum ahead of 4.997 high. Meanwhile, break of 4.568 will indicate that it’s at least in a near term pullback towards 55 D EMA (now at 4.408.

BoC nears interest rate cuts as inflation eases, says Macklem

BoC Governor Tiff Macklem, at a Senate committee testimony, indicated that Canada is edging closer to conditions that would allow for easing monetary policy. “The short answer is we are getting closer,” he affirmed.

Inflation in Canada has moderated effectively, remaining under 3% since January and aligning with the central bank’s forecasts. This stabilization is expected to persist through the first half of 2024, with key core measures of consumer prices showing a consistent downward trend.

“We are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained,” Macklem explained.

Furthermore, Macklem addressed the impact of fiscal policy on the economic outlook, noting that recent governmental fiscal plans are unlikely to significantly alter the Bank’s projections for the economy or inflation.

Looking ahead

Swiss CPI, retail sales, and PMI manufacturing will be released in European session. Eurozone will release PMI manufacturing final. Later in the day, US will release trade balance, jobless claims, non-farm productivity, and factor orders. Canada will also publish trade balance.

USD/JPY Daily Outlook

Daily Pivots: (S1) 152.27; (P) 155.13; (R1) 157.26; More…

USD/JPY’s correction from 160.20 short term top extended with another dip to 152.99, but quickly recovered again. For now, risk will be mildly on the downside as long as 157.98 resistance holds. Deeper pullback would be seen to 55 D EMA (now at 152.25), and possibly further to 61.8% retracement of 146.47 to 160.20 at 151.71. But strong support should be seen from 150.87 to bring rebound.

In the bigger picture, current rise from 140.25 is seen as the third leg of the up trend from 127.20 (2023 low). Next target is 100% projection of 127.20 to 151.89 from 140.25 at 164.94. Outlook will remain bullish as long as 150.87 resistance turned support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Mar | -0.20% | 14.90% | 15.90% | |

| 23:50 | JPY | Monetary Base Y/Y Apr | 2.10% | 1.70% | 1.60% | |

| 23:50 | JPY | BoJ Meeting Minutes | ||||

| 01:30 | AUD | Building Permits M/M Mar | 1.90% | 3.20% | -1.90% | -0.90% |

| 01:30 | AUD | Trade Balance (AUD) Apr | 5.02B | 7.37B | 7.28B | 6.59B |

| 05:00 | JPY | Consumer Confidence Apr | 38.3 | 39.5 | 39.5 | |

| 06:30 | CHF | Real Retail Sales Y/Y Mar | 0.20% | -0.20% | ||

| 06:30 | CHF | CPI M/M Apr | 0.20% | 0.00% | ||

| 06:30 | CHF | CPI Y/Y Apr | 1% | |||

| 07:30 | CHF | Manufacturing PMI Apr | 45.8 | 45.2 | ||

| 07:45 | EUR | Italy Manufacturing PMI Apr | 49.8 | 50.4 | ||

| 07:50 | EUR | France Manufacturing PMI Apr F | 44.9 | 44.9 | ||

| 07:55 | EUR | Germany Manufacturing PMI Apr F | 42.2 | 42.2 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Apr F | 45.6 | 45.6 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Apr | 0.70% | |||

| 12:30 | CAD | Trade Balance (CAD) Mar | 1.0B | 1.4B | ||

| 12:30 | USD | Trade Balance (USD) Mar | -69.3B | -68.9B | ||

| 12:30 | USD | Initial Jobless Claims (Apr 26) | 212K | 207K | ||

| 12:30 | USD | Nonfarm Productivity Q1 P | 0.80% | 3.20% | ||

| 12:30 | USD | Unit Labor Costs Q1 P | 3.20% | 0.40% | ||

| 14:00 | USD | Factory Orders M/M Mar | 1.60% | 1.40% | ||

| 14:30 | USD | Natural Gas Storage | 68B | 92B |