Mumbai: Payments for minors and senior citizen-friendly features were some of the proposals discussed during a meeting convened by RBI with UPI players.

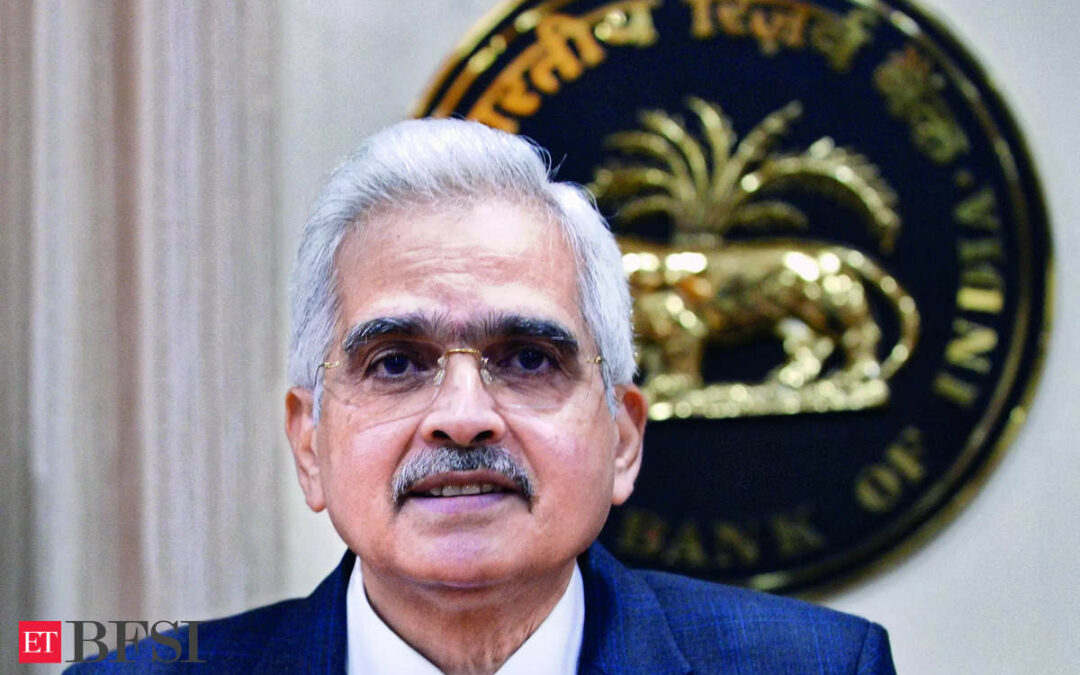

RBI governor Shaktikanta Das on Wednesday convened a meeting of banks, leading third-party UPI apps, and NPCI. Banks said they have beefed up their systems to manage transactions, which have more than tripled after the pandemic. NPCI is geared up to handle 100 crore transactions daily, which is more than double the current level of transactions.

Some fintechs suggested that merchant discount rates – a fee charged to merchants to facilitate digital payment acceptance – be allowed on UPI payments to enterprise retail. Currently, Google Pay and PhonePe have a large share of the UPI market. Smaller fintechs have said they are not in a position to make large investments to increase their share of UPI transactions because there is no revenue.

There are 25 third-party application providers, which include large players like Bajaj Finserv, Tata Neu, Samsung, Whatsapp, Aditya Birla Digital and Cred. However, PhonePe, Google Pay and Paytm command over 90% market share.

Bankers said that while the UPI system was among the most secure payments, frauds still occurred because people fell victim to confidence tricksters and shared credentials. However, govt is having a separate discussion to expedite the freezing of accounts where funds have been wrongly transferred.

RBI laws allow those above 10 years of age to independently operate a bank account. However, the UPI platform is not actively promoted among the youth. Most banks do not issue debit cards to minors which makes onboarding difficult.

RBI said the discussions focused on expanding the reach and usage of UPI. Stakeholders provided input and suggestions on scaling up UPI infrastructure, expanding the product portfolio, and addressing the ecosystem’s challenges with innovative solutions. Suggestions were also made on integrating potential users into the digital payments ecosystem.

“The suggestions received will be examined, and appropriate action will be initiated by RBI in due course,” the central bank said in a statement. RBI has been asking banks to invest in IT capacity. Kotak Mahindra Bank CEO Ashok Vaswani had said the bank would be prioritising investments to building capacity and resilience for IT transactions given that UPI transactions have gone through the roof. RBI has recently restricted the bank from onboarding new customers digitally and issuing credit cards after finding inadequacies in IT system.