- USDJPY in a recovery mode after pull back comes to a halt

- Momentum indicators suggest intensifying positive momentum

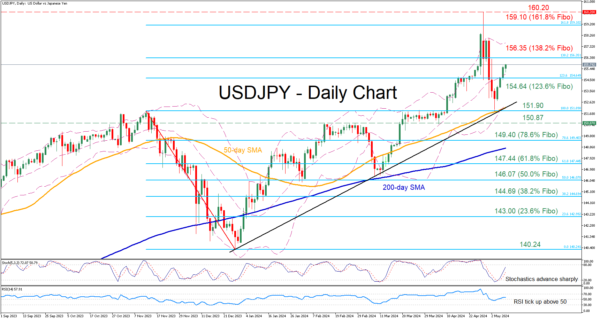

USDJPY experienced a strong pullback from its 34-year high of 160.20 following the intervention by Japanese authorities a week ago. However, the pair managed to find its feet at the 50-day simple moving average (SMA) and recoup a significant part of its recent losses.

Should bullish pressures persist, the price could challenge 156.35, which is the 138.2% Fibonacci extension of the 151.90-140.24 downleg. Further upside attempts could then cease at the 161.8% Fibo of 159.10. Conquering this barricade, the bulls may then attack the 34-year peak of 160.20.

On the flipside, if the pair comes under selling pressure, initial support could be found at the 123.6% Fibo of 154.64. Failing to halt there, the price could descend towards the May deflection point of 151.84, which lies very close to the 50-day SMA. In case of a downside violation, the April support of 150.87 could come under scrutiny.

In brief, after some roller coaster sessions in the aftermath of the Japanese intervention, USDJPY has been in a steady advance towards its recent highs. Therefore, we could see some heightened volatility moving forward as the price approaches levels that the Japanese side seems willing to defend.