Dollar falls broadly in early US session following the release of CPI data that shows disinflation resumed in April. This has reignited hopes that Fed is on track to start cutting interest rates by September, with Fed fund futures now indicating more than 70% probability of such a move. The renewed optimism has also boosted stock futures, which are pointing to a significantly higher open. Should major stock indexes extend their gains and to new record highs today, the resulting risk-on sentiment could feed back into currency markets and push the Dollar even lower.

Overall in the forex market,Yen is surprisingly the strongest currency of the day at this point. While it’s too soon to confirm a definitive reversal, the drop in global benchmark yields in response to US CPI data could support a sustainable near-term rebound for Yen. New Zealand Dollar follows as the second strongest currency, trailed by British Pound. On the weaker side, Euro is the second worst performer, following Dollar, with Canadian Dollar just ahead. Australian Dollar and Swiss Franc are positioned in the middle of the pack.

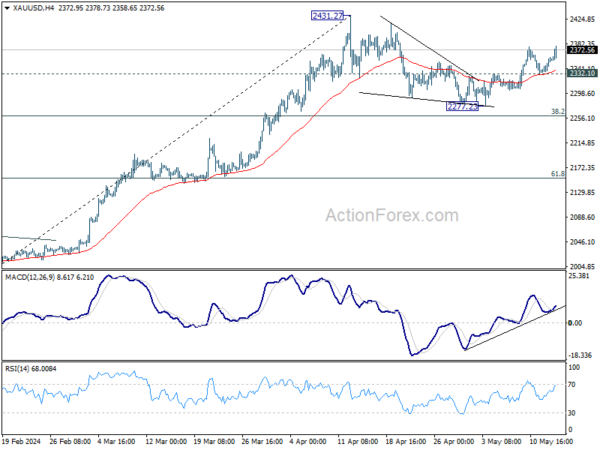

Technically, Gold also bounces following Dollar’s selloff. Outlook is unchanged that correction from 2431.27 has completed as a triangle at 2277.23. Strong support from 55 4H EMA is reinforcing this view. Further rally should be seen to retest 2431.27 next. This will remain the favored case as long as 2332.10 support holds.

In Europe, at the time of writing, FTSE is up 0.38%. DAX is up 0.85%. CAC is up 0.24%. UK 10-year yield is down -0.105 at 4.069. Germany 10-year yield is down -0.126 at 2.425. Earlier in Asia, Nikkei rose 0.08%. Hong Kong was on holiday. China Shanghai SSE fell -0.82%. Singapore fell -0.72%. Japan 10-year yield fell -0.0111 to 0.954.

US CPI slows to 3.4% in Apr, core CPI down to 3.6%

US CPI rose 0.3% mom in April, matched expectations. CPI core (ex food and energy) rose 0.3% mom, matched expectations. Energy index rose 1.1% mom while food index was unchanged.

Over the 12-months, CPI slowed from 3.5% yoy to 3.4% yoy , matched expectations. CPI core slowed from 3.8% yoy to 3.6% yoy, matched expectations. Energy index rose 2.6% yoy while good index rose 2.2% yoy.

Also released, retail sales was flat in April, below expectation of 0.4% mom. Ex-auto sales rose 0.2% mom, matched expectations.

Eurozone industrial production rises 0.6% mom in Mar, EU up 0.2% mom

Eurozone industrial production rose 0.6% mom in March, above expectation of 0.5% mom. Industrial production decreased by -0.5% mom for intermediate goods, -0.9% mom for energy, -1.1% mom for durable consumer goods, and -2.7% mom for non-durable consumer goods. Production increased by 1.0% mom for capital goods.

EU industrial production rose 0.2% mom. The highest monthly increases were recorded in Ireland (+12.8%), Belgium (+6.8%) and Luxembourg (+4.5%). The largest decreases were observed in Slovenia (-5.9%), Poland (-5.1%) and Denmark (-4.3%).

ECB Rehn reiterates the conditional signal of Jun rate cut

ECB Governing Council member Olli Rehn reiterated that a June interest rate cut is on the table, depending on the progress of inflation.

Rehn referred to the April meeting where the ECB gave a “conditional signal” about rate reductions. He elaborated, “If we gain more confidence that inflation is moving sustainably towards our target, we can reduce the restrictiveness of our monetary policy – in other words, we can lower interest rates.”

Australia’s wage price index rises 0.8% qoq, 4.1% yoy in Q1

Australia wage price index rose 0.8% qoq, below expectation of 0.9% qoq. The private sector rose 0.8% qoq and the public sector rose 0.5% qoq. Over the year, WPI slowed from 4.2% yoy to 4.1% yoy, below expectation of 4.2% yoy.

Michelle Marquardt, ABS head of prices statistics, said: “The WPI annual all sectors wage growth has remained at or above 4 per cent since September quarter 2023. The last time wages growth was at this level for three consecutive quarters was March quarter 2009.”

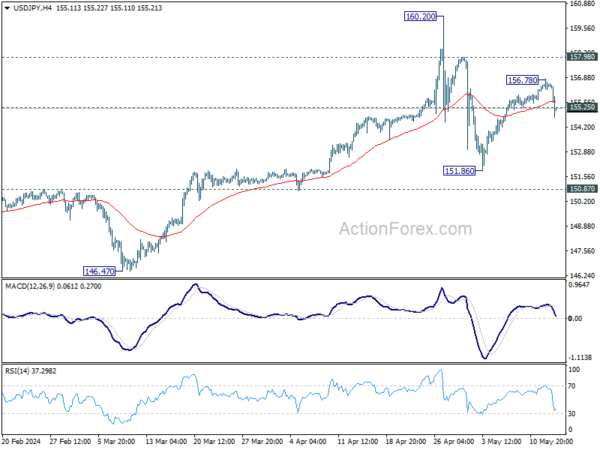

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 156.09; (P) 156.43; (R1) 156.78; More…

USD/JPY’s break of 155.25 minor support argues that rebound from 151.86 has completed already. Fall from 156.78 is seen as the third leg of the corrective pattern from 160.20 high. Intraday bias is back on the downside for 151.86 support and possibly below. On the upside, however, break of 156.78 will resume the rebound from 151.86 to 157.98 resistance instead.

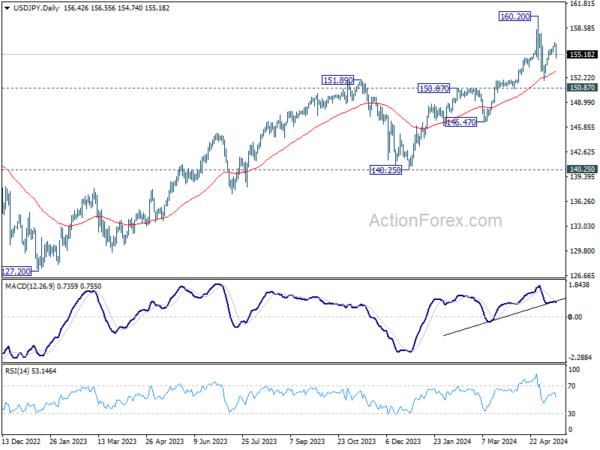

In the bigger picture, a medium term top might be formed at 160.20. But as long as 150.87 resistance turned support holds, fall from there is seen as correcting rise from 150.25 only. However, decisive break of 150.87 will argue that larger correction is possibly underway, and target 146.47 support next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Wage Price Index Q/Q Q1 | 0.80% | 1.00% | 0.90% | 1.00% |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.30% | 0.30% | 0.30% | |

| 09:00 | EUR | Eurozone Employment Change Q/Q Q1 P | 0.30% | 0.30% | 0.30% | |

| 09:00 | EUR | Eurozone Industrial Production M/M Mar | 0.60% | 0.50% | 0.80% | |

| 12:15 | CAD | Housing Starts Y/Y Apr | 240K | 232K | 242K | |

| 12:30 | CAD | Manufacturing Sales M/M Mar | -2.10% | -1.40% | 0.70% | 0.90% |

| 12:30 | USD | Empire State Manufacturing Index May | -15.6 | -10.8 | -14.3 | |

| 12:30 | USD | Retail Sales M/M Apr | 0.00% | 0.40% | 0.70% | |

| 12:30 | USD | Retail Sales ex Autos M/M Apr | 0.20% | 0.20% | 1.10% | |

| 12:30 | USD | CPI M/M Apr | 0.30% | 0.30% | 0.40% | |

| 12:30 | USD | CPI Y/Y Apr | 3.40% | 3.40% | 3.50% | |

| 12:30 | USD | CPI Core M/M Apr | 0.30% | 0.30% | 0.40% | |

| 12:30 | USD | CPI Core Y/Y Apr | 3.60% | 3.60% | 3.80% | |

| 14:00 | USD | Business Inventories Mar | 0.00% | 0.40% | ||

| 14:00 | USD | NAHB Housing Market Index May | 51 | 51 | ||

| 14:30 | USD | Crude Oil Inventories | -0.4M | -1.4M |