- After cool US CPI, attention shifts to UK and Japanese inflation

- Flash PMIs will be watched too amid signs of a rebound in Europe

- Fed to stay in the spotlight as plethora of speakers, minutes on tap

- No fireworks expected from RBNZ policy decision

Will CPI report bring BoC nearer to a rate cut?

Inflation data will dominate the economic agenda once again in the coming week as CPI numbers are due in Canada, Japan and the United Kingdom. The Canadian figures are up first on Tuesday. Prior to that, it will be an unusually quiet start to the week as several markets will be closed on Monday.

Price pressures appear to be on the wane again in Canada after the downward trend in the various CPI metrics flatlined in the second half of 2023. The underlying gauges – CPI trim, median and common – eased for the third straight month in March. The headline rate did tick up slightly to 2.8%, but this isn’t seen as anything worrying and wage growth has also been moderating since the beginning of the year.

The Bank of Canada meets on June 5 and there is around a 40% probability of a 25-basis-point cut. A softer-than-expected CPI report for April could push those odds closer to 50%. Nevertheless, even if there continues to be good progress in reining in inflation, a rate cut is more likely in July.

For the Canadian dollar, weaker inflation data could come as a setback for its one-month long uptrend against the greenback. But in the bigger picture, Fed rate cut expectations will be a bigger force in deciding the loonie’s fate. Investors will also be watching retail sales numbers for March out on Friday.

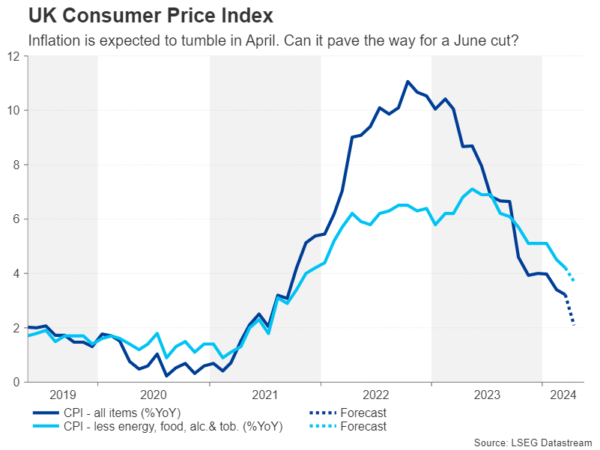

UK inflation to plummet as BoE hints at cut

The UK will publish its inflation stats a day later on Wednesday. Headline CPI fell to 3.2% in March to the lowest since September 2021. There’s been an encouraging drop in core CPI too in the first few months of 2023 and April is expected to be another good month for UK inflation. The headline rate is projected to fall to around the Bank of England’s target of 2.0%, mainly on the back of the base effect from the changes to the energy price cap in the UK.

Policymakers are wary that inflation may creep back up again once this effect begins to wear off, but there have been some hints from the BoE that interest rates could still be cut during the summer. Investors have lately started to ramp up their bets of a cut as early as June, with the odds rising to just over 50%.

There will be one more CPI report before the June policy meeting so should the two releases conform to expectations, the BoE may decide not to wait until August before slashing rates. The danger is that economic momentum seems to be recovering much faster than anticipated, and if consumer confidence gets a boost as the cost-of-living crisis eases further, there may not be much room for large rate cuts, especially as wage pressures have yet to subside substantially.

Thursday’s flash PMIs for May will likely support the narrative of rebounding growth, while Friday’s retail sales data will be vital too for underscoring the improving sentiment for the UK economy.

The brighter outlook could keep the pound’s current rebound versus the US dollar intact even as inflation heads lower, as long as the Fed is also seen to be cutting rates in the coming months.

BoJ hike in doubt as inflation is easing

Over in Japan, lower inflation will likely not be so welcome when the April report is released on Friday. Core CPI fell from 2.8% to 2.6% in March and is forecast to drop to 2.2% in April.

An inflation print too close to 2.0% combined with shrinking GDP would make it difficult for the Bank of Japan to raise interest rates again anytime soon. Investors see the BoJ hiking by at least a further 20bps in 2024 but not before September.

The flash PMIs on Thursday, however, might shed a more positive light on the economy. But that might not necessarily convince investors much that additional hikes are around the corner, and whether the yen can extend its recent bounce will depend on the dollar staying on the backfoot.

Fed hawks don’t seem to be budging

In America, economic data will take a backseat, with only existing home sales (Wednesday), new home sales (Thursday), and durable goods orders (Friday) attracting some attention. Not to forget, however, Thursday’s PMI surveys that will probably be scrutinized for more clues that the US economy is losing some steam, or at the very least, that input costs are rising at a slower pace.

Despite the lighter agenda, Fed rate cut expectations will remain front and centre, as the minutes of the May policy meeting are due on Wednesday, while FOMC officials will be out in force over the coming week, providing more up-to-date views than the minutes.

There’s been little deviation by policymakers from their hawkish remarks post the CPI report, and if there’s more ‘higher for longer’ rhetoric next week, the US dollar may recoup some of its recent losses and yields may edge higher too.

For equities, though, the absence of a dialling down of the hawkish Fed talk could deal a blow to Wall Street’s latest bid for fresh record highs.

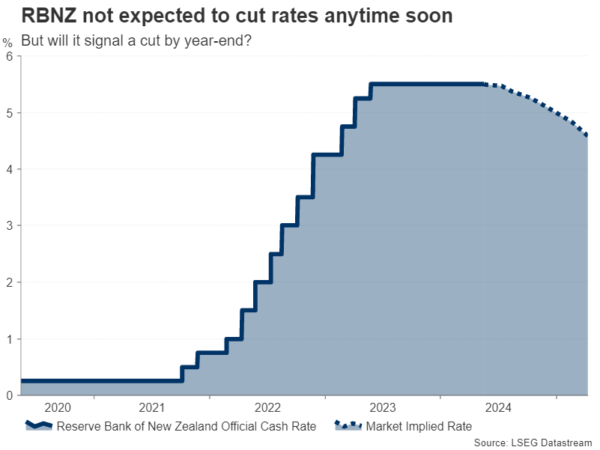

RBNZ to stay on pause but focus is on timing

The Reserve Bank of New Zealand is the only major central bank that meets for a policy decision next week. Although inflation in New Zealand has been gradually on the decline over the past year, it hasn’t been receding as fast as policymakers would like.

While the cooldown in the labour market and falling inflation expectations bode well for the outlook, the RBNZ is concerned about the stickiness in non-tradable inflation. Hence, policymakers are not expected to open the door to a summer or autumn rate cut as they hold the cash rate at 5.50% on Wednesday.

Yet, there is a slight possibility that the RBNZ might bring forward the timing of its projected rate cut from the second quarter of 2025 to the first quarter or earlier when it publishes its updated Monetary Policy Statement, and this alone could be interpreted as a dovish tilt.

For the New Zealand dollar, however, even if it were to take a hit from revised forecasts pointing to an earlier cut, there is scope for some bullish correction in the future, as market expectations remain significantly far off, with investors betting on a cut starting in October.

Kiwi traders will also be keeping an eye on quarterly retail sales figures due on Thursday.

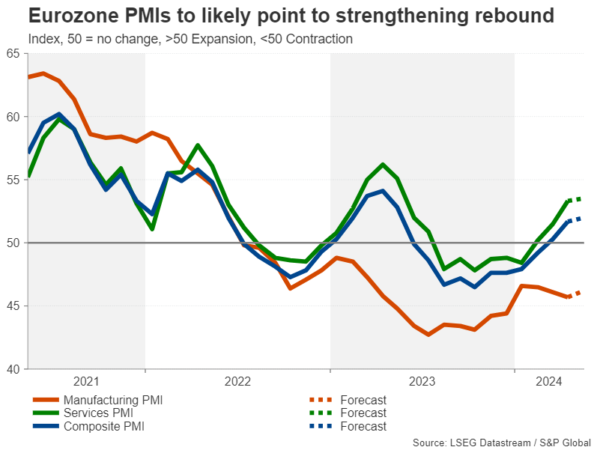

Will Eurozone recovery derail ECB cuts?

In the euro area, the flash PMIs released on Thursday will be the main focal point. Both the services and manufacturing PMIs are forecast to have increased slightly in May’s preliminary estimates, with the composite PMI increasing further above 50.0.

The Eurozone exited a shallow recession in the first quarter and growth could accelerate further in the coming months. So whilst a rate cut in June seems like a done deal, there’s a risk that stronger-than-expected numbers might weigh on ECB bets beyond June, which would be positive for the euro.

However, if there’s a softer set of PMI readings, the euro’s rebound versus the dollar could falter, as investors would price in deeper rate cuts.