As trading progresses into US session, activity in the forex markets remains relatively muted. Euro is showing signs of recovery ahead of key support levels against Dollar and crucial support against Sterling. Eurozone PMIs revealed that economic recovery is strengthening, with Germany, the region’s largest economy, finally catching up. Despite this positive data, Euro’s gains are still modest.

Currently, New Zealand Dollar is the strongest performer of the day, supported by strong retail sales data. Following closely is Australian Dollar while Swiss Franc is the third strongest. On the other end of the spectrum, Dollar is the weakest performer, trailed by Japanese Yen and British Pound. Canadian Dollar and Euro are positioned in the middle of the performance spectrum.

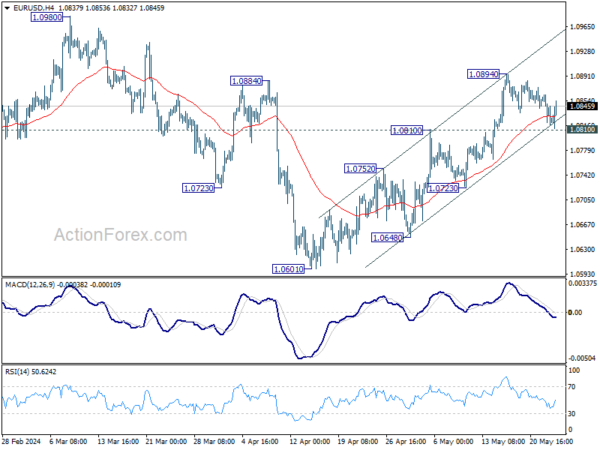

Technically, focus is now on whether EUR/USD could extend the bounce from slightly above 1.0810 resistance turned support. Further break of 1.0894 will confirm underlying bullishness momentum. Rise from 1.0601 should then target 1.0980 resistance next.

In Europe, at the time of writing, FTSE is flat. DAX is up 0.41%. CAC is up 0.50%. UK 10-year yield is down -0.021 at 4.215. Germany 10-year yield is up 0.012 at 2.551. Earlier in Asia, Nikkei rose 1.26%. Hong Kong HSI fell -1.70%. China Shanghai SSE fell -1.33%. Singapore Strait Times rose 0.44%. Japan 10-year JGB yield rose 0.002 to 1.003.

US initial jobless claims falls to 215k, vs exp 220k

US initial jobless claims fell -8k to 215k in the week ending May 18, below expectation of 220k. Four-week moving average rose 2k to 220k. Continuing claims rose 8k to 1794k in the week ending May 11. Four-week moving average of continuing claims rose 5k to 1782k.

UK PMI manufacturing rises to 22-month high, services growth slows

UK PMI Manufacturing rose from 49.1 to 51.3 in May, surpassing expectations of 49.2 and reaching a 22-month high. However, PMI Services fell from 55.0 to 52.9, below the anticipated 54.8 and marking a 6-month low. Consequently, PMI Composite dropped from 54.1 to 52.8.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, stated that the flash PMI indicates a “further expansion” of UK business activity, aligning with GDP growth of around 0.3% in Q2. He highlighted an “encouraging revival of manufacturing accompanied by sustained, but slower, service sector growth.”

The survey also revealed positive news regarding service sector inflation, which is cooling. Companies reported the slowest price growth in over three years, with headline inflation falling close to BoE’s target. Williamson noted that the PMI data support the view that BoE will start cutting interest rates in August, assuming the data continues to improve over the summer.

Eurozone PMI composite hits 12-month high at 52.3, pointing to 0.3% GDP growth in Q2

In May, Eurozone’s PMI Manufacturing rose from 45.7 to 47.4, surpassing expectations of 46.6 and marking a 15-month high. PMI Services remained unchanged at 53.3, slightly below the forecast of 53.5. PMI Composite increased from 51.7 to 52.3, reaching a 12-month high.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that Eurozone’s economy is “gathering further strength.” He highlighted that new orders are growing at a healthy rate, and companies’ confidence is reflected in a steady hiring pace.

Additionally, de la Rubia pointed out some positive developments for ECB. Rates of inflation for input and output prices in the services sector have softened. This trend supports ECB’s apparent stance to cut rates at the upcoming meeting on June 6.

Incorporating PMI numbers into their GDP nowcast, de la Rubia suggested that Eurozone will likely grow at a rate of 0.3% during Q2, effectively dispelling fears of a recession. He further indicated that GDP growth rate of nearly 1% could be achievable this year, with potential for even higher growth.

Also released, French PMI Manufacturing rose from 45.3 to 46.7 in May. PMI Services fell from 51.3 to 49.4. PMI Composite fell from 50.5 to 49.1, back in contraction.

Germany PMI Manufacturing rose from 42.5 to 45.4 in May, a 4-month high. PMI Services rose from 53.2 to 53.9, an 11-month high. PMI Composite rose from 50.6 to 52.2, a 12-month high.

Japan’s PMI manufacturing rises to 50.5, first expansion in a year

Japan’s PMI Manufacturing rose from 49.6 to 50.5 in May, exceeding expectations of 49.7 and signaling improving business conditions for the first time in a year. Meanwhile, PMI Services declined from 54.3 to 53.6, and PMI Composite inched up from 52.3 to 52.4.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, noted that Japan’s private sector expansion accelerated for the third consecutive month, reaching its fastest pace since August 2023. This suggests continued growth momentum midway through Q2, hinting at a better GDP reading after the disappointing Q1 results.

Pan highlighted that the expansion in business activity remained “services-led,” but the “near-stabilization” of manufacturing output offers hope for broader growth later in the year.

Both input cost and output price inflation rates eased, indicating “softer inflationary pressures across official gauges.” However, manufacturers continue to face rising cost pressures, partly due to “yen fluctuations,” which remain an important factor to monitor.

Australia PMI composite dips to 52.6, increasing cost pressures

Australia’s PMI Manufacturing remained steady at 49.6 in April, a joint 9-month high. PMI Services dropped slightly from 53.6 to 53.1, while PMI Composite decreased from 53.0 to 52.6.

Warren Hogan, Chief Economic Advisor at Judo Bank, noted that PMI remains “firmly in expansionary territory,” and pointed to growth at “around the long-term trend rate, if not a touch higher”.

However, Hogan warned that weak consumer spending will drag on growth in the first half of the year. Despite this, businesses are still hiring, with the employment index reaching a 6-month high.

Composite input price index hit a 6-month high, with service industry cost pressures rising slightly. Hogan remarked, “This does not suggest a material step down in domestic inflation pressures in Q2.”

Additionally, manufacturing input prices hit a one-year high in May, raising doubts about further deflation in domestic goods prices. This has been crucial in bringing inflation below 4% over the past year. Any increase in goods inflation, alongside high service sector inflation, poses a significant concern for RBA, which expects inflation to decrease over the next 18 months.

NZ retail sales up 0.5% in Q1, ending two-year downturn

New Zealand’s retail sales volumes rose by 0.5% qoq to NZD 25B in Q1, significantly outperforming the anticipated -0.3% qoq decline. Sales values increased by 0.7% qoq to NZD 30B.

“In the March quarter, we saw a modest increase in retail activity, with growth across most industries,” said Melissa McKenzie, business financial statistics manager. “This followed two years of declines.”

Of the 15 retail industries, nine experienced higher sales volumes during the quarter. The most notable contributions came from food and beverage services, which rose by 2.2%, motor vehicle and parts retailing, which increased by 1.1%, recreational goods retailing, which surged by 4.7%, and accommodation, which climbed by 4.1%.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2691; (P) 1.2726; (R1) 1.2753; More…

Intraday bias in GBP/USD stays neutral for the moment. On the upside. decisive break of 100% projection of 1.2298 to 1.2633 from 1.2445 at 1.2780 will extend the rally from 1.2298 to 1.2892 resistance next. However, break of 1.2685 will minor support will turn bias back to the downside, for retreat to 55 4H EMA (now at 1.2661) and below.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern. Fall from 1.2892 is seen as the third leg which might have completed already. Break of 1.2892 resistance will argue that larger up trend from 1.0351 (2022 low) is ready to resume through 1.3141. Meanwhile, break of 1.2298 support will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q1 | 0.50% | -0.30% | -1.90% | -1.80% |

| 22:45 | NZD | Retail Sales ex Autos Q/Q Q1 | 0.40% | 0.00% | -1.70% | -1.60% |

| 23:00 | AUD | Manufacturing PMI May P | 49.6 | 49.6 | ||

| 23:00 | AUD | Services PMI May P | 53.1 | 53.6 | ||

| 00:30 | JPY | Manufacturing PMI May P | 50.5 | 49.7 | 49.6 | |

| 00:30 | JPY | Services PMI May P | 53.6 | 54.3 | ||

| 01:00 | AUD | Consumer Inflation Expectations May | 4.10% | 4.60% | ||

| 07:15 | EUR | France Manufacturing PMI May P | 46.7 | 45.5 | 45.3 | |

| 07:15 | EUR | France Services PMI May P | 49.4 | 51.5 | 51.3 | |

| 07:30 | EUR | Germany Manufacturing PMI May P | 45.4 | 43.5 | 42.5 | |

| 07:30 | EUR | Germany Services PMI May P | 53.9 | 53.5 | 53.2 | |

| 08:00 | EUR | Eurozone Manufacturing PMI May P | 47.4 | 46.6 | 45.7 | |

| 08:00 | EUR | Eurozone Services PMI May P | 53.3 | 53.5 | 53.3 | |

| 08:30 | GBP | Manufacturing PMI May P | 51.3 | 49.2 | 49.1 | |

| 08:30 | GBP | Services PMI May P | 52.9 | 54.8 | 55 | |

| 12:30 | USD | Initial Jobless Claims (May 17) | 215K | 220K | 222K | 223K |

| 13:45 | USD | Manufacturing PMI May P | 50.1 | 50 | ||

| 13:45 | USD | Services PMI May P | 51.5 | 51.3 | ||

| 14:00 | USD | New Home Sales Apr | 674K | 693K | ||

| 14:00 | EUR | Eurozone Consumer Confidence May P | -14 | -15 | ||

| 14:30 | USD | Natural Gas Storage | 84B | 70B |