- EURUSD retreats from a fresh 2-month high of 1.0894

- But meets support a tad above its long-term restrictive trendline

- Oscillators suggest bulls remain in charge despite the latest drop

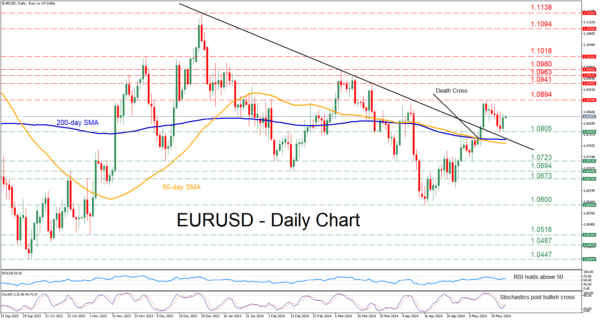

EURUSD had been in a steady advance following its 2024 bottom of 1.0600 on April 16. However, the pair reversed lower after its rejection at a fresh two-month high of 1.0894 in mid-May, with the price finding strong support just above its long-term downward sloping trendline.

Should the latest uptick gain momentum, the price might revisit the recent two-month peak of 1.0894. Conquering that hurdle, the bulls may attack a series of lower highs that have formed the pair’s descending trendline such as 1.0941, 1.0963 and 1.0980 all registered in March.

Alternatively, if the short-term weakness persists, the recent support of 1.0805 could act as the first line of defence. Violating that zone, the pair could challenge the descending trendline in place since December 2023 before it descends towards 1.0723, a region that provided support in February, April and May. A violation of that barrier could set the stage for the February bottom of 1.0694.

In brief, EURUSD came under some selling pressure after posting a fresh two-month high of 1.0894, but the bulls appear to retain the upper hand. That being said, a break below the crucial downward sloping trendline is needed for the technical picture to shift back to bearish.