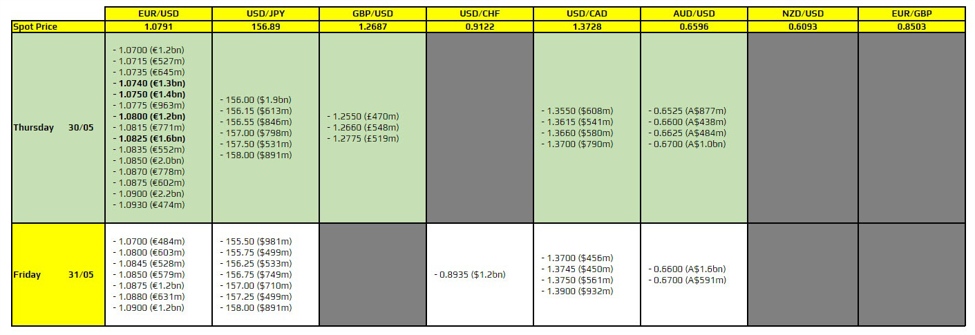

There are a few to take note of on the day, as highlighted in bold.

They are all for EUR/USD, so let’s take a look at how the expiries might impact price action as such. The first ones are at the 1.0740-50 level but that might not factor in too much as the key technical levels here are more important for now. But on a break below the 200-day moving average in European trading, the expiries here could help to hold losses alongside the 50.0 Fib retracement level at 1.0750 at least.

Then, there are the ones at 1.0800 and 1.0825. The one at the figure level is the more pertinent one and could act as more of a magnet, as Eamonn pointed out here. But do be mindful of the broader market mood, as the dollar is holding firmer with risk sentiment looking rather sour going into European trading. That will see the technical levels above be a more critical factor in play instead.

For more information on how to use this data, you may refer to this post here.