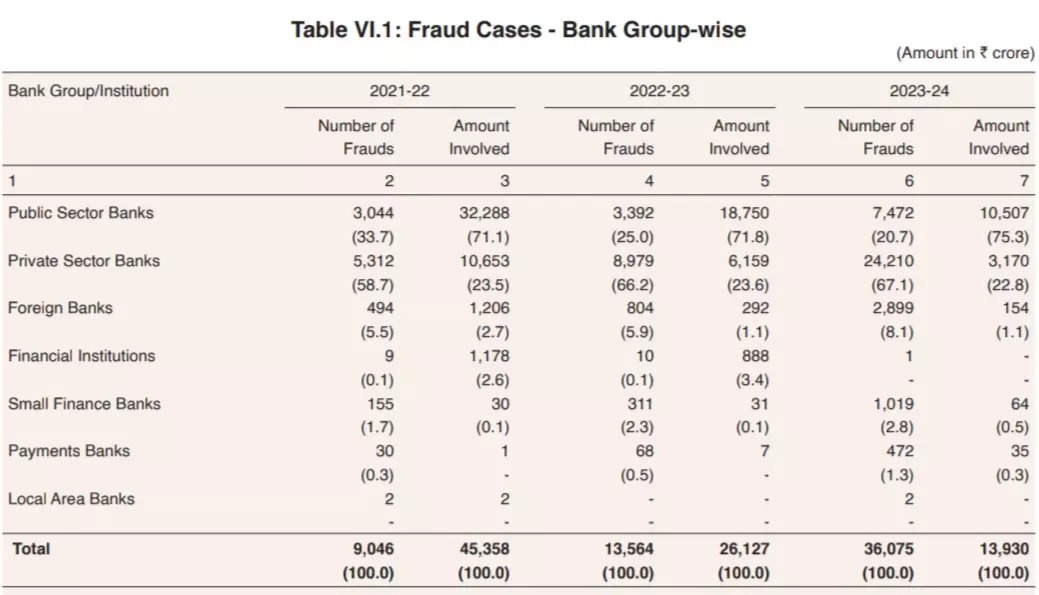

According to RBI’s annual report released on Thursday, the number of fraud cases reported in FY24 were 36,075, up nearly 300 per cent from the 9,046 cases reported in FY22.

However, the total amount involved in these frauds nearly halved, having reduced by 46.7 per cent. The total amount lost in bank frauds went down to Rs 13,930 crore in the financial year ended March 2024, compared to Rs 26,127 crore a year earlier.

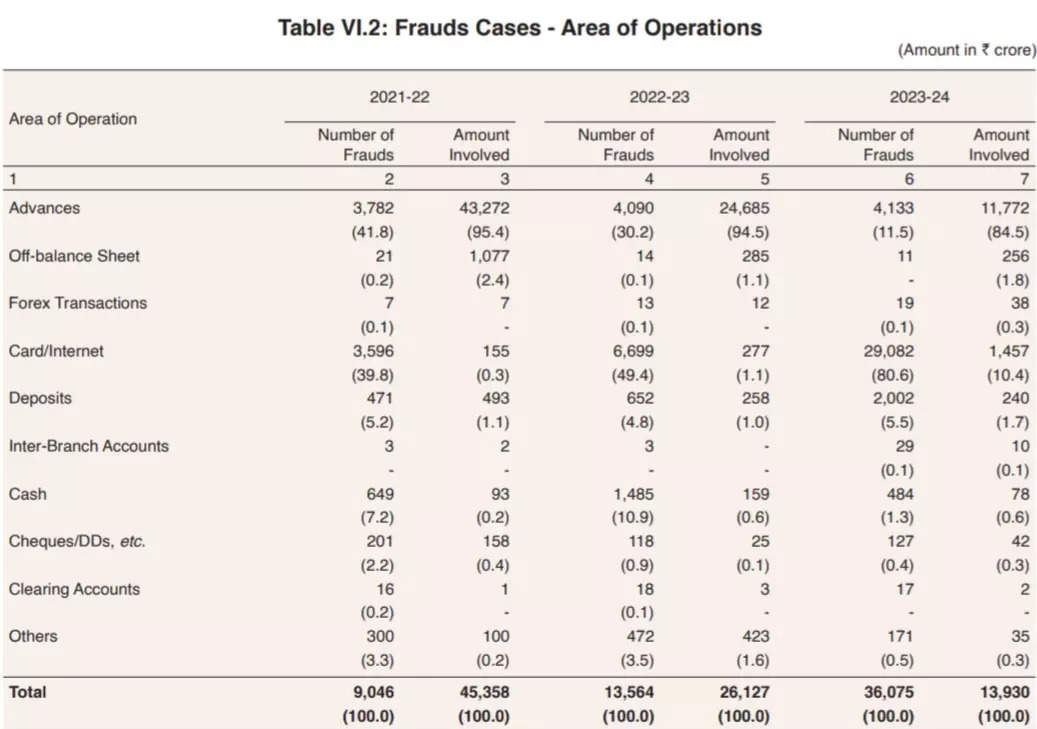

Frauds have occurred predominantly in the category of digital payments (card/internet), in terms of number. In terms of value, frauds have been reported primarily in the loan portfolio (advances category).

Private sector banks reported maximum number of frauds in last 3 years while public sector banks continued to contribute maximum to the fraud amount in last 3 years.

The frauds reported by payment banks increased to Rs 35 crore in a total of 472 cases in FY24. There were only 68 cases reported involving Rs 7 crore a year earlier.

ALSO READ: Cyber frauds crossed 14K mark in 2021, led by ATM and OTP frauds: NCRB Data

Maximum Frauds in Digital Payments

Maximum frauds were seen in digital payments while also involved credit/debit cards, internet banking, etc. However, the amounts lost in these frauds tend to be smaller in size than an average loan fraud.

“>

“>Loan frauds still accounted for the biggest chunk of all bank frauds in the country, of Rs 11,772 crore, of the total bank frauds worth Rs 13,930 crore in FY24.

The number of frauds reported related to card and internet payments increased from 3,596 in FY22 to 29,082 in FY24. In terms of value, it increased from Rs 155 crore in FY22 to Rs 1,457.

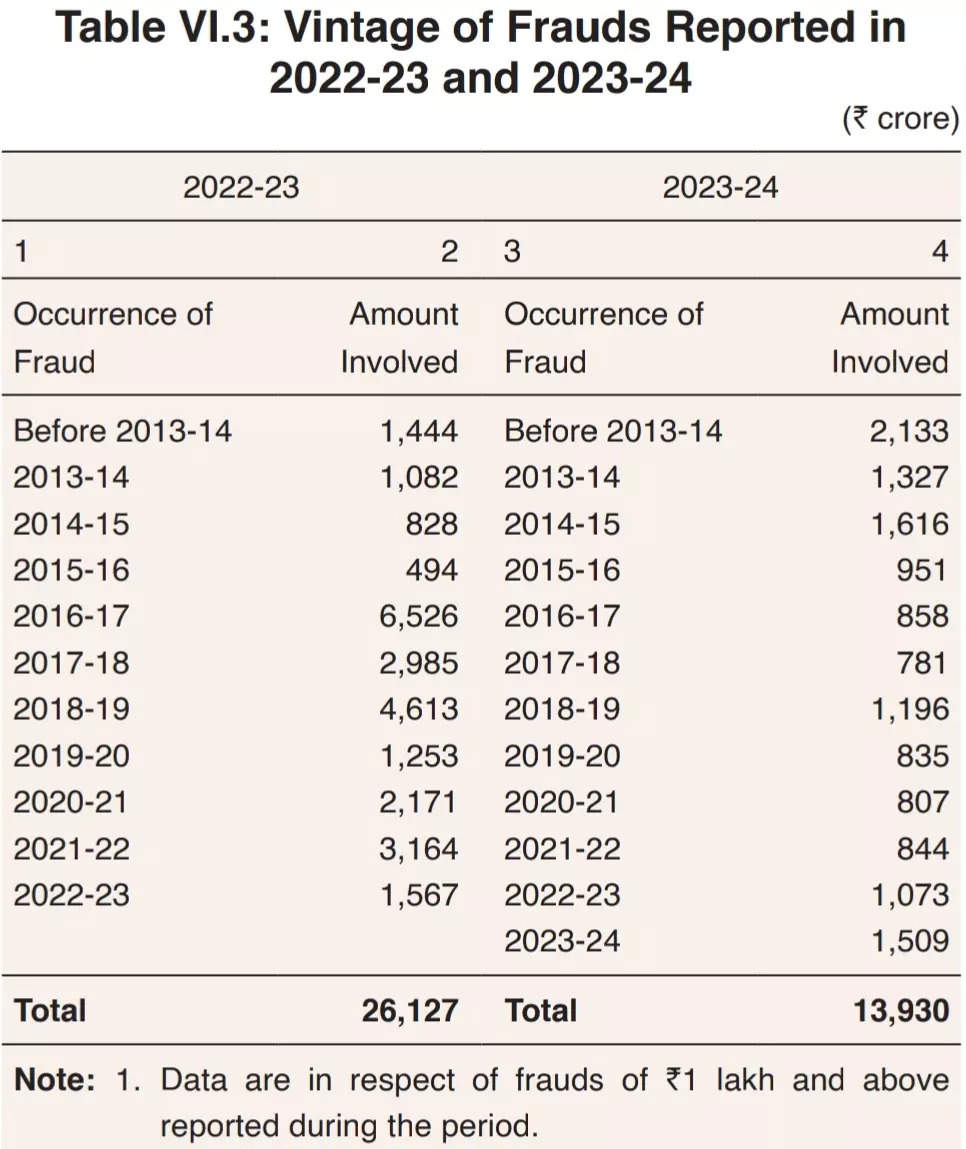

Lag in Occurence & Detection

The Reserve Bank of India also witnessed a significant lag in the occurence of the fraud and its detection.

The RBI report highlighted that many of the frauds that may have been reported in a given year, are actually frauds that may have been committed earlier. About 89.2 per cent of all bank frauds reported in FY24, actually occurred in previous financial years.

The amount involved in frauds that occurred in previous financial years formed 94 per cent of the frauds reported in FY23 in terms of value.

ALSO READ: Data and Credential thefts top two concerns for SMBs: Report

RBI’s action against increasing frauds:

The Apex Bank in its annual report revealed some goals that the cenbank has taken for 2024-25 to prevent such scams.

The RBI decided on setting up of cyber range to augment cyber incident response capability of SCBs (Utkarsh 2.0) and to augment supervisory capabilities by a suite of SupTech data tools on micro-data analytics and other similar use cases using artificial intelligence and machine learning (Utkarsh 2.0).