A recent survey by Ujjivan Small Finance Bank highlights significant differences in banking preferences between metro and non-metro customers. While non-metro customers prioritize insurance and transparency, metro customers favor lifestyle perks and exclusive offers.

According to the survey, 42% of non-metro customers are interested in premium savings accounts offering accidental insurance coverage of INR 10 lakhs. In contrast, 67% of metro customers are more inclined towards shopping and travel-related offers. Complimentary airport lounge access was a popular feature, with 50% of metro customers and 31% of non-metro customers expressing interest.

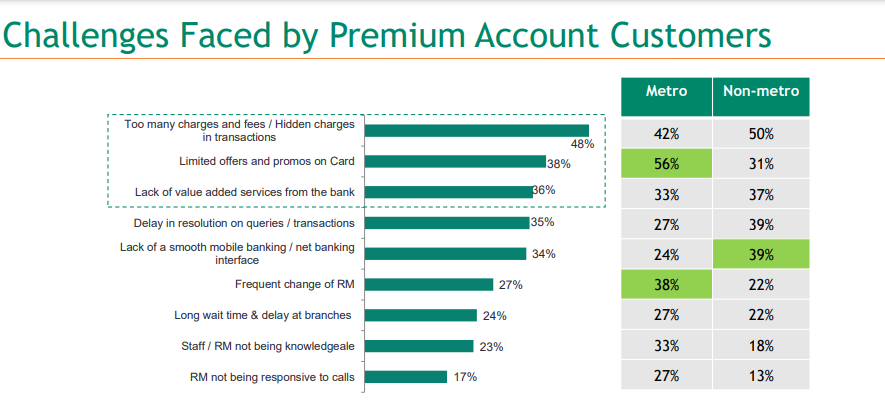

Conducted across 400+ branches, the survey also found that 50% of non-metro customers are concerned about hidden charges and high transaction fees, underscoring the need for transparency. Conversely, 56% of metro customers expressed dissatisfaction with limited offers and promotions, indicating a preference for tailored perks and exclusive benefits.

Both non-metro (37%) and metro customers (33%) cited the lack of value-added services as a significant challenge.

Commenting on the findings, Ittira Davis, MD & CEO of Ujjivan Small Finance Bank, emphasized the importance of understanding regional customer expectations to provide personalized premium banking solutions. “With evolving banking needs, it is critical to offer relevant and meaningful solutions coupled with unparalleled experiences,” he said.

In response to these insights, Ujjivan SFB has launched the Maxima Savings Account and Business Maxima Current Account, designed to provide a premium banking experience.

These accounts offer a range of benefits tailored to the diverse needs of customers across metros and non-metros, including wellness services, exclusive merchant offers, airport lounge access, and premium health checkups.