Euro surges broadly today after Eurozone inflation data showed larger than expected re-acceleration in May. While this increase doesn’t shift the consensus that ECB will proceed with a rate cut next week, it significantly dampens any remaining expectations for a subsequent cut in July. Market speculation now leans towards the possibility of only two ECB rate cuts this year, rather than the previously anticipated three.

Amidst these developments, Euro’s rally is overshadowed by stronger performances from New Zealand Dollar and Australian Dollar, driven by a robust rebound in risk markets following the release of US. PCE inflation data. The data revealed that both headline and core inflation annual rates remained stable, aligning with forecasts. However, it was the slightly lower-than-expected monthly increase in core PCE that ignited a positive response from the markets, prompting a jump in US futures and a corresponding decline in the 10-year yield.

For the week, the Swiss Franc holds its position as the strongest currency, followed by Aussie and then Kiwi. On the other end of the spectrum, British Pound has emerged as the weakest, with Japanese Yen and US. Dollar also underperforming. Canadian Dollar and Euro are positioning in the middle.

In Europe, at the time of writing, FTSE is up 0.64%. DAX is up 0.13%. CAC is up 0.14%. UK 10-year yield is down -0.009 at 4.342. Germany 10-year yield is up 0.014 at 2.667. Earlier in Asia, Nikkei rose 1.14%. Hong Kong HSI fell -0.83%. China Shanghai SSE fell -0.16%. Singapore Strait Times rose 0.40%. Japan 10-year JGB yield rose 0.0149 to 1.075.

US PCE unchanged at 2.7% yoy in Apr, core PCE steady at 2.8% yoy

US PCE price index rose 0.3% mom in April, matched expectations. Core PCE price index (excluding food and energy) rose 0.2% mom, below expectation of 0.3% mom. Prices for goods increased 0.2% mom, and prices for services increased 0.3% mom. Food prices decreased -0.2 mom and energy prices increased 1.2% mom.

Annually, PCE price index was unchanged at 2.7% yoy. Core PCE price index was unchanged at 2.8% yoy. Both matched expectations. Prices for goods increased 0.1% yoy and prices for services increased 3.9% yoy. Food prices increased 1.3% yoy and energy prices increased 3.0% yoy.

Personal income rose 0.3% mom or USD 65.3B, matched expectations. Personal spending rose 0.2% mom or USD 39.1B, below expectation of 0.3% mom.

Canada’s GDP flat in Mar, up 0.4% qoq in Q1

Canada’s GDP was essentially unchanged in March, matched expectations. Both goods-producing and services-producing industries were essentially unchanged. Overall, 11 of 20 sectors increased in the month.

Advance estimate suggests that GDP rose 0.3% mom in April. Increases in manufacturing, mining, quarrying, and oil and gas extraction and wholesale trade were partially offset by decreases in utilities.

In Q1, GDP increased 0.4% qoq, Higher household spending on services was the top contributor to the increase in GDP, while slower inventory accumulations moderated overall growth.

Eurozone CPI rises to 2.6% in May, CPI core up to 2.9%

Eurozone CPI accelerated from 2.4% yoy to 2.6% yoy in May, above expectation of 2.5% yoy. CPI core (ex-energy, food, alcohol & tobacco) also jumped from 2.7% yoy to 2.9% yoy, above expectation of 2.7% yoy.

Looking at the main components, services is expected to have the highest annual rate in May (4.1%, compared with 3.7% in April), followed by food, alcohol & tobacco (2.6%, compared with 2.8% in April), non-energy industrial goods (0.8%, compared with 0.9% in April) and energy (0.3%, compared with -0.6% in April).

ECB’s Panetta advocates for prompt and gradual policy adjustments

ECB Governing Council member Fabio Panetta suggested today that even multiple rate cuts would leave ECB’s monetary policy in a tight stance. Panetta emphasized the importance of managing these adjustments carefully to avoid macroeconomic instability, stating, “When defining the path of policy rate cuts, it should be borne in mind that prompt and gradual action contains macroeconomic volatility better than a tardy and hasty approach.”

Panetta clarified that the anticipated rate cuts should not be seen as economic “stimulus” but rather as necessary adjustments to prevent the monetary policy from becoming “excessively tight” which might otherwise risk an inflation undershoot.

“Over the coming months, if the incoming data is consistent with the current projections, it will be appropriate to ease monetary conditions,” he said. “This will not stop the action to restore price stability.”

Reacting to today’s release of Eurozone inflation data, Panetta described the figures as “neither good nor bad.”

Japan’s Tokyo CPI core rises in May, industrial production weakens in Apr

In May, Japan’s Tokyo CPI core (excluding fresh food) increased from 1.6% yoy to 1.9% yoy, matching expectations. This rise was primarily driven by higher electricity costs. However, CPI core-core (excluding food and energy) slowed slightly from 1.8% yoy to 1.7% yoy. Private sector service inflation also decreased from 1.6% yoy to 1.4% yoy. The headline CPI saw an uptick from 1.8% yoy to 2.2% yoy.

April’s industrial production declined by -0.1% mom, falling short of the anticipated 1.5% mom rise. The Ministry of Economy, Trade, and Industry maintained its assessment that industrial production “showed weakness while fluctuating indecisively.” Among the 15 industrial sectors surveyed, seven reported lower output, while eight saw increases. Manufacturers expect output to rise by 6.9% in May before falling by -5.6% in June.

Additionally, April’s retail sales jumped by 2.4% yoy, surpassing the expected 1.9% increase. Unemployment rate remained steady at 2.6%.

China’s manufacturing PMI falls back into contraction in May

China’s official PMI Manufacturing index fell from 50.4 to 49.5 in May, below the expected 50.5, indicating contraction after two months of expansion. The new manufacturing export order subindex also dropped significantly to 47.2 from 50.6 in April, highlighting weakening external demand.

PMI Non-Manufacturing index ticked down slightly from 51.2 to 51.1, missing the expectation of 51.5. Within this sector, the construction new order subindex decreased to 44.1 from 45.3, and the service sector business activity subindex declined to 47.4 from 50.3, showing reduced activity.

PMI Composite, which combines manufacturing and non-manufacturing data, fell from 51.7 to 51.0, indicating a slowdown in overall economic activity.

EUR/USD Mid-Day Outlook

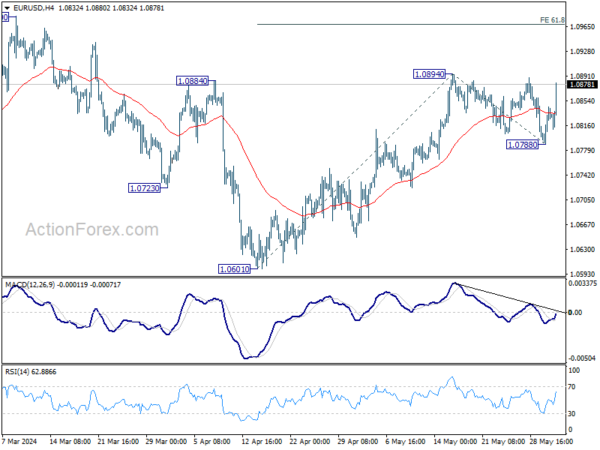

Daily Pivots: (S1) 1.0798; (P) 1.0822; (R1) 1.0855; More….

Focus is now on 1.0894 in EUR/USD with today’s strong bounce. Firm break there will resume whole rally from 1.0601, and target 61.8% projection of 1.0601 to 1.0894 from 1.0788 at 1.0969. For now, risk will stay on the upside as long as 1.0788 support holds, in case of retreat.

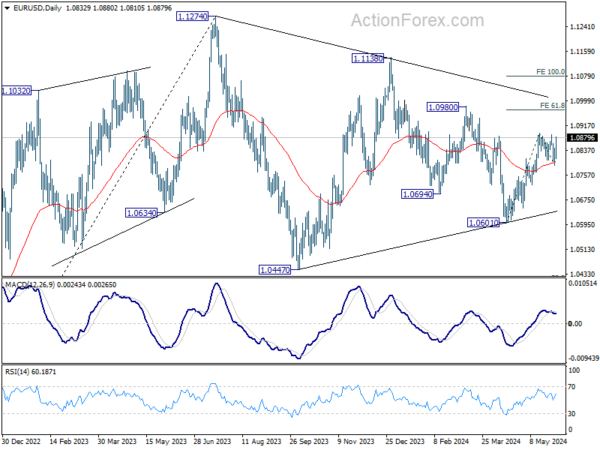

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern. Fall from 1.1138 is seen as the third leg and could have completed. Firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high. On the downside, break of 1.0601 will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y May | 2.20% | 1.80% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y May | 1.90% | 1.90% | 1.60% | |

| 23:30 | JPY | Tokyo CPI ex Food & Energy Y/Y May | 1.70% | 1.80% | ||

| 23:30 | JPY | Unemployment Rate Apr | 2.60% | 2.60% | 2.60% | |

| 23:50 | JPY | Industrial Production M/M Apr P | -0.10% | 1.50% | 4.40% | |

| 23:50 | JPY | Retail Trade Y/Y Apr | 2.40% | 1.90% | 1.20% | 1.10% |

| 01:30 | AUD | Private Sector Credit M/M Apr | 0.50% | 0.40% | 0.30% | 0.40% |

| 01:30 | CNY | NBS Manufacturing PMI May | 49.5 | 50.5 | 50.4 | |

| 01:30 | CNY | NBS Non-Manufacturing PMI May | 51.1 | 51.5 | 51.2 | |

| 05:00 | JPY | Housing Starts Y/Y Apr | 13.90% | -0.20% | -12.80% | |

| 06:00 | EUR | Germany Import Price M/M Apr | 0.70% | 0.50% | 0.40% | |

| 06:00 | EUR | Germany Retail Sales M/M Apr | -1.20% | 0.10% | 1.80% | 2.60% |

| 06:30 | CHF | Real Retail Sales Y/Y Apr | 2.70% | 0.20% | -0.10% | -0.20% |

| 06:45 | EUR | France GDP Q/Q Q1 | 0.20% | 0.20% | 0.20% | |

| 08:30 | GBP | Mortgage Approvals Apr | 61K | 62K | 61K | |

| 08:30 | GBP | M4 Money Supply M/M Apr | 0.10% | 0.40% | 0.70% | |

| 09:00 | EUR | Eurozone CPI Y/Y May P | 2.60% | 2.50% | 2.40% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y May P | 2.90% | 2.70% | 2.70% | |

| 12:30 | CAD | GDP M/M Mar | 0.00% | 0.00% | 0.20% | |

| 12:30 | USD | Personal Income M/M Apr | 0.30% | 0.30% | 0.50% | |

| 12:30 | USD | Personal Spending Apr | 0.20% | 0.30% | 0.80% | 0.70% |

| 12:30 | USD | PCE Price Index M/M Apr | 0.30% | 0.30% | 0.30% | |

| 12:30 | USD | PCE Price Index Y/Y Apr | 2.70% | 2.70% | 2.70% | |

| 12:30 | USD | Core PCE Price Index M/M Apr | 0.20% | 0.30% | 0.30% | |

| 12:30 | USD | Core PCE Price Index Y/Y Apr | 2.80% | 2.80% | 2.80% | |

| 13:45 | USD | Chicago PMI May | 40 | 37.9 |