- ECB set to slash rates on Thursday, focus on forward guidance

- But will the BoC take the lead when it meets on Wednesday?

- US jobs report eyed on Friday as Fed unyielding on cuts

- OPEC+ might extend some output reductions into 2025

ECB poised to cut rates, but what’s next?

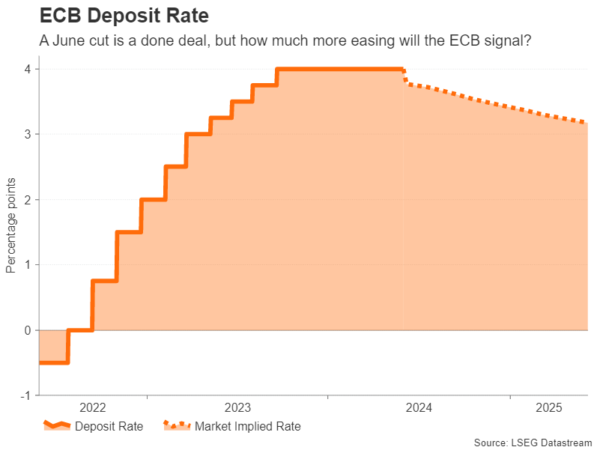

The path by central banks to lower borrowing costs has been far from smooth, but it seems that the European Central Bank will be among the first to reach its desired destination. The ECB meets on Thursday for its June policy decision and is widely expected to cut its three main lending rates by 25 basis points. This would take the deposit rate down to 3.75%, widening the differential with the Fed funds rate, which currently stands at a range of 5.25%-5.50%.

The euro has been surprisingly resilient against all the rate cut speculation, staging a rebound even as a June move became increasingly baked in by the markets. The improving economic picture across the euro area is likely behind the recent bounce. However, stronger growth might make it more difficult for the ECB to cut rates too quickly, especially as inflationary pressures have yet to subside completely.

Hence, the main debate for ECB policymakers at the June meeting will be not so much whether or not to go ahead with the much publicised cut, but by how much and how quickly to ease policy thereafter. Investors think there will be at least one more 25-bps cut after June, but dovish Governing Council members are likely leaning closer to three and maybe even four cuts.

President Lagarde will have a tough balancing act to perform and ultimately, it is the tone of the press conference that markets will react to the most. If Lagarde plays down the prospect of rapid rate reductions, the euro could leap above the $1.09 level.

In other data out of the Eurozone, the final PMI estimates for May will be watched on Wednesday, and German industrial output and trade figures might attract some attention on Friday too.

Will the BoC take the plunge and cut rates?

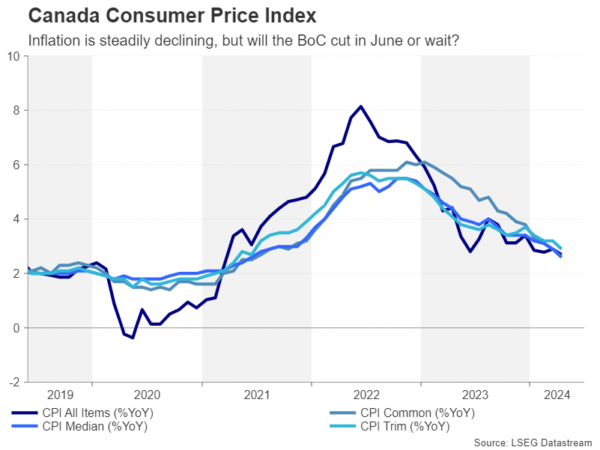

Amid the sticky inflation picture in the US, the ECB is not the only central bank in a much more advantageous position than the Fed. The Bank of Canada has also seen good progress in getting inflation much closer to its target midpoint of 2%. Headline inflation fell to a three-year low of 2.7% in April and all three underlying measures of CPI have been on the decline so far this year, slipping below 3.0%.

With Canada’s labour market cooling slightly over the past year and economic growth being somewhat sluggish, there is a strong case for lowering rates on Wednesday when the Bank meets. However, a 25-bps cut is only 60% priced in by the markets, with a July move seen as much more of a done deal.

The delay to the Fed’s own rate-cutting plans is likely a factor in this as the Bank of Canada will not want to diverge significantly from the Fed out of fear of sparking a sharp slide in the loonie. Nevertheless, the option to cut in June remains firmly on the table and should the BoC deliver such a surprise, policymakers will probably try to signal that this is not the start of an aggressive rate-cutting cycle.

The Canadian dollar is in danger of breaking out of its bullish channel versus the greenback if the BoC cuts rates, while traders will also be keeping an eye on employment numbers for May due on Friday.

NFP and ISM PMIs to shed valuable light

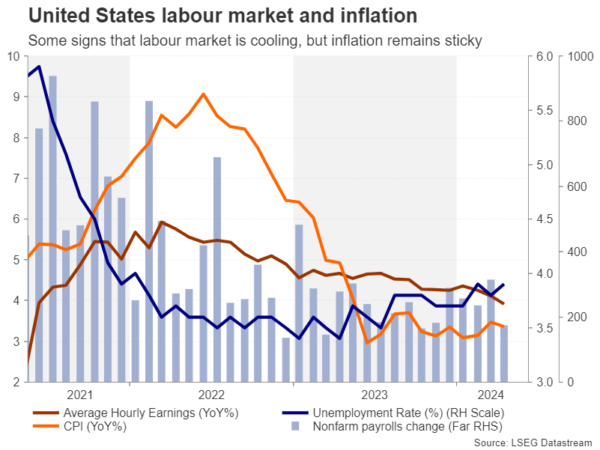

It’s been one setback after another for the Fed this year as inflation has been hovering nearer 3.0% rather than the 2% target, which is looking increasingly elusive. Fed officials remain confident that inflation will eventually resume its downward trajectory, but the tight labour market and robust consumer spending have made the task challenging.

More recently, though, there have been some signs that the jobs market is cooling off and consumers are turning more cautious. Friday’s nonfarm payrolls report will be crucial in setting expectations ahead of the June 12 FOMC meeting.

In April, the US economy added 175k jobs, which was a marked slowdown from the prior month. But what is perhaps a more significant indication that the hiring spree is coming to an end is the fact that the unemployment rate has been slowly inching higher over the past year, reaching 3.9% in April, while wage growth has been moderating too.

If this trend is maintained in the May report, investors are likely to feel more hopeful that the Fed will be able to cut rates by at least once in 2024. One of the headaches for policymakers during this ‘patience’ phase of the policy cycle is that the data has been very mixed and even contradictory.

There’s a risk that the economic releases ahead of the NFP numbers will further confuse markets. They include the ISM manufacturing and services PMIs, due Monday and Wednesday respectively, factory orders and the JOLTS job openings on Tuesday, and the ADP employment report on Wednesday. The ISM PMIs in particular will provide vital updates on business momentum as well as gauging price pressures.

Unless the data clear some of the fog over the Fed policy path, the US dollar will likely continue to trade sideways against a basket of currencies.

OPEC+ meets, busy week for the aussie

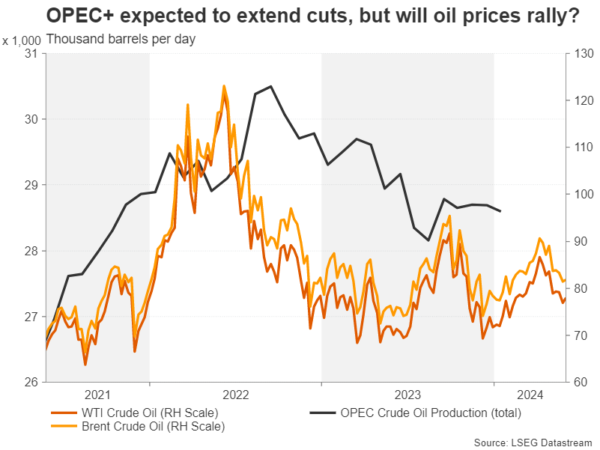

The decision by OPEC and non-OPEC countries on output levels will greet markets on Monday as the cartel is scheduled to hold online meetings on Sunday. Reports suggest that the oil alliance will extend the voluntary cuts of 2.2 million barrels per day into the second half of 2024 while the pledges by all OPEC+ members to restrict output by 3.66 million bpd could be stretched into 2025.

Oil prices haven’t been impressed by the rumours but an agreement that takes the cuts into next year would be positive for the outlook.

Elsewhere, the Australian dollar will be on standby for the latest domestic GDP readings on Wednesday. Australia’s economy has been steadily losing steam over the past few quarters and it’s expected that GDP growth held at a meagre 0.2% q/q in Q1.

If growth is faster than forecast, this would add to bets that the Reserve Bank of Australia is more likely to hike rates than to cut them in the upcoming months, lifting the aussie.

Chinese data will also be important for the aussie next week. The Caixin manufacturing and services PMIs will be watched on Monday and Wednesday, respectively, while on Friday, investors will be hoping to see stronger exports growth when May trade stats are released.

Finally, Japanese wage figures out on Wednesday might offer the beleaguered yen some support should they show an acceleration in pay growth in April.