With a parade of new models and a marketing tailwind from Formula 1, sports car maker Aston Martin expects to become cash-flow positive this year, according to executive chairman Lawrence Stroll.

“We’re now at a really transitional moment, with an inflection point for this company,” Stroll told CNBC. “We’re introducing all our products, finally, after designing and building them for the last four years, after I took over. Going forward, we will now have a normal quarterly output, not these hockey sticks we’ve seen in the past, but the more traditional quarterly flow of new vehicles constantly coming to market.”

Stroll said the company, which has been losing money for years, expects to become cash flow positive starting in the third quarter, and continue to be cash flow positive in the fourth quarter and beyond.

That would mark a dramatic turnaround for the storied British carmaker, famed for its role in the James Bond movies and for its history of financial ups and downs. Stroll, a billionaire former fashion mogul who stepped in as Aston Martin executive chairman in 2020, imposed a sweeping plan to restore the brand’s shine and profits.

Aston Martin has overhauled and improved manufacturing, shored up its financials to make investments in the future, and is now launching a fleet of new products defined by high-performance and luxury finishes.

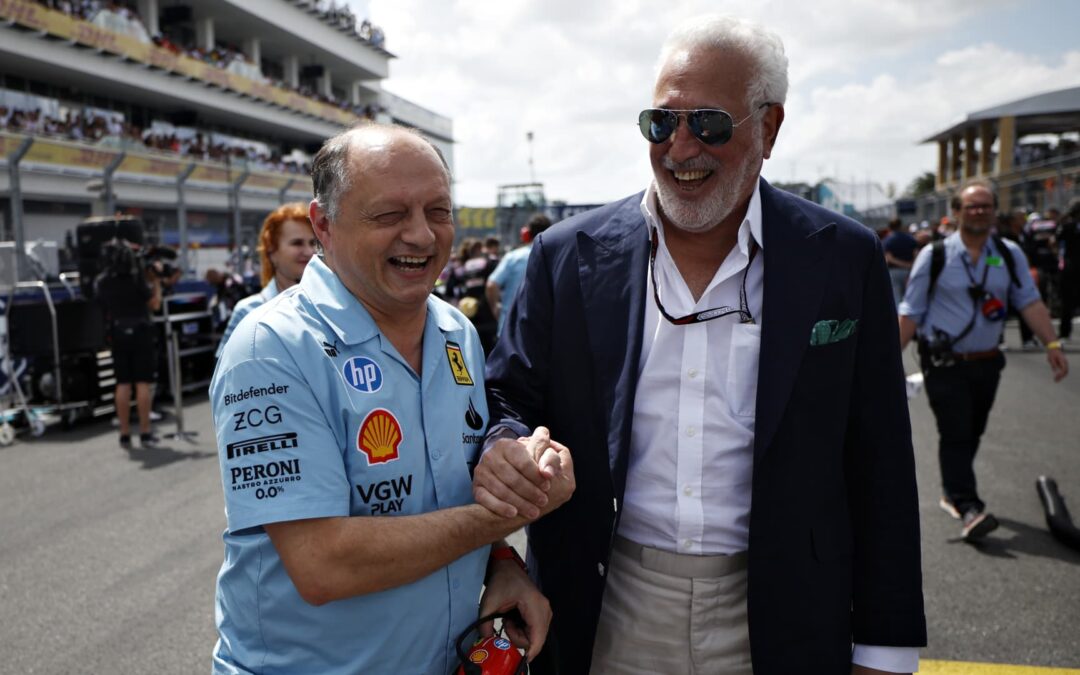

Owner of Aston Martin F1 Team Lawrence Stroll (R) shakes hands with Ferrari Team Principal Frederic Vasseur on the grid prior to the F1 Grand Prix of Miami at Miami International Autodrome on May 05, 2024 in Miami, Florida.

Chris Graythen | Getty Images

Still, production fell and pre-tax losses doubled in the first quarter compared to the previous year, sending the company’s shares to their lowest level since 2022. Stroll said the production drop, as well as an expected drop in the second quarter, is part an intentional plan to phase out older models and make room for the slate of new models to ramp up in the coming months.

“We made a conscious decision to stop all production” on certain models, he said. “We reduced the manufacturing wholesale volume in order to not have a build up of older cars at the dealer networks while we’re launching all our brand new vehicles.”

The new vehicles include the new Vantage, a front-engine, rear-wheel-drive sports car with 656 horsepower and a starting price of $191,000.

The automaker also unveiled the new DBX707, its high-powered SUV, which can do 0-60mph in 3.1 seconds and can top 200 mph, as well as an open-topped version of its DB12, called the DB12 Volante.

Aston Martin has teased a new super-powered V-12, expected to be called Vanquish, later this year.

It’s also expected to begin deliveries of its $800,000 hybrid supercar, called the Valhalla, at the end of this year or early 2025.

The $800,000 Aston Martin hybrid Valhalla.

Courtesy: Aston Martin

Along with new models, Aston Martin is betting on continued growth from its personalization program. A year after opening its “Q New York” showroom, which allows customers to customize their cars with their own paint colors, interior fabrics, stitching and other details. The company is planning Q locations in London, Miami and California.

Stroll said some customers are paying an additional $100,000 to $200,000 beyond the sticker price of their cars for highly specialized personalizations. One customer even requested fur in the interior, he said.

The customization program has helped boost the average sale price of an Aston Martin by 35% over the past two years, to $294,0000.

“It’s really, really been a home run,” Stroll said. “Not only from the financial point of view. People come in [to Q New York] and they understand what Aston Martin is all about. They say, ‘OK, I get it.’ You know, it’s the show, it’s the feeling.”

Aston Martin is also attracting a younger buyer, thanks in large part to its Formula 1 team, which Stroll owns. Stroll said the average age of an Aston Martin customer is now 42, down from 55 four years ago.

“The brand is really on fire, and a lot of it is to do with Formula 1,” he said. “Being in Formula 1 the last three years has really rejuvenated the brand significantly, and also all of our new product portfolio.”

Stroll dismissed reports that he’s looking to sell a minority stake in the Aston Martin Formula 1 team to help fund the car company.

“We absolutely do not need to raise capital,” he said. “When you start making 8,000, 9,000 vehicles [a year], we become extremely cash flow positive. … So no there’s no interest or requirement to raise” more.

On the company’s electric vehicle future, Stroll said the company is delaying the launch of an all-electric Aston Martin from 2025 to 2026. The company has designed four EVs based on the same platform, but Aston Martin customers aren’t showing enough demand.

“We don’t want to swim upstream,” he said. “Our consumer, at least the Aston Martin customer, the high-performance customer, is telling us we’re not ready for an electric vehicle, at least not from us. So we’re hearing that loud and clear.”