By InvestMacro

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday May 28th and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

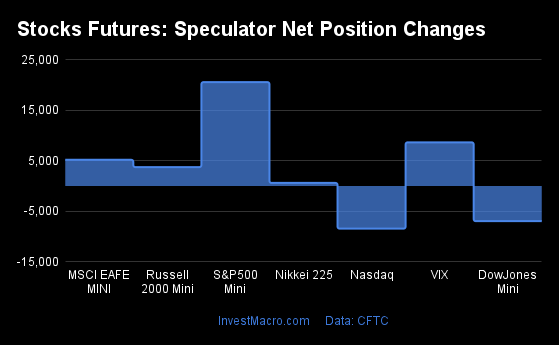

Weekly Speculator Changes led by S&P500 & VIX

The COT stock markets speculator bets were higher this week as five out of the seven stock markets we cover had higher positioning while the other two markets had lower speculator contracts.

Leading the gains for the stock markets was with the S&P500-Mini (20,566 contracts), the VIX (8,648 contracts), the MSCI EAFE-Mini (5,188 contracts), the Russell-Mini (3,739 contracts) and the Nikkei 225 (609 contracts) also showing a positive week.

The markets with the declines in speculator bets this week were the Nasdaq-Mini (-8,444 contracts) with the DowJones-Mini (-6,965 contracts) also registering lower bets on the week.

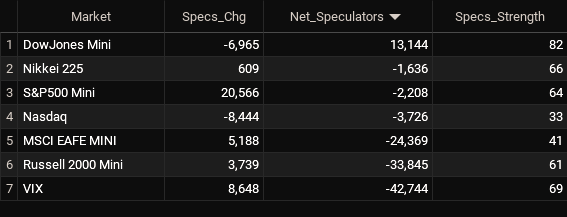

Stock Market Net Speculators Leaderboard

Legend: Weekly Speculators Change | Speculators Current Net Position | Speculators Strength Score compared to last 3-Years (0-100 range)

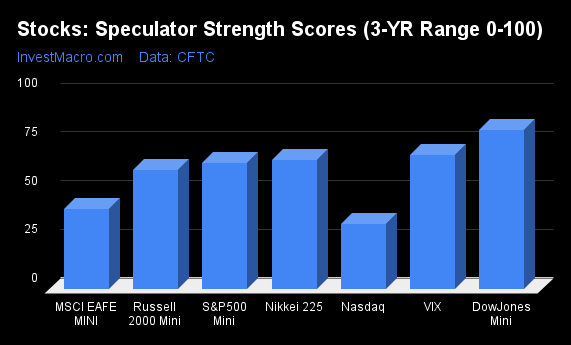

Strength Scores led by DowJones-Mini

COT Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that the DowJones-Mini (82 percent) leads the stock markets this week. The VIX (69 percent) and Nikkei 225 (66 percent) came in as the next highest in the weekly strength scores.

On the downside, the Nasdaq-Mini (33 percent) comes in at the lowest strength level currently while the next lowest strength score is the MSCI EAFE-Mini (41 percent).

Strength Statistics:

VIX (68.9 percent) vs VIX previous week (59.5 percent)

S&P500-Mini (64.4 percent) vs S&P500-Mini previous week (61.3 percent)

DowJones-Mini (81.7 percent) vs DowJones-Mini previous week (93.0 percent)

Nasdaq-Mini (33.4 percent) vs Nasdaq-Mini previous week (46.5 percent)

Russell2000-Mini (61.1 percent) vs Russell2000-Mini previous week (58.4 percent)

Nikkei USD (66.2 percent) vs Nikkei USD previous week (61.0 percent)

EAFE-Mini (41.2 percent) vs EAFE-Mini previous week (35.8 percent)

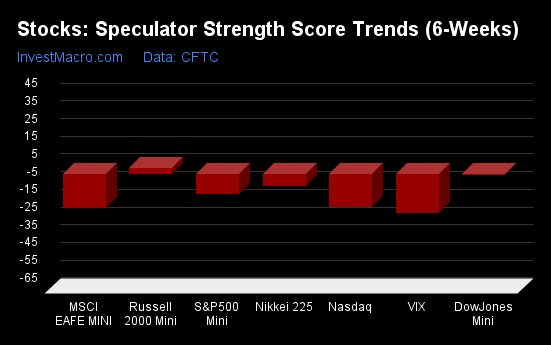

Russell-Mini top the 6-Week Strength Trends

COT Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that the Russell-Mini (3 percent) leads the past six weeks trends for the stock markets.

The VIX (-22 percent) leads the downside trend scores currently with the MSCI EAFE-Mini (-19 percent) coming in as the next market with lower trend scores.

Strength Trend Statistics:

VIX (-21.9 percent) vs VIX previous week (-21.7 percent)

S&P500-Mini (-11.4 percent) vs S&P500-Mini previous week (6.0 percent)

DowJones-Mini (-0.9 percent) vs DowJones-Mini previous week (5.1 percent)

Nasdaq-Mini (-19.0 percent) vs Nasdaq-Mini previous week (-4.4 percent)

Russell2000-Mini (3.3 percent) vs Russell2000-Mini previous week (-7.1 percent)

Nikkei USD (-6.7 percent) vs Nikkei USD previous week (-2.8 percent)

EAFE-Mini (-19.4 percent) vs EAFE-Mini previous week (-20.1 percent)

Individual Stock Market Charts:

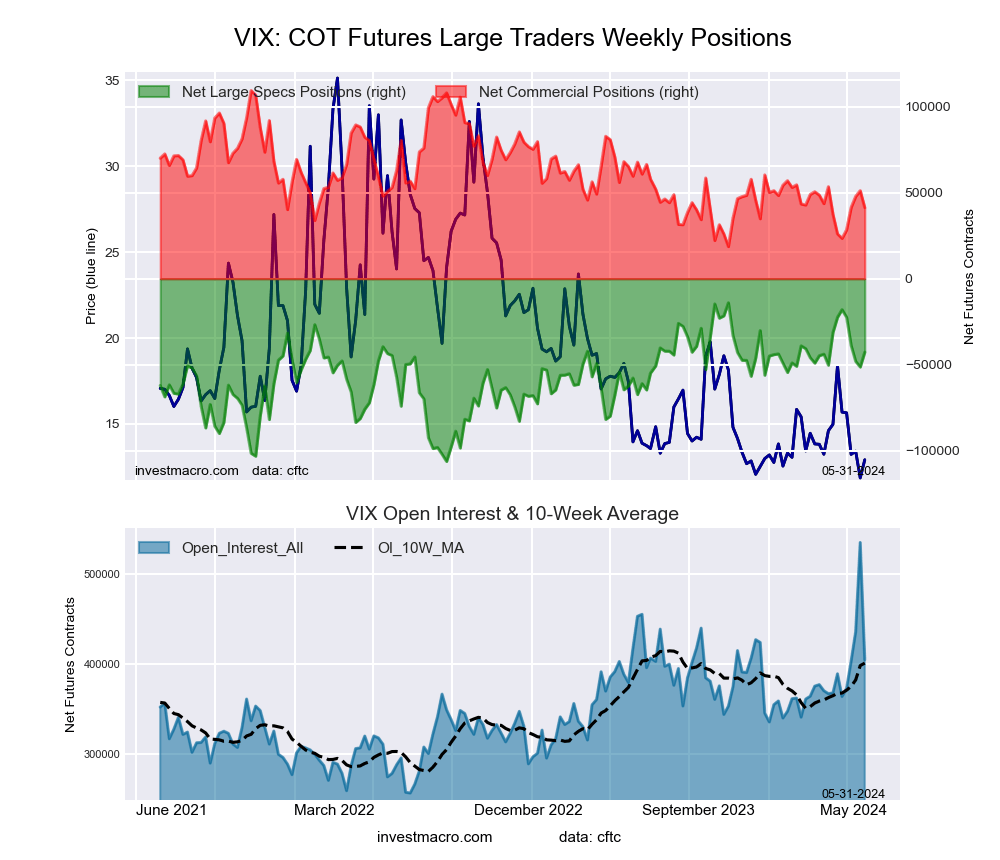

VIX Volatility Futures:

The VIX Volatility large speculator standing this week reached a net position of -42,744 contracts in the data reported through Tuesday. This was a weekly lift of 8,648 contracts from the previous week which had a total of -51,392 net contracts.

The VIX Volatility large speculator standing this week reached a net position of -42,744 contracts in the data reported through Tuesday. This was a weekly lift of 8,648 contracts from the previous week which had a total of -51,392 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 68.9 percent. The commercials are Bearish with a score of 25.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 100.0 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| VIX Volatility Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 20.5 | 40.8 | 7.5 |

| – Percent of Open Interest Shorts: | 31.0 | 30.5 | 7.1 |

| – Net Position: | -42,744 | 41,398 | 1,346 |

| – Gross Longs: | 82,966 | 165,143 | 30,267 |

| – Gross Shorts: | 125,710 | 123,745 | 28,921 |

| – Long to Short Ratio: | 0.7 to 1 | 1.3 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 68.9 | 25.0 | 100.0 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -21.9 | 16.8 | 24.6 |

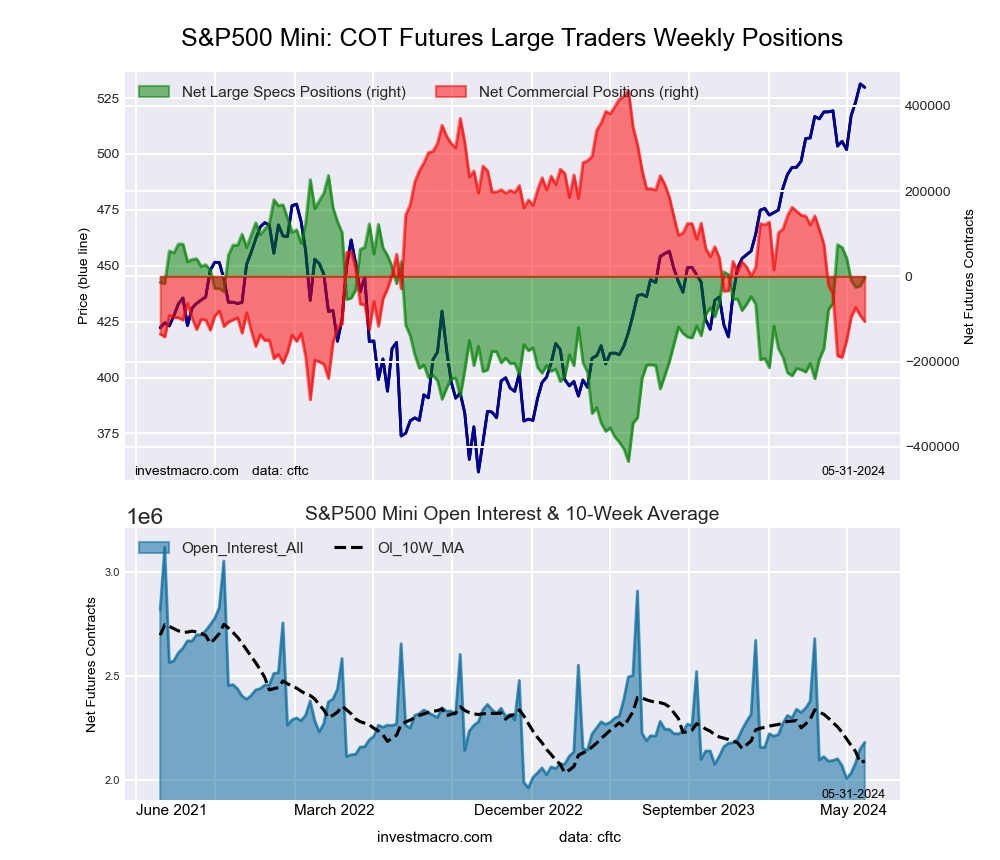

S&P500 Mini Futures:

The S&P500 Mini large speculator standing this week reached a net position of -2,208 contracts in the data reported through Tuesday. This was a weekly advance of 20,566 contracts from the previous week which had a total of -22,774 net contracts.

The S&P500 Mini large speculator standing this week reached a net position of -2,208 contracts in the data reported through Tuesday. This was a weekly advance of 20,566 contracts from the previous week which had a total of -22,774 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 64.4 percent. The commercials are Bearish with a score of 25.3 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 80.0 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| S&P500 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 15.2 | 69.0 | 13.3 |

| – Percent of Open Interest Shorts: | 15.3 | 73.8 | 8.3 |

| – Net Position: | -2,208 | -105,944 | 108,152 |

| – Gross Longs: | 330,937 | 1,503,708 | 289,071 |

| – Gross Shorts: | 333,145 | 1,609,652 | 180,919 |

| – Long to Short Ratio: | 1.0 to 1 | 0.9 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 64.4 | 25.3 | 80.0 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -11.4 | 11.1 | -1.6 |

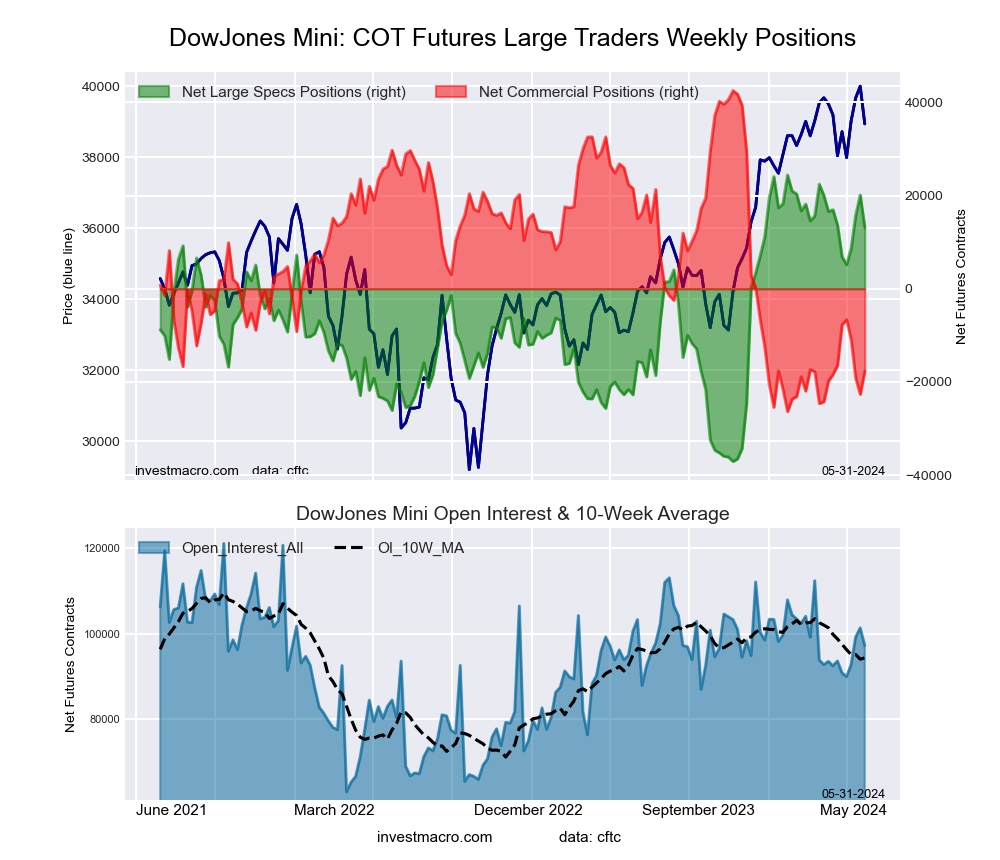

Dow Jones Mini Futures:

The Dow Jones Mini large speculator standing this week reached a net position of 13,144 contracts in the data reported through Tuesday. This was a weekly decrease of -6,965 contracts from the previous week which had a total of 20,109 net contracts.

The Dow Jones Mini large speculator standing this week reached a net position of 13,144 contracts in the data reported through Tuesday. This was a weekly decrease of -6,965 contracts from the previous week which had a total of 20,109 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 81.7 percent. The commercials are Bearish-Extreme with a score of 12.6 percent and the small traders (not shown in chart) are Bullish with a score of 65.9 percent.

Price Trend-Following Model: Weak Uptrend

Our weekly trend-following model classifies the current market price position as: Weak Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| Dow Jones Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 22.9 | 54.9 | 15.9 |

| – Percent of Open Interest Shorts: | 9.4 | 73.1 | 11.3 |

| – Net Position: | 13,144 | -17,654 | 4,510 |

| – Gross Longs: | 22,285 | 53,401 | 15,471 |

| – Gross Shorts: | 9,141 | 71,055 | 10,961 |

| – Long to Short Ratio: | 2.4 to 1 | 0.8 to 1 | 1.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 81.7 | 12.6 | 65.9 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -0.9 | -1.7 | 8.4 |

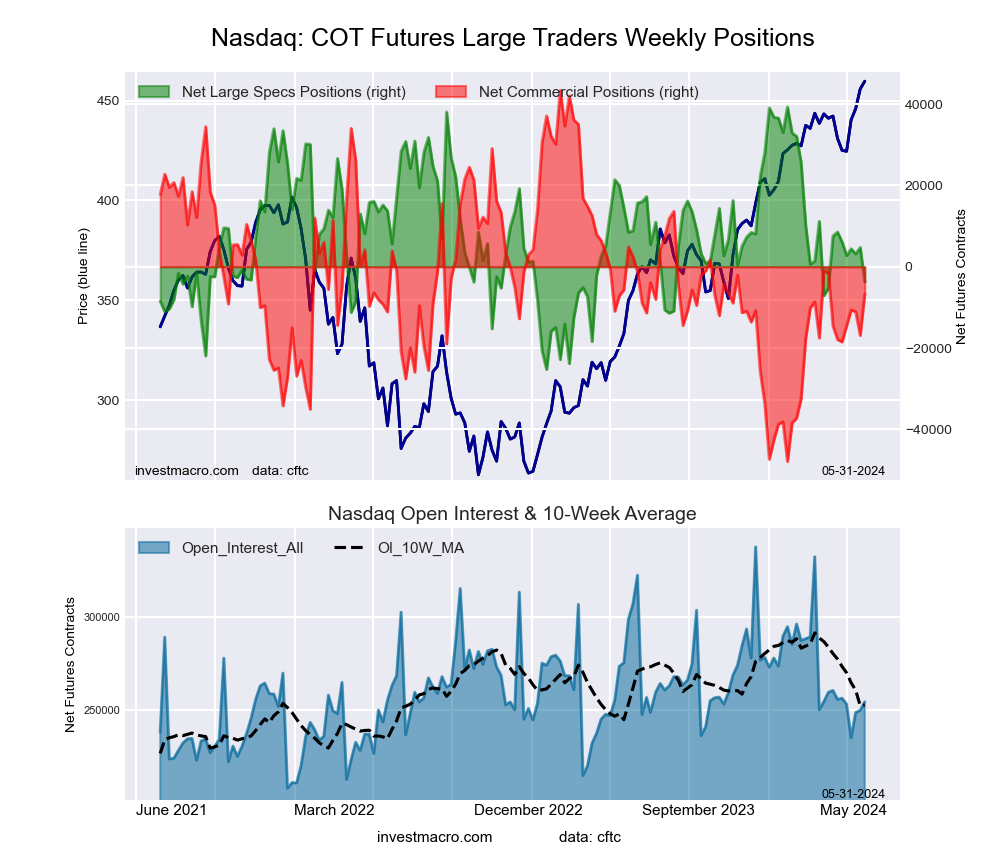

Nasdaq Mini Futures:

The Nasdaq Mini large speculator standing this week reached a net position of -3,726 contracts in the data reported through Tuesday. This was a weekly lowering of -8,444 contracts from the previous week which had a total of 4,718 net contracts.

The Nasdaq Mini large speculator standing this week reached a net position of -3,726 contracts in the data reported through Tuesday. This was a weekly lowering of -8,444 contracts from the previous week which had a total of 4,718 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 33.4 percent. The commercials are Bearish with a score of 45.2 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 95.3 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| Nasdaq Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.9 | 54.4 | 17.3 |

| – Percent of Open Interest Shorts: | 28.4 | 57.0 | 13.2 |

| – Net Position: | -3,726 | -6,683 | 10,409 |

| – Gross Longs: | 68,402 | 138,387 | 43,934 |

| – Gross Shorts: | 72,128 | 145,070 | 33,525 |

| – Long to Short Ratio: | 0.9 to 1 | 1.0 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 33.4 | 45.2 | 95.3 |

| – Strength Index Reading (3 Year Range): | Bearish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -19.0 | 12.3 | 2.6 |

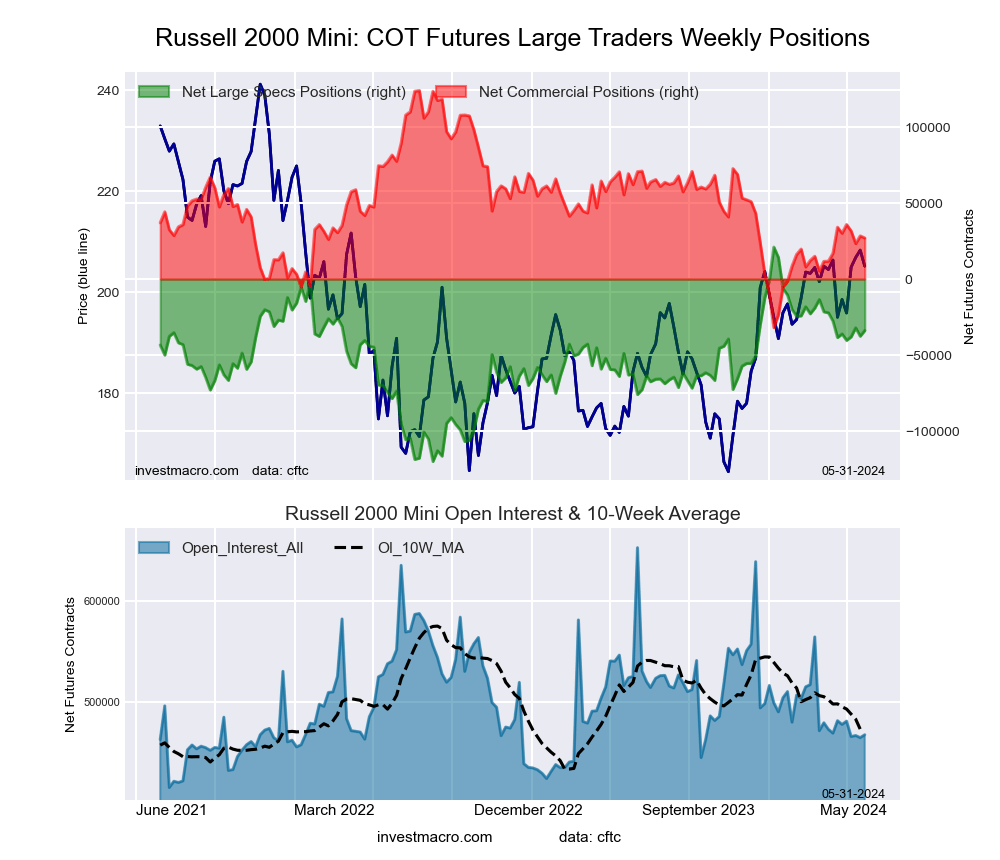

Russell 2000 Mini Futures:

The Russell 2000 Mini large speculator standing this week reached a net position of -33,845 contracts in the data reported through Tuesday. This was a weekly advance of 3,739 contracts from the previous week which had a total of -37,584 net contracts.

The Russell 2000 Mini large speculator standing this week reached a net position of -33,845 contracts in the data reported through Tuesday. This was a weekly advance of 3,739 contracts from the previous week which had a total of -37,584 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 61.1 percent. The commercials are Bearish with a score of 37.8 percent and the small traders (not shown in chart) are Bullish with a score of 51.9 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| Russell 2000 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 17.7 | 73.5 | 5.9 |

| – Percent of Open Interest Shorts: | 25.0 | 67.7 | 4.5 |

| – Net Position: | -33,845 | 27,036 | 6,809 |

| – Gross Longs: | 82,901 | 343,514 | 27,628 |

| – Gross Shorts: | 116,746 | 316,478 | 20,819 |

| – Long to Short Ratio: | 0.7 to 1 | 1.1 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 61.1 | 37.8 | 51.9 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 3.3 | -4.5 | 8.2 |

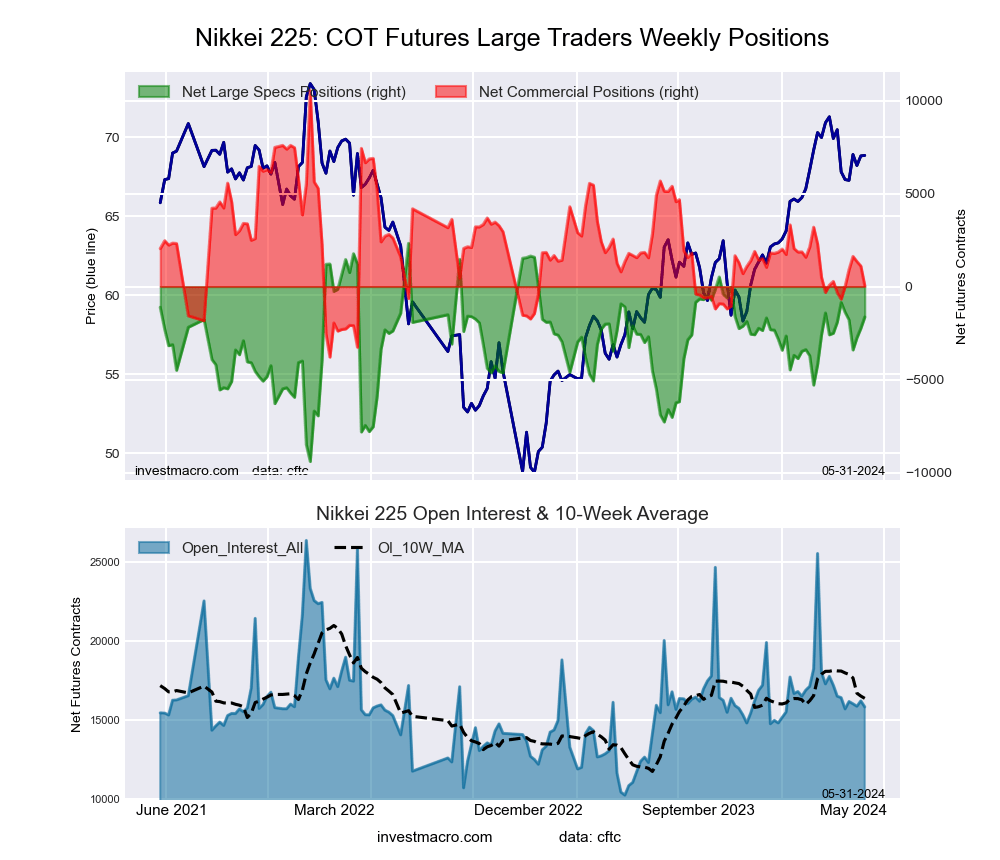

Nikkei Stock Average (USD) Futures:

The Nikkei Stock Average (USD) large speculator standing this week reached a net position of -1,636 contracts in the data reported through Tuesday. This was a weekly gain of 609 contracts from the previous week which had a total of -2,245 net contracts.

The Nikkei Stock Average (USD) large speculator standing this week reached a net position of -1,636 contracts in the data reported through Tuesday. This was a weekly gain of 609 contracts from the previous week which had a total of -2,245 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 66.2 percent. The commercials are Bearish with a score of 26.8 percent and the small traders (not shown in chart) are Bullish with a score of 63.9 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| Nikkei Stock Average Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 11.5 | 61.5 | 25.5 |

| – Percent of Open Interest Shorts: | 21.9 | 61.2 | 15.5 |

| – Net Position: | -1,636 | 49 | 1,587 |

| – Gross Longs: | 1,823 | 9,739 | 4,033 |

| – Gross Shorts: | 3,459 | 9,690 | 2,446 |

| – Long to Short Ratio: | 0.5 to 1 | 1.0 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 66.2 | 26.8 | 63.9 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -6.7 | 5.1 | 0.9 |

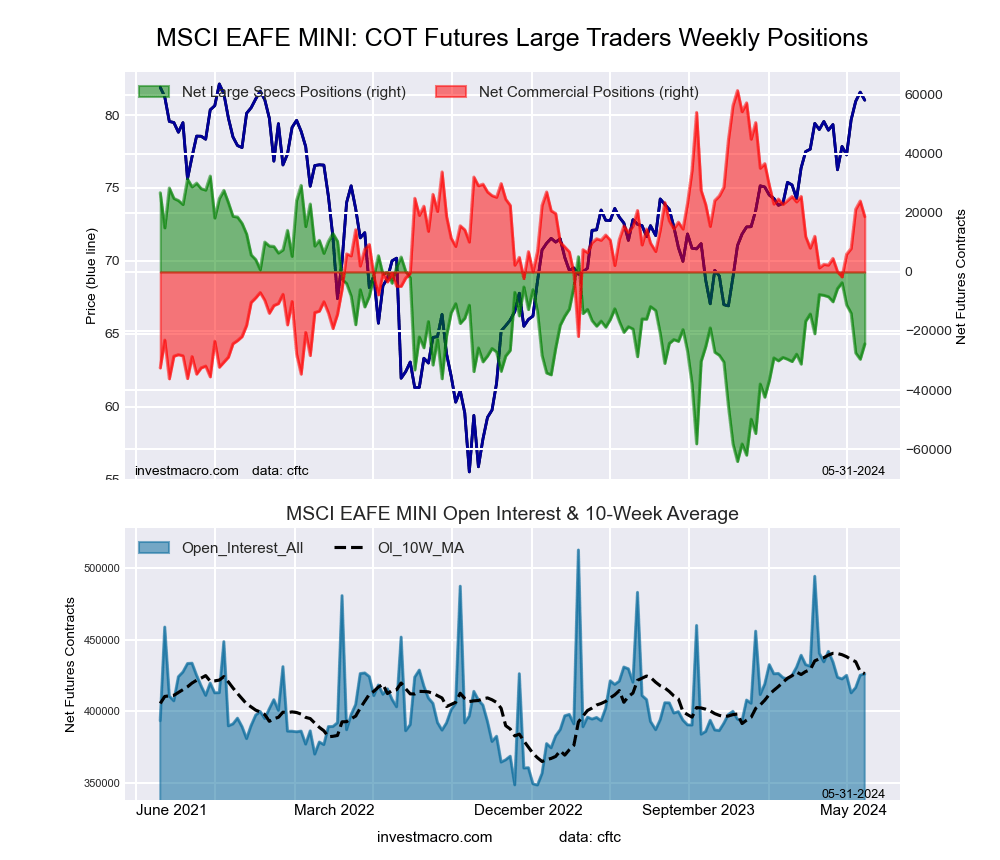

MSCI EAFE Mini Futures:

The MSCI EAFE Mini large speculator standing this week reached a net position of -24,369 contracts in the data reported through Tuesday. This was a weekly gain of 5,188 contracts from the previous week which had a total of -29,557 net contracts.

The MSCI EAFE Mini large speculator standing this week reached a net position of -24,369 contracts in the data reported through Tuesday. This was a weekly gain of 5,188 contracts from the previous week which had a total of -29,557 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 41.2 percent. The commercials are Bullish with a score of 56.3 percent and the small traders (not shown in chart) are Bearish with a score of 45.1 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| MSCI EAFE Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 7.0 | 89.6 | 2.9 |

| – Percent of Open Interest Shorts: | 12.7 | 85.2 | 1.6 |

| – Net Position: | -24,369 | 18,742 | 5,627 |

| – Gross Longs: | 29,861 | 381,756 | 12,467 |

| – Gross Shorts: | 54,230 | 363,014 | 6,840 |

| – Long to Short Ratio: | 0.6 to 1 | 1.1 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 41.2 | 56.3 | 45.1 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -19.4 | 19.1 | 0.5 |

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- COT Stock Market Charts: Speculator bets led by S&P500 & VIX Jun 2, 2024

- Week Ahead: Brent waits on OPEC+ meeting May 31, 2024

- Investors’ focus today is on the PCE Price Index data. Conditions for inflation growth are forming in Japan May 31, 2024

- New Zealand Dollar gains for second day against US Dollar May 31, 2024

- Brent crude oil declines again May 30, 2024

- Traders further lowered their expectations for a Fed interest rate cut this year May 30, 2024

- Target Thursday: Cotton, EURCHF & UK100 hit targets May 30, 2024

- Australian dollar hits 0.6650 amid mixed economic signals May 29, 2024

- Oil rises amid increasing geopolitical tensions in the Middle East. Inflation is rising in Australia May 29, 2024

- Bitcoin: Shaky ahead of PCE inflation data May 29, 2024