TradingView is now offering traders improved futures data from the Hong Kong Stock Exchange: they can now back-adjust contracts, use settlement prices and track Open interest.

- Back-adjustment of previous contracts

Since price discrepancies across different contracts can make analyzing historical price movements challenging, this feature can significantly impact your strategy design. It helps you adjust previous contract prices in continuous futures and, as a result, eliminate gaps and account for the rollover effect. This feature comes with labels displaying roll dates – they will help you navigate contract switching on the chart.

Activating back-adjustment is simple: click the B-ADJ button at the bottom of the chart or check the “Adjust for contracts changes” box in the chart settings.

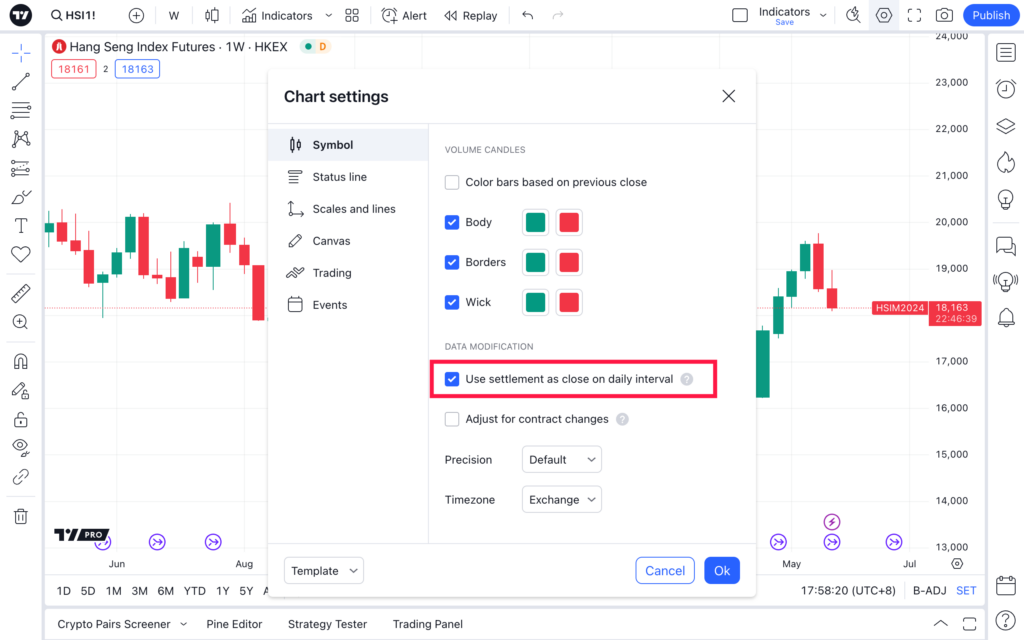

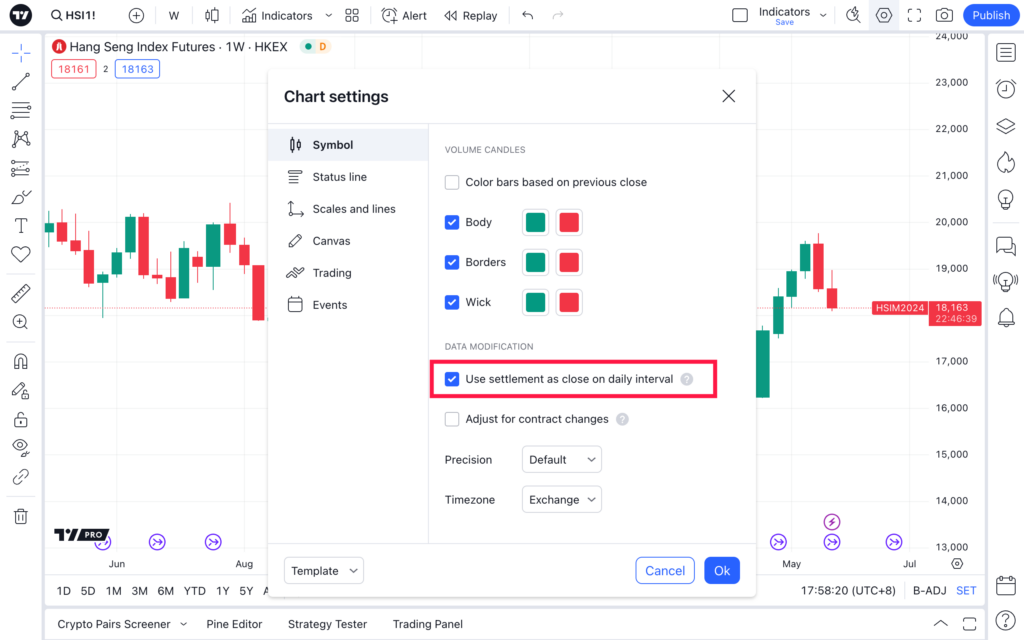

TradingView has also introduced the settlement price to its charts. Now, you’ll be able to choose between the last or settlement price as the closing value for contracts. The settlement price, determined by the exchange at the end of each trading day, can be very helpful as it provides a clearer view of the gains and losses associated with your positions. To switch between these options, click the SET button at the bottom of the chart or select the “Use settlement as close on daily interval” option in the chart settings.

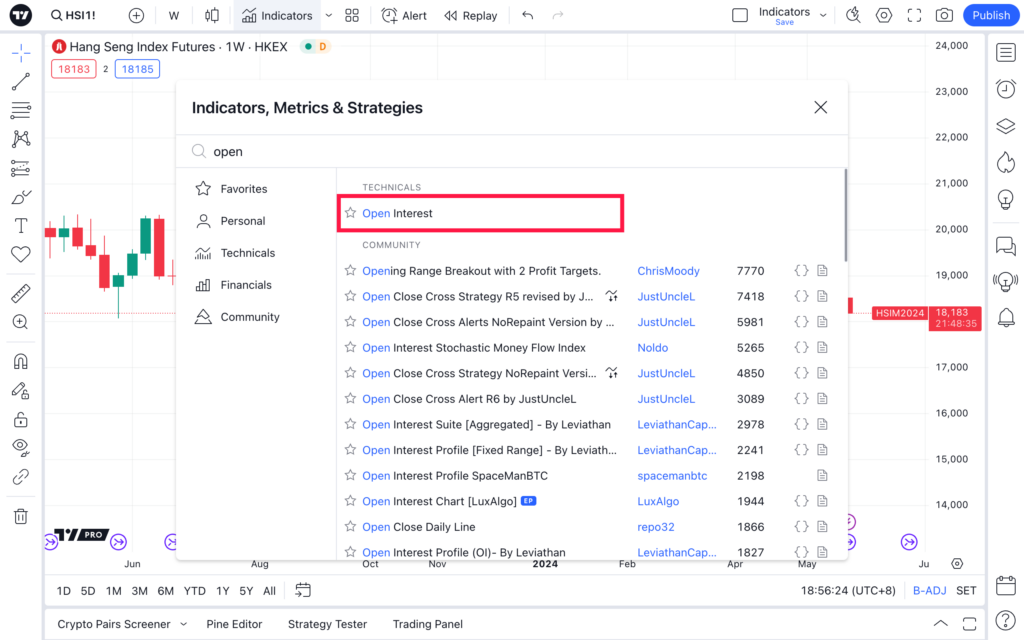

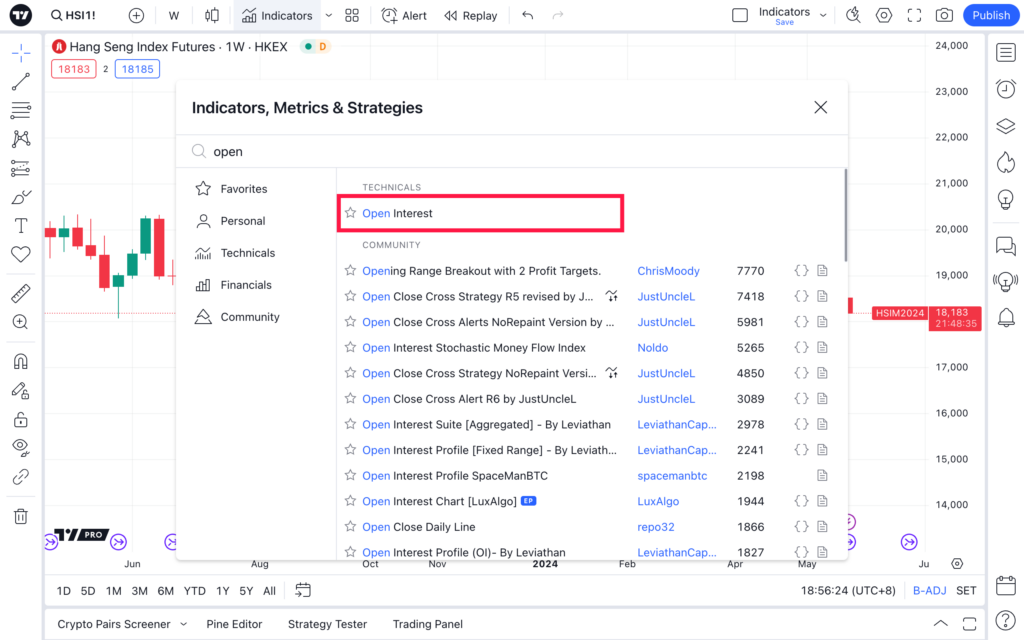

To further enhance your market analysis, TradingView has added the Open Interest indicator for HKEX futures. Open interest reflects the number of open and unsettled derivative contracts. As such, it can offer valuable insights into market sentiment. For example, a declining open interest shows that traders are closing their positions, which can mean a weakening trend for the futures you analyze. To access this data, open the Indicators, Metrics & Strategies menu and select the Open Interest indicator.

The TradingView platform reliably connects to hundreds of data feeds, with direct access to 1,357,880 instruments from all over the world.