- AUDCAD is trading sideways, above upside channel

- RSI and MACD corroborate the lack of momentum

- A break above 0.9125 could shift the bias to the upside

- A dip below 0.9000 may only confirm a larger correction

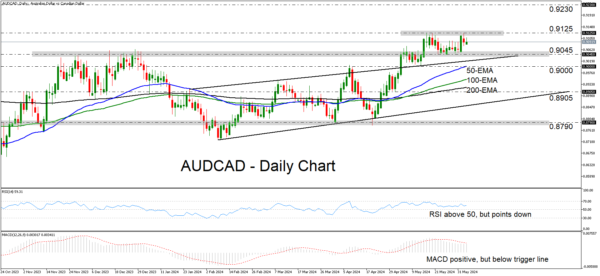

AUDCAD has been trading in a sideways manner since May 15, staying between the key support of 0.9045 and the 0.9125 resistance. In the bigger picture, the pair remains above the upper bound of an upward sloping channel, as well as above all three of the plotted moving averages, which means that the bulls could take charge again very soon.

The daily oscillators corroborate the notion that the longer-term uptrend has run out of some steam, at least temporarily. The RSI, although above 50, has turned down, while the MACD, even though positive, has dropped below its trigger line.

A break above 0.9125 could signal that the bulls are back in the driver’s seat. Such a move would confirm a higher high and may see scope for advances towards the 0.9230 zone, a territory last tested more than a year ago, on March 22 and 23, 2023.

On the downside, a break back below the 0.9000 round number may signal the pair’s return within the aforementioned upside channel. Thus, the outlook would still be far from reversing to bearish. For that to happen, AUDCAD may need to drop below the 0.8905 territory.

To recap, AUDCAD is consolidating above the upper bound of a prior bullish channel, which implies that the next directional leg could still be positive.