- Markets crave weaker US data to support their rate cut expectations

- Strong data this week could cause an acute market reaction

- The Fed might find it easier to act if financial stability is under threat

The key question in the market participants’ minds is when the Fed is going to start easing its monetary policy stance. The year started with the market pricing in at least five rate cuts by the Fed in 2024, but with inflation remaining above 3% since July 2023, expectations have tanked.

With the ECB expected to cut rates this week and the BoE possibly following suit in early August, the pressure is on the Fed to turn dovish and cut rates in September ahead of the November US Presidential elections. Otherwise, it might have to wait until December when either the Fed would potentially be significantly behind the curve, or the US economy might not need a more accommodative monetary policy stance.

Two main reasons for Fed to cut rates

Based on the Fed’s mandate, there are two key reasons for the Fed to start cutting rates: (a) weak economic data, and particularly lower inflation, and (b) a severe risk-off episode in stock markets that threatens the stability of the system.

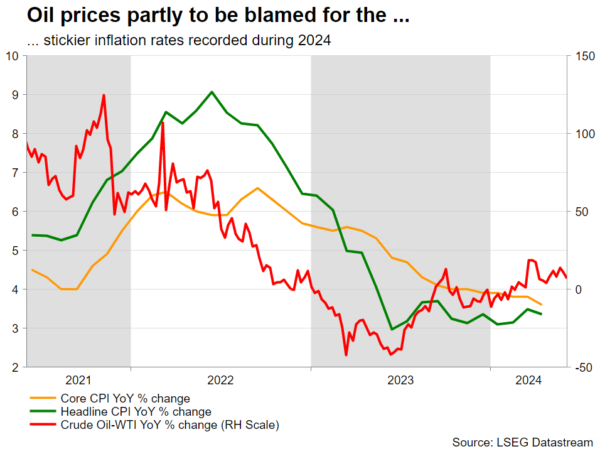

(a) Oil prices and US domestic demand hold the key for lower inflation

Higher inflation during 2024 has been attributed to the elevated oil prices and the strong domestic demand. Encouragingly for the Fed doves, oil prices have suffered severe selling in the past few sessions and hence opened the door to lower inflationary pressures ahead.

Similarly, increased wage earnings have been fuelling consumer appetite and cancelled out most of the impact of the higher cost of money. However, both the consumer confidence index and the University of Michigan consumer sentiment survey have been recently showing signs of weakness.

Focusing on this week’s key data calendar and an array of weaker prints, for example a sub-100k increase in non-farm payrolls led by weaker private payrolls, and a decent jump in the unemployment rate, could increase exponentially the pressure on the Fed to turn dovish at next week’s gathering and prepare for a rate cut in September.

(b) US yields, stock markets matter for the Fed

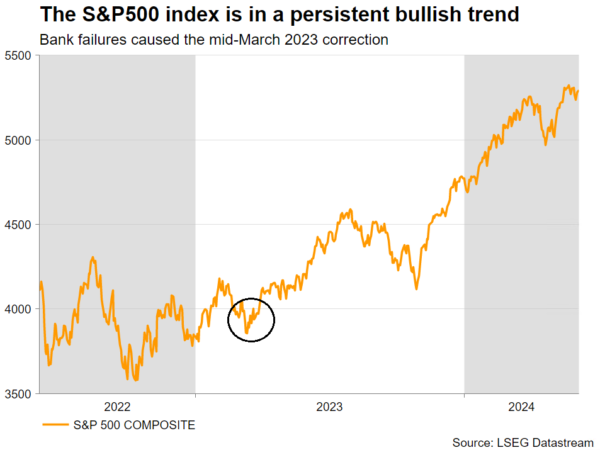

Financial stability is taken very seriously by the Fed, especially following the March 2023 events with the failure of three mid-sized banks. Therefore, another unexpected surge in US yields, on the back of stronger US data, is bound to increase the Fed members’ concerns about similar bank failures.

Similarly, the Fed does not enjoy massive risk-off episodes that cause acute stock market moves. Seasoned market participants are aware of the famous “Fed put” – the belief that the Fed would step in and act appropriately to limit the stock market’s decline.

Data this week has significant market-moving potential. A strong set of prints on Friday, for example a sizeable upside surprise in the non-farm payroll figures and a jump in average earnings, could trigger a stock market correction, which could gradually evolve into a crash as market participants realize that the chances of a rate cut before December are extremely low.

In this case, Fed officials might be forced to react by delivering the much-awaited rate cut much faster than currently foreseen, and despite the recent economic data not fully justifying such a move.

Therefore, while intuitively a weaker set of data this week opens the door to a dovish tilt at the June meeting, a very strong set of data prints could push US treasury yields much higher and gradually result in a severe stock market correction. Maybe the threat of financial instability could be the catalyst that the Fed doves have been waiting for.