Dollar rebounds broadly in early US session following stronger-than-expected employment data. Despite a slight uptick in unemployment rate, robust headline job growth and wage increases highlighted the US job market’s continued tightness. This suggests that Fed should remain cautious about premature policy easing.

In reaction to the data, US futures tumbled significantly, pointing to a lower open. A key question now is how much this sentiment will impact the resilient tech sector, with NASDAQ having just reached another record high this week. Additionally, 10-year Treasury yield staged a strong rebound, climbing back above 4.4% mark.

In the broadly currency markets, Canadian Dollar remains the worst performer for the week, despite slightly better-than-expected Canadian job data. Australian Dollar is the second worst and may weaken further before the weekly close due to risk-off sentiment. Euro is currently the third worst. Conversely, Swiss Franc and Yen are the best performers, though their positions could be overtaken by the surging Dollar.

In Europe, at the time of writing, FTSE is down -0.70%. DAX is down -0.86%. CAC is down -0.79%. UK 10-year yield is up 0.0726 at 4.251. Germany 10-year yield is up 0.077 at 2.630. Earlier in Asian, Nikkei fell -0.05%. Hong Kong HSI fell -0.59%> China Shanghai SSE rose 0.08%. Singapore Strait Times closed flat. Japan 10-year JGB yield rose 0.0069 to 0.973.

US NFP grows 272k, average hourly earnings rises 0.4% mom

US non-farm payroll employment grew 272k in May, well above expectation of 180k. That’s also higher than the average monthly gain of 232k over the prior 12 months.

Unemployment rate ticked up from 3.9% to 4.0%, above expectation of 3.9%. Labor force participation rate fell from 62.7% to 62.5%.

Average hourly earnings rose 0.4% mom, above expectation of 0.3% mom. Over the 12 months period, average hourly earnings rose 4.1% yoy.

Canada employment grows 26.7, unemployment rate up to 6.2%

Canada’s employment grew 26.7k in May slightly above expectation of 24.8k. Part-time employment rose 62k while full-time jobs fell -36k.

Unemployment rate ticked up from 6.1% to 6.2%, matched expectations. Average hourly wages increased 5.1% yoy, up from April’s 4.7% yoy.

ECB’s Nagel: Rate cuts not on autopilot

ECB Governing Council member Joachim Nagel stated today that the decision to cut interest rates yesterday was “logical” given the tendency for inflation to decrease. However, he emphasized that inflation remains “stubborn,” particularly in the services sector.

Nagel highlighted that negotiated wages are expected to rise sharply this year and continue strong growth thereafter. He noted, “We on the ECB Governing Council are not driving on autopilot when it comes to interest rate cuts.”

Council member Olli Rehn stated that inflation will continue to decline and interest rate cuts will support economic recovery. Rehn suggested that the possible scale of interest rate cuts over the next few years could range from 1 to 2 percentage points, assuming no new economic shocks occur.

Council member Gediminas Šimkus indicated that more than one rate cut might be necessary this year. He acknowledged that while data shows clear signs of disinflation, the path ahead will be challenging. Vice President Luis de Guindos added that inflation is expected to be around 2% next year but also noted “huge uncertainty in the economy.”

China’s exports rises 7.6% yoy in May, trade surplus exceeds expectations

In May, China’s exports rose by 7.6% yoy, surpassing the expectation of 6.0% yoy growth. Notably, exports to US increased by 4.8% yoy, marking the highest growth in three months. Exports to ASEAN countries saw a significant jump of 25% yoy, while exports to the EU declined by -0.7% yoy.

On the import side, growth was more subdued, with imports rising by only 1.8% yoy, falling short of the expected 4.2% yoy increase.

China’s trade balance for May reported a surplus of USD 82.6B, well above the anticipated USD 72.2B.

USD/CHF Mid-Day Outlook

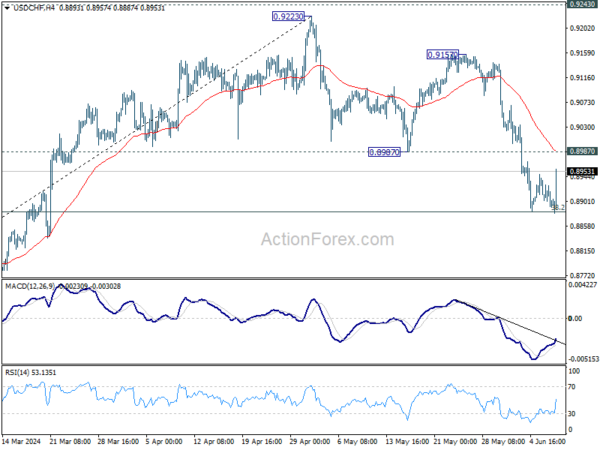

Daily Pivots: (S1) 0.8874; (P) 0.8911; (R1) 0.8930; More….

USD/CHF recovers after another take on 0.8883 fibonacci level but stays below 0.8987 support turned resistance. Intraday bias stays neutral first. Strong rebound from current level, followed by firm break of 0.8987 support turned resistance, will suggest that correction from 0.9223 has completed, and retain near term bullishness. However, sustained break of 0.8883 fibonacci level will carry larger bearish implications and bring deeper decline.

In the bigger picture, price actions from 0.8332 medium term bottom are tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance, followed by sustained break of 38.2% retracement of 0.8332 to 0.9223 at 0.8883 will strengthen this case, and maintain medium term bearishness. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish for 1.0146.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Manufacturing Sales Q1 | 0.70% | -0.60% | -0.50% | |

| 23:30 | JPY | Household Spending Y/Y Apr | 0.50% | 0.60% | -1.20% | |

| 03:00 | CNY | Trade Balance (USD) May | 82.6B | 71.5B | 72.4B | |

| 06:00 | EUR | Germany Industrial Production M/M Apr | -0.10% | 0.20% | -0.40% | |

| 06:00 | EUR | Germany Trade Balance (EUR) Apr | 22.1B | 25.5B | 22.3B | 22.2B |

| 06:45 | EUR | France Trade Balance (EUR) Apr | -7.6B | -5.4B | -5.5B | -5.4B |

| 07:00 | CHF | Foreign Currency Reserves (CHF) May | 718B | 720B | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q1 | 0.30% | 0.30% | 0.30% | |

| 09:00 | EUR | Eurozone Employment Change Q/Q Q1 F | 0.30% | 0.30% | 0.30% | |

| 12:30 | USD | Nonfarm Payrolls May | 272K | 180K | 175K | 165K |

| 12:30 | USD | Unemployment Rate May | 4.00% | 3.90% | 3.90% | |

| 12:30 | USD | Average Hourly Earnings M/M May | 0.40% | 0.30% | 0.20% | |

| 12:30 | CAD | Net Change in Employment May | 26.7K | 24.8K | 90.4K | |

| 12:30 | CAD | Unemployment Rate May | 6.20% | 6.20% | 6.10% | |

| 14:00 | USD | Wholesale Inventories Apr F | 0.20% | 0.20% |