The forex markets are predominantly range-bound today as traders eagerly anticipate two pivotal events: US Consumer Price Index release and Federal Reserve’s economic projections. These announcements have the potential to trigger significant market volatility, given their implications for future monetary policy. While Euro struggles amid ongoing political turmoil in France, other major currencies remain steady in anticipation of today’s developments.

Currently, risk sentiment in the markets remains strong, evidenced by NASDAQ and S&P 500 reaching new record highs overnight. However, there is a palpable sense of caution as traders consider the possibility that a hawkish stance from Fed could maintain higher interest rates for an extended period, potentially dampening the current optimism.

As of now, New Zealand Dollar leads as the strongest currency of the week, followed by Australian Dollar and British Pound. Euro remains the weakest due to political instability in France and broader concerns within the EU. Japanese Yen and Swiss Franc are also underperforming, indicating a prevailing risk-on mood among investors. Dollar and Canadian Dollar are in a neutral position as the market awaits further cues.

Technically, EUR/AUD is worth a note today as it’s falling back towards 1.6211 support. Decisive break there would confirm resumption of the decline from 1.6742, which is seen as the third leg of the corrective pattern from 1.7062. In this case, deeper fall should then be seen to 1.6127 support and below. The downward movement could be catalyzed by escalating risk-on sentiment in the markets or worsening political conditions in the European Union.

In Asia, at the time of writing, Nikkei is down -0.57%. Hong Kong HSI is down -1.27%. China Shanghai SSE is up 0.15%. Singapore Strait Times is up 0.11%. Japan 10-year JGB yield is down -0.0292 at 0.987. Overnight, DOW fell -0.31%. S&P 500 rose 0.27%. NASDAQ rose 0.88%. 10-year yield fell -0.065 to 4.404.

US CPI and Fed awaited, NASDAQ surges to new record

Global financial markets are on high alert today as they await two critical announcements from the US, including the release of May’s CPI and FOMC rate decision accompanied by new economic projections. These events are expected to play a crucial role in shaping market sentiment and monetary policy outlooks.

Analysts expect headline CPI to remain steady at 3.4% yoy, while core CPI, which strips out volatile food and energy prices, is anticipated to dip further from 3.6% yoy to 3.5% yoy. On a month-over-month basis, headline CPI is projected to rise by 0.2% mom, and core CPI by 0.3% mom.

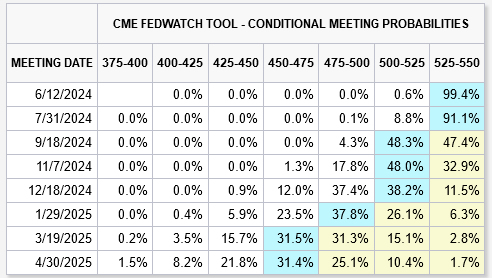

Regarding Fed’s upcoming decision, the consensus is that interest rates will be held steady at 5.25-5.50%. However, the focus will be on the updated dot plot, which reflects the rate expectations of Fed policymakers. Key questions include how many policymakers now foresee fewer than two rate cuts this year and whether any still see the need for further hikes.

Current market sentiment suggests that Fed might only cut rates once this year, with an 88.5% probability of a cut by December. The chances of a rate cut in September stand at 52.6%, while the likelihood of a cut in November is slightly higher at 67.1%. These expectations will be closely scrutinized against the backdrop of today’s announcements.

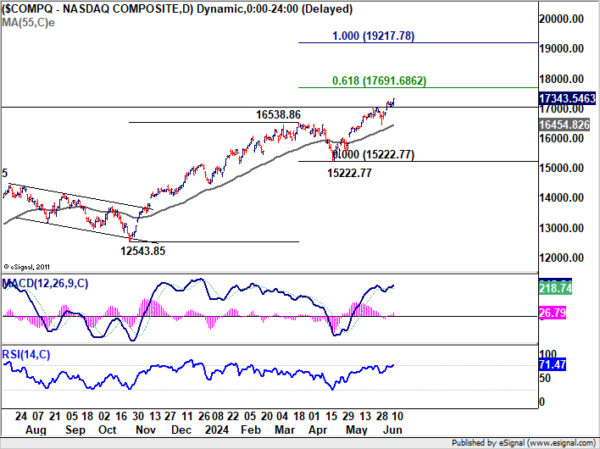

Ahead of theses key events, NASDAQ is looking unstoppable as it surged to fresch all-time highs. S&P 500 also closed at record but its gain was dwarfed by the tech index, while DOW lagged further behind with a loss.

Technically, further rise is expected in NASDAQ as long as 17343.54 support holds. Next target is 61.8% projection of 12543.85 to 16538.86 from 1522.77 at 17691.68. Firm break there could prompt upside acceleration to 100% projection at 19217.78. On the downside, break of 17343.54 will bring consolidations first before staging another rally.

World Bank raises 2024 global growth forecast but warns of persistent slowdown

In the Global Economic Prospects, the World Bank raised its global growth forecast for 2024 by 0.2% to 2.6%, which matches the pace of 2023. Growth is expected to rise slightly to 2.7% in both 2025 and 2026, but still well below the pre-pandemic average of 3.1%.

“In a sense, we see the runway for a soft landing,” said World Bank Deputy Chief Economist Ayhan Kose. “That’s the good news. What is not good news is that we may be stuck in the slow lane.”

The report includes an alternative scenario where persistent inflation in advanced economies keeps interest rates about 40 basis points higher than the baseline forecast, potentially cutting 2025 global growth to 2.4%.

For the US, the World Bank now predicts 2.5% growth in 2024, consistent with the 2023 rate and up from January’s forecast of 1.6%. Growth is expected to slow to 1.8% in both 2025 and 2026.

In the Eurozone, growth is projected to accelerate to 0.7% in 2024, unchanged from previous forecasts, and then increase to 1.4% in 2025 before slightly dipping to 1.3% in 2026.

Japan’s growth forecast for 2024 has been revised down to 0.7% from 0.9%, due to weak consumption and slowing exports, though growth is expected to improve to 1.0% in 2025 and 0.9% in 2026.

China’s growth forecast for 2024 has been upgraded to 4.8% from 4.5%, driven by increased exports. However, growth is expected to decline to 4.1% in 2025 and 4.0% in 2026, due to weak investment, low consumer confidence, and a struggling property sector.

Japan’s CGPI rises to 2.4% yoy, highest in nine months

Japan’s corporate goods price index accelerated from 1.1% yoy to 2.4% yoy in May, surpassing expectations of 2.0% yoy increase. This marks the fastest annual rise in nine months. The Yen-based import goods price index also rose 6.9% yoy , up from a 6.6% yoy gain in April, indicating that the Yen’s depreciation is driving up the cost of raw material imports.

In a related development, a draft government policy blueprint released today emphasizes Japan’s commitment to using “all policy tools” to sustain wage hikes. These wage increases are deemed crucial for ending deflation and achieving consistent economic growth above 1%, despite the country’s rapidly shrinking population.

China’s CPI stagnates in May, PPI remains in negative territory

China’s CPI rose 0.3% yoy in May, unchanged from the previous month’s reading and falling short of the expected 0.4% yoy increase. Food prices declined by -2.0% yoy, while non-food prices saw a modest increase of 0.8% yoy. Prices of consumer goods remained flat, and service prices rose by 0.8% yoy .

On a monthly basis, CPI edged down by -0.1% mom, missing the expectation of no change. Food prices were stable, but non-food prices fell by -0.2% mom, consumer goods prices decreased by -0.1% mom, and service prices also fell by 0.1% mom.

PPI dropped by -1.4% yoy, an improvement from the previous month’s -2.5% yoy decline and better than the expected -1.8% yoy fall. Despite this improvement, PPI has been negative for the 20th consecutive month, indicating ongoing deflationary pressures in the industrial sector.

Looking ahead

UK GDP is the main focus in European session. Later in the day, all eyes are on US CPI, FOMC rate decision and new economic projections.

USD/CHF Daily Outlook

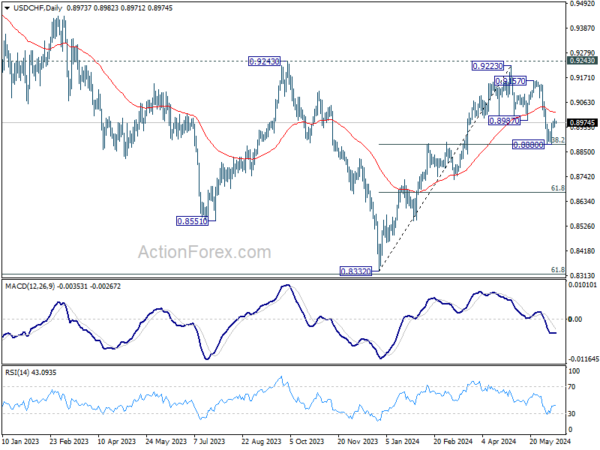

Daily Pivots: (S1) 0.8955; (P) 0.8974; (R1) 0.8996; More….

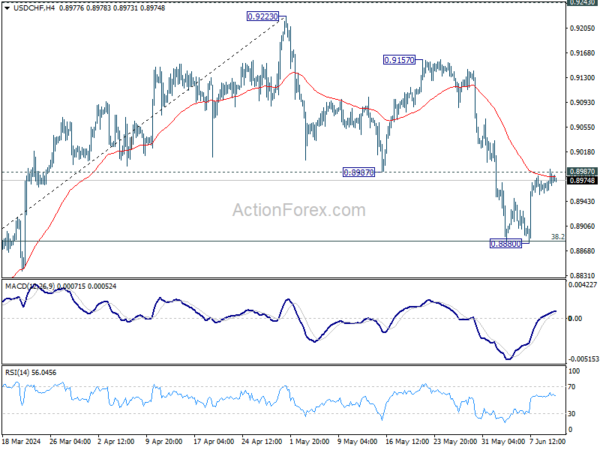

USD/CHF failed to break through 0.8987 support turned resistance decisively despite breaching it. Intraday bias stays neutral first. On the upside, firm break of 0.8987 support turned resistance will argue that correction from 0.9223 has completed, after drawing support from 0.8883 fibonacci level. Intraday bias will be back on the upside for 0.9157/9223 resistance zone. Nevertheless, sustained break of 0.8883 fibonacci level will carry larger bearish implications and bring deeper decline.

In the bigger picture, price actions from 0.8332 medium term bottom are tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance, followed by sustained break of 38.2% retracement of 0.8332 to 0.9223 at 0.8883 will strengthen this case, and maintain medium term bearishness. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish for 1.0146.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y May | 1.90% | 2.10% | 2.20% | |

| 01:30 | AUD | NAB Business Confidence May | -3 | 1 | ||

| 01:30 | AUD | NAB Business Conditions May | 6 | 7 | ||

| 06:00 | GBP | ILO Unemployment Rate (3M) Apr | 4.40% | 4.30% | 4.30% | |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Apr | 5.90% | 5.70% | 5.70% | 5.90% |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Apr | 6.00% | 6.00% | 6.00% | |

| 06:00 | GBP | Claimant Count Change May | 50.4K | 10.2K | 8.9K | 8.4K |

| 10:00 | USD | NFIB Business Optimism Index May | 90.5 | 89.8 | 89.7 | |

| 12:30 | CAD | Building Permits M/M Apr | 20.50% | 5.20% | -11.70% | -12.30% |