- EURUSD corrects sharply down to 1½-month low; gives up previous gains

- Technical signals remain bearish; support expected near 1.0650-1.0660

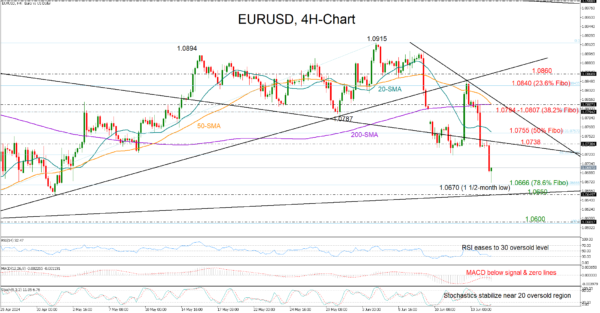

EURUSD continued to sink for the second consecutive day on Friday, reversing entirely its post-US CPI upturn and trimming a significant portion of its April-June uptrend to trade at a 1½-month low of 1.0670.

The sharp selling started after the bulls failed to climb above the support-turned-resistance trendline at 1.0850 and the 200-period simple moving average (SMA), while lower, the rejection near the former resistance line at 1.0745 motivated more downside today, putting the pair back on a bearish trajectory.

Both the RSI and the stochastic oscillator are positioned in the oversold territory, increasing optimism for some stability in the coming sessions as the 78.6% Fibonacci retracement of its previous uptrend is nearby at 1.0666. The tentative support trendline, which connects the lows from 2023 and 2024, is also within a short distance at 1.0650 and near May’s low. If the bears breach the latter, the door will open for the 1.0600 level again.

On the upside, the 1.0738-1.0755 constraining zone, which includes the 20-period SMA and the 50% Fibonacci level, could prevent a bullish continuation towards the 1.0794-1.0800 region. Even higher, the 23.6% Fibonacci of 1.0840 could renew selling pressures, blocking the way up to 1.0860.

In brief, EURUSD returned to bearish territory and could be at risk of losing more if the 1.0666-1.0650 support does not place a strong footing under the price.