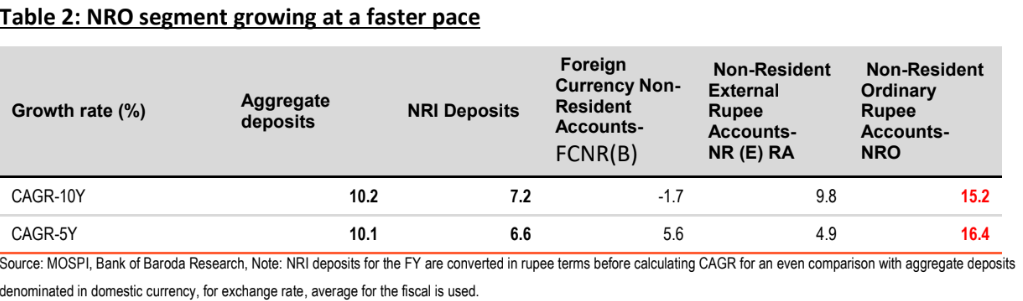

India’s robust post-pandemic economic performance has provided a stable foundation for the surge in NRI deposits, reflecting confidence in the country’s financial stability and growth prospects. A new study on trends in NRI deposits by Bank of Baroda has shown the growth in Non-Resident Indian (NRI) deposits keeping pace with the rapid increase in overall deposits, now accounting for 6.2% of the total. Over the past decade, NRI deposits have seen a compound annual growth rate (CAGR) of 7.2%, compared to 10.2% for aggregate deposits.

NRI deposits play a crucial role in augmenting banks’ aggregate deposits and bringing in foreign exchange. The flow of these funds largely depend on interest rate differentials and remittance trends. Based on the last decade’s trends, NRI deposits are expected to grow at a rate of 9-10% over the next five years. This aligns with the anticipated growth in overall deposits, projected at 12-13%, and a rupee depreciation rate of 2-3% per annum.

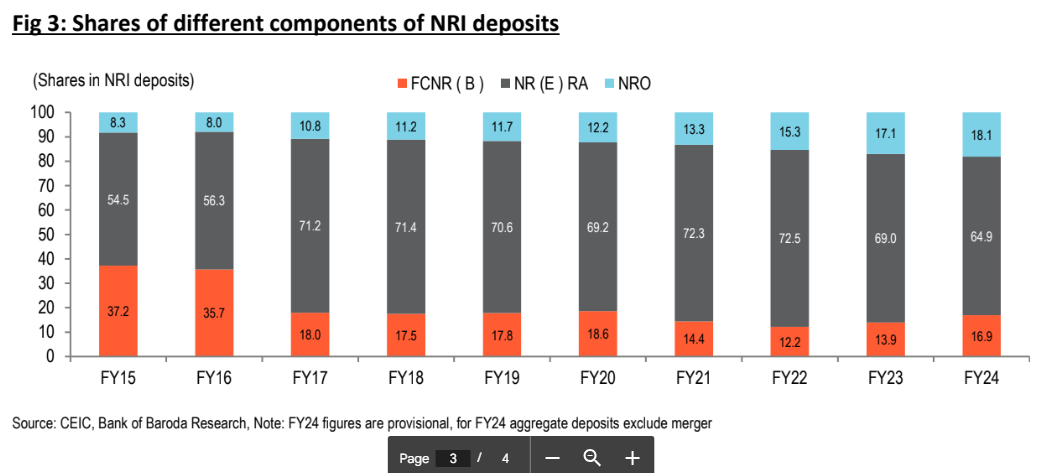

The share of Foreign Currency Non-Resident (FCNR) deposits and Non-Resident Ordinary (NRO) deposits has significantly increased owing to the interest rate differential and India’s insulated economy amid global disturbances.

NRI Deposits During and After the Pandemic

The trajectory of NRI deposits has been particularly notable. During the COVID-19 pandemic, these deposits sharply increased from $131 billion to $142 billion, despite a globally lower interest rate regime. During uncertain times, bank deposits became the preferred choice for savings, as other asset classes were highly volatile, the report noted.

The global increase in precautionary savings, evidenced by the world’s gross savings rate rising to 27.1% from 25.8% (World Bank data), also led to higher bank deposits. However, as economic activities normalized, a slight correction was observed in FY22 and FY23. Provisional figures for FY24 indicate renewed momentum, possibly due to a more measured approach by India’s central bank compared to the volatility of global central banks’ interest rate policies.

Comparison with Aggregate Deposits

NRI deposits in rupee terms have grown at a 10-year CAGR of 7.2%, while aggregate deposits have surged at 10.2%, supported by higher domestic resources. During this period, the rupee depreciated by 3.2%. Over the last five years, NRI deposits grew at a 6.6% CAGR, while overall deposits saw a double-digit growth of 10.1%.

NRO accounts have particularly grown at a faster pace, with a 10-year CAGR of 15.2%, surpassing the growth of aggregate deposits. This increase is likely due to factors such as ease of liquidity, interest rate differential, and repatriation issues. In contrast, FCNR(B) deposits have experienced some volatility.

Evolution of NRI Deposit Components

The composition of NRI deposits has shifted over recent years. Post-COVID, the share of NRO deposits has risen consistently. These accounts handle domestic revenue, and India’s relatively stable economy compared to global counterparts could explain this increase. Since FY22, FCNR(B) deposits have also picked up, possibly due to higher remittance flows.

The higher share of FCNR(B) deposits during FY15 and FY16 was a unique event driven by central bank measures to support the domestic currency. However, the share of FCNR(B) deposits remains lower than pre-COVID levels. Meanwhile, Non-Resident External Rupee Accounts (NR(E)RA) have shown volatility, likely impacted by global economic conditions, inflation, and elevated borrowing costs affecting company profitability.