- We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 5.25% on 20 June, which is in line with consensus and current market pricing.

- Overall, we expect the MPC to stick to its current communication, priming the markets for a forthcoming start to a cutting cycle. We expect the first 25bp cut in August.

- We expect a muted market reaction but see the balance of risk skewed to a move higher in EUR/GBP as the BoE tends to err on the dovish side.

We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 5.25% on 20 June, which is in line with consensus and current market pricing. We expect the vote split to be 7-2, with the majority voting for an unchanged decision and Ramsden and Dhingra voting for a cut. Note, this meeting will not include updated projections or a press conference following the release of the statement.

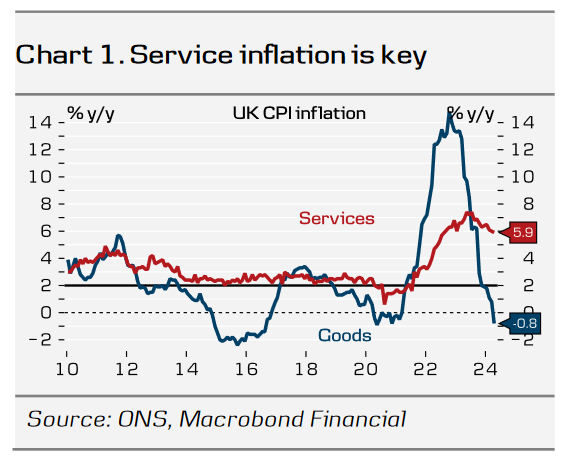

Overall, we expect the MPC to stick to previous guidance, priming the markets for a forthcoming start to a cutting cycle. We expect them to retain much of its wording in terms of forward guidance, repeating that “monetary policy could remain restrictive even if Bank Rate were to be reduced, given that it was starting from an already restrictive level” and “the Committee will keep under review for how long Bank Rate should be maintained at its current level“. Since the last monetary policy decision in May, data has overall been slightly stronger than expected. Activity picked up in Q1 with the economy growing 0.6% q/q (vs BoE forecast of 0.4%), although the pickup is largely due to net exports with private consumption growth remaining more muted. Service inflation remained elevated at 5.9% in April with underlying momentum still strong and wage growth remains elevated underpinned by the recent rise in the National Living Wage. While inflation data for the month of May is released on Wednesday, the day before the meeting, we do not expect this to affect the immediate policy decision in June but will prove important in terms of guidance.

UK election. Since the announcement of a UK snap election, all speeches from MPC members have been cancelled. We do not expect the election to have an impact on the immediate policy action. In the base case of Labour election win, we will most likely not see a budget accompanied by an OBR forecast until in September, which will then be formally incorporated into BoE forecasts.

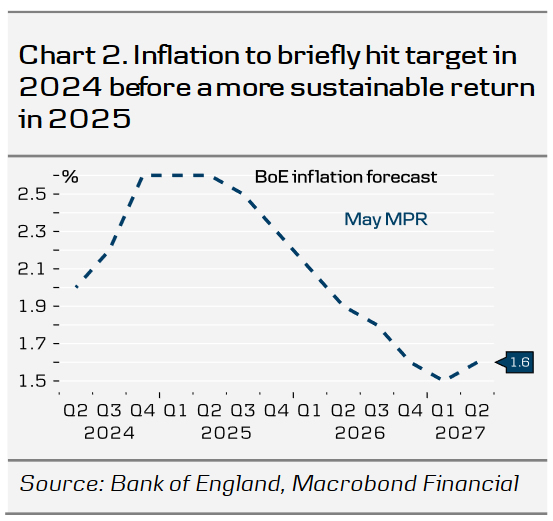

BoE call. We expect the BoE to deliver the first cut of 25bp in August. Subsequently, we expect quarterly cuts through 2024 and 2025. Markets are pricing 45bp for the remainder of the year with the first 25bp cut fully priced by November.

FX. In our base case we expect a muted reaction in EUR/GBP but see the balance of risk skewed to a move higher as the BoE tends to err on the dovish side. With risks to both growth and inflation tilted to the topside, this leaves a more challenging backdrop for an impending BoE cutting cycle. By extension and combined with the political uncertainty in France, this also acts as a downside risk to our EUR/GBP forecast of 0.88 in 6-12 months.