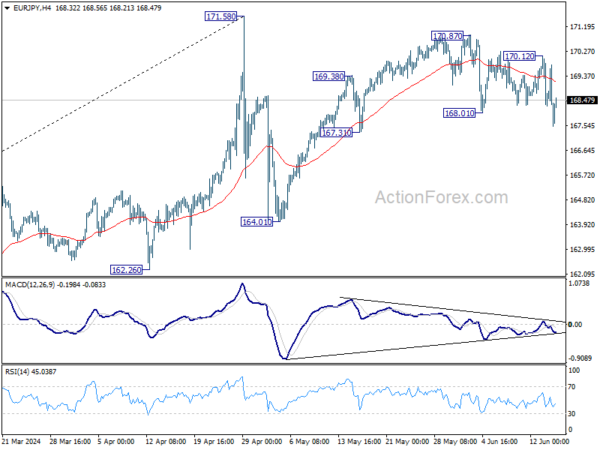

EUR/JPY engaged in sideway trading most of last week but late break of 168.01 support is inline with the case that rise from 164.01 has completed already. Initial bias is back on the downside this week. Sustained trading below 55 D EMA (now at 167.41) will extend the fall from 170.87, as the third leg of the pattern from 151.58, to 164.01 support next. For now, risk will stay on the downside as long as 170.12 resistance holds, in case of recovery.

In the bigger picture, as long as 55 W EMA (now at 159.51) holds, price actions from 171.58 medium term top are seen as as correcting the rise from 153.15 only. That is, larger up trend remains in favor to continue as a later stage. However, sustained break of 55 W EMA will argue that larger scale correction is underway and target 153.15 support.

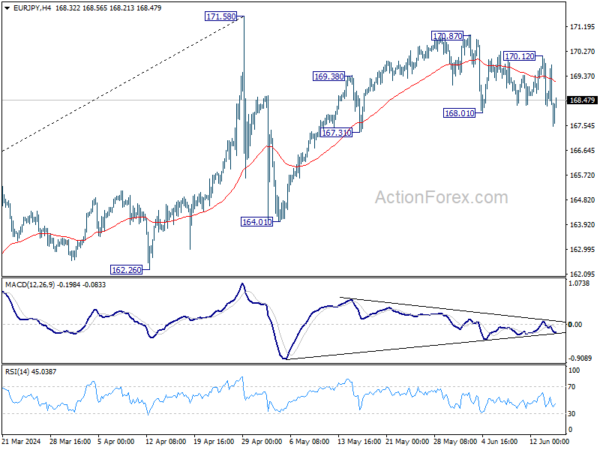

In the long term picture, rise from 114.42 (2020 low) is seen as the third leg of the whole up trend from 94.11 (2012 low). 100% projection of 94.11 to 149.76 from 114.42 at 170.07 was already met but there is no signal of reversal yet. Firm break of 170.07 will target 138.2% projection at 191.32. This will remain the favored case as long as 153.15 support holds.