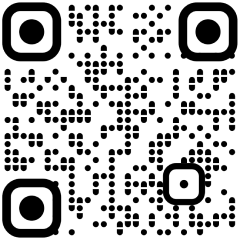

According to latest data by 1Lattice, the outward remittances from India has witnessed a slight fall of approximately 1.98 per cent, month on month in April 2024 after a 14 per cent increase in March and 23 per cent dip in February. For the past 3 years, overseas travel and leisure has had the highest share in outward remittances from India, while education remittances declined from FY22.

The month of April has recorded outward remittances worth USD 2.2 billion compared to USD 2.3 billion in March, USD 2 billion in February and USD 2.6 billion in January, with travel holding the majority share of 50 per cent, followed by education of 9 per cent, family maintenance of 17 per cent, gifts of 14 per cent and investment in equity/debt holding a 4 per cent share, the data highlighted.

Remittances clocked a record high of USD 27.14 billion in FY23. According to latest data by RBI, remittances increased 16.91 per cent year-on-year from the previous high of USD 27.14 billion clocked in FY23. Indians remitted USD 29.43 billion abroad during the April-February period as compared to USD 24.18 billion in the same period of the previous year.

Forex remittances had averaged over USD 3 billion a month between April-Sept 2023 before the increased tax collection at source (TCS) came into effect in October.

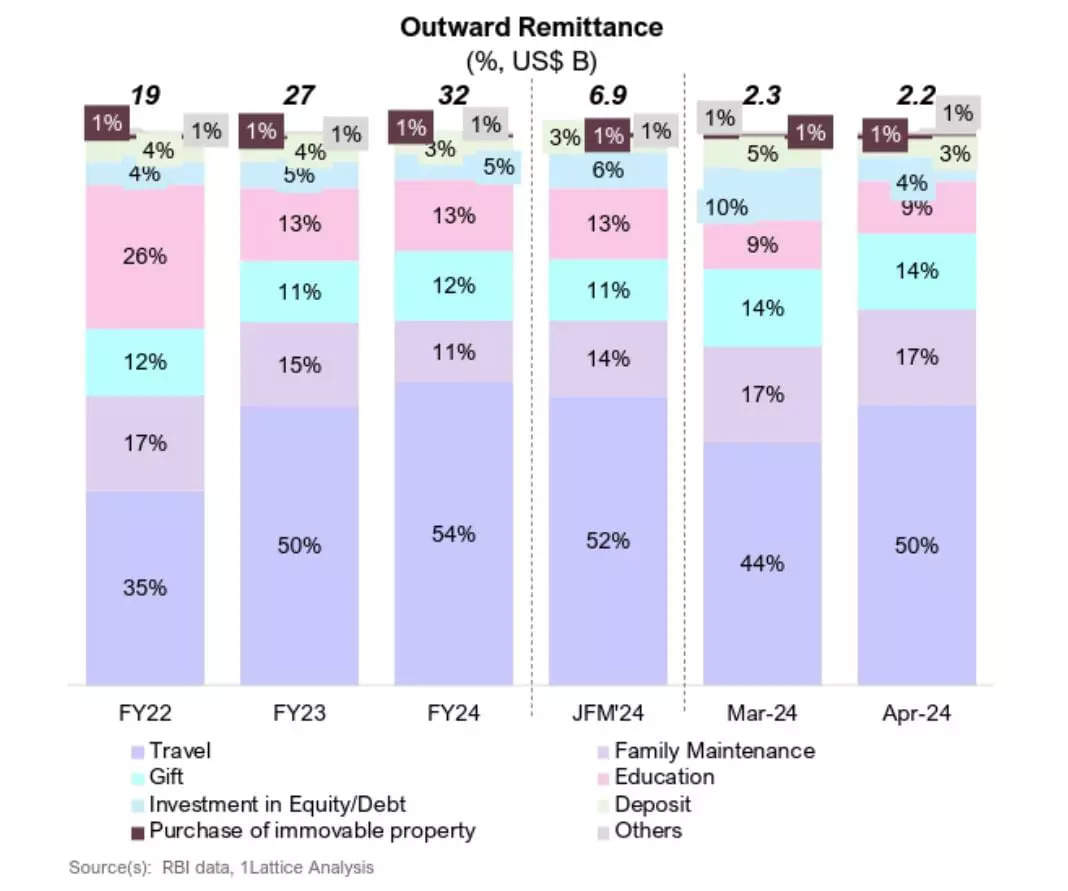

Outward remittance towards investment on debt/equity witnessed a significant decrease of about 56 per cent m-o-m, in April 2024, in comparison to 66 per cent jump in March, about 126 per cent increase in February and 41 per cent decline in January, 2024. After international travel, Indians spent most on overseas education, followed by maintenance of close relatives, and gifts.

The Indian government had recently raised the tax collection at source (TCS) rate on foreign remittances under the Liberalised Remittance Scheme (LRS) from 5 per cent to 20 per cent, which has been effective since October 1, 2023.

According to latest data by the Reserve Bank of India, the amount remitted under LRS stood at USD 24.80 billion in the 9-month period ended in December 2023, compared to USD 20.63 billion in the same period last year.

In the first half of FY24, money sent abroad by Indians under the Liberalised Remittance Scheme (LRS) hit a record high of USD 18.34 billion. The introduction of the TCS saw remittances drop sharply from nearly USD 3.5 billion in September to about USD 2.2 billion in a month’s time.

The LRS allows resident Indians to transfer funds abroad without restrictions, up to a specified limit. This month-on-month fall was due to a decline in funds sent for maintenance of close relatives.

The Liberalised Remittance Scheme (LRS) allows every Indian to send up to USD 250,000 abroad annually.

Outward remittances recorded in FY20 was USD 18 billion, in FY21 it was USD 12 billion and in FY22 it was a whopping USD 19 billion, said the 1Lattice data.

Overall remittances hit a new high of USD 31.73 billion in FY24, on the back of robust growth in the international travel segment.