Starting June 25, HDFC Bank will stop sending text alerts for low-value UPI transactions. This means that HDFC Bank customers will receive SMS alerts for UPI transactions exceeding Rs 100 when sending money and similar notification for when received is above Rs 500. However, the bank will continue to send email alerts for all transactions with no absolutely change.

In a mail as well as SMS alert sent to its customers, HDFC Bank said: “Starting from 25th June, 2024: Email Alerts: Continue to receive email alerts for all UPI transactions. SMS Notifications: Now only for transactions above Rs 100 (money sent/paid) and Rs 500 (money received).”

Why HDFC Bank is making this change

This change aligns with banking norms, which require text messages for transactions over Rs 5,000. Despite this, many banks send alerts for lower-value debits as well. HDFC Bank stated that feedback indicated alerts for low-value transactions were deemed ‘not useful,’ as there is often duplication of notifications from UPI payment apps.

Bankers noted that bulk text messages cost between Rs 0.01-0.03 each. With UPI transactions averaging around 40 crores per day, banks collectively spend several crores daily on text message alerts.

What is UPI Lite and why banks are pushing it

Banks are also promoting the use of UPI Lite for transactions up to Rs 500. UPI Lite allows a small amount of money to be set aside by the app, facilitating quick payments without the need for second-factor authentication.By reducing the frequency of low-value transaction alerts, HDFC Bank and others aim to streamline notifications for customers while also cutting costs. This shift is expected to enhance the user experience and encourage the adoption of UPI Lite for smaller transactions. However, users can register their email with HDFC bank to receive messages of all the UPI transactions

How to register for email to receive all the UPI transaction alerts

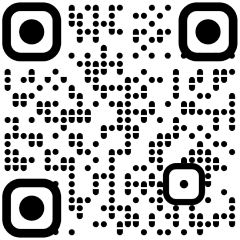

Step 1: Click on https://instaservices.hdfcbank.com/?journey=107&source_type=103

Step 2: Enter the registered mobile number

Step 3: Identify using DoB or PAN or Customer ID and click on Get OTP.