Yen recovered mildly in quiet Asian session along with the Swiss Franc, driven by mild risk aversion in the region. Despite this uptick, there is no strong indication of a significant rebound for the Japanese currency following its sharp decline last week. Notably, Japan did not utilize the thin liquidity at the beginning of the week to intervene in the currency markets. While some traders remain vigilant for possible intervention should USD/JPY surpass 160 level, we believe that the intervention threshold may have already been adjusted higher.

Japan’s verbal intervention has been relatively restrained too. Finance Minister Shunichi Suzuki warned against excessive speculative movements in the current market, pledging to respond appropriately if necessary. However, stronger language, such as monitoring the markets with a “high sense of urgency,” was notably absent. Meanwhile, top currency diplomat Masato Kanda only reiterated that “we are always ready to take appropriate action when there are excessive moves,” and emphasized that Japan is prepared to intervene 24 hours a day if needed.

In the broader currency market, Sterling and US Dollar followed Yen and Swiss Franc as the stronger performers of the session. Meanwhile, New Zealand Dollar, Australian Dollar, and Canadian Dollar lagged, with Euro positioned in the middle. As the first half of the year draws to a close, upcoming inflation data from Canada, Australia, Tokyo, and the US are expected to inject more volatility into the markets.

Technically, AUD/JPY’s long term up trend resumed last week and surged to the highest level since 2007, passing through 2013 high at 105.42. Further rally is expected as long as 104.91 resistance turned support holds. Next target is 61.8% projection of 95.48 to 104.91 from 102.59 at 108.41 which is above 2007 high at 107.88. This advance will depend on Japan’s intervention stance and Australia’s monthly CPI data scheduled for release on Wednesday.

In Asia, at the time of writing, Nikkei is up 0.60%. Hong Kong HSI is down -1.02%. China Shanghai SSE is down -0.70%. Singapore Strait Times is down -0.04%. Japan 10-year JGB yield is up 0.0212 at 0.999.

BoJ deliberates on rate hikes, Yen depreciation, and JGB purchase adjustments

During Monetary Policy Meeting on June 13-14, BoJ board discussed the need for adjustments in response to rising inflation risks. One key opinion indicated that if April Outlook Report’s economic and inflation forecasts are realized, BoJ will raise the policy interest rate and adjust monetary accommodation.

Another member warned that prices could “deviate upward” from the baseline scenario if recent cost increases are passed on to consumers, suggesting a need for further policy adjustments from a “risk management” perspective. It’s also highlighted the growing “upside risks” to prices, with one member stating these risks have affected consumer sentiment and that the policy interest rate should be raised “not too late” if appropriate.

The impact of Yen’s depreciation was also discussed, with an opinion suggesting an “upward revision” to the inflation outlook, warranting a higher risk-neutral policy interest rate. Some members emphasized the importance of basing monetary policy on the “overall picture of developments in economic activity and prices,” rather than short-term foreign exchange fluctuations. They stressed that policy should be informed by trends in prices and wage developments.

Regarding asset purchases, one opinion recommended reducing the purchase amount of Japanese government bonds to allow long-term interest rates to form more freely in financial markets. This reduction should be “sizeable” and “predictable,” while ensuring flexibility to maintain stability in JGB market.

New Zealand’s goods exports reach record high in may, trade surplus exceeds expectations

New Zealand’s goods exports rose by 2.9% yoy to NZD 7.2B in May, marking the first time that monthly exports have surpassed the NZD 7B mark. Goods imports also saw a slight increase, rising by 0.6% yoy to NZD 7.0B. This resulted in a trade surplus of NZD 204m, exceeding the expected NZD 155m.

Breaking down the top monthly export movements by country, New Zealand saw mixed results. Exports to China fell by -12% yoy, and exports to Australia dropped by -3.8% yoy. In contrast, exports to the US surged by 33% yoy, while exports to the EU and Japan rose by 2.8% yoy and 12% yoy, respectively.

On the import side, imports from China increased by 2.6% yoy, while imports from the EU decreased by -1.8% yoy. Imports from Australia -4.7% yoy, whereas imports from the US and South Korea rose by 1.6% yoy and 5.8% yoy, respectively.

Inflation reports from Canada, Australia, Japan, and US to drive currencies

Inflation data will once again be the focus this week, with critical reports coming from Canada, Australia, and Tokyo in Japan. The United States will also release its PCE inflation data.

The minutes of BoC’s June meeting revealed that governing council had considered delaying a rate cut until July but decided to act earlier this month, citing significant progress in reducing inflation. Thus, it is unlikely for BoC to deliver a back-to-back rate cut in July, although this will depend on how inflation evolves. Canada’s CPI common has steadily declined from 3.9% in December to 2.6% in April. However, a stalling of progress in May could keep BoC cautious.

Australia’s monthly CPI data for May might show a slight tick down in inflation. Yet, the readings have been stuck between 3.4% and 3.6% since last December, a situation that does not instill confidence in RBA to close the door on further tightening. While RBA will wait for Q2 CPI for a more comprehensive assessment, the monthly CPI could still provide valuable insight into inflation trends.

In Japan, Tokyo’s core CPI is expected to tick up slightly in June, continuing to hover around the 2% level due to fluctuations in energy prices. BoJ has repeatedly indicated that a rate hike in July is a possibility, but the situation remains complex. Fading demand-led price pressures would likely keep the BoJ cautious about tightening further. However, cost-push inflation resulting from a weakening Yen could prompt a monetary policy response.

In the US, PCE core price index is expected to rise by only 0.1% mom in May, the smallest increase since last November. This would be a positive development for Fed, suggesting that inflationary pressures are easing. But it is way too early for Fed to decide on whether to start cutting interest rates in September, considering that it is only June. More data will be needed to make an informed decision.

Here are some highlights for the week:

- Monday: New Zealand trade balance; BoJ summary of opinions; Germany Ifo business climate.

- Tuesday: Japan corporate service price index; Australia Westpac consumer sentiment; Canada CPI; US house price index, consumer confidence.

- Wednesday: Australia monthly CPI; Germany Gfk consumer sentiment; Swiss UBS economic expectations; US new home sales.

- Thursday: Japan retail sales; New Zealand ANZ business confidence; Eurozone M3 money supply; US Q1 GDP final, jobless claims, durable goods orders, goods trade balance, pending home sales.

- Friday: Japan Tokyo CPI, unemployment rate, industrial production, housing starts; Germany import price: UK Q1 GDP final; Swiss KOF economic barometer; Germany unemployment; Canada GDP; US personal income and spending, PCE inflation, Chicago PMI.

USD/JPY Daily Outlook

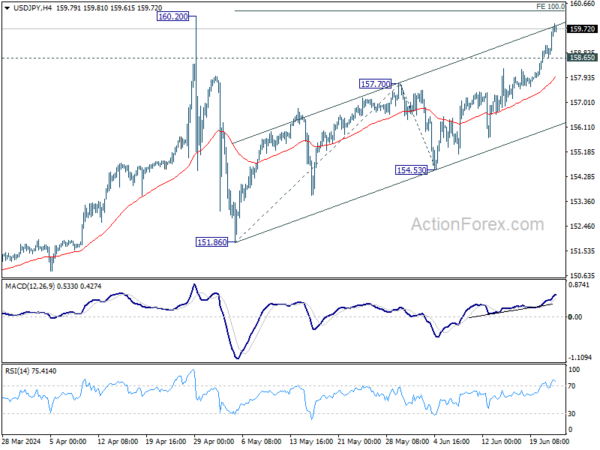

Daily Pivots: (S1) 159.02; (P) 159.44; (R1) 160.22; More…

Intraday bias in USD/JPY remains on the upside for the moment. Current rally should target 160.20 high, or possibly to 100% projection of 151.86 to 157.70 from 154.53 at 160.37. Upside could be limited there, at least on first attempt. On the downside, below 158.24 minor support will turn intraday bias neutral first. However, decisive break of 160.37 will pave the way to 161.8% projection at 163.97.

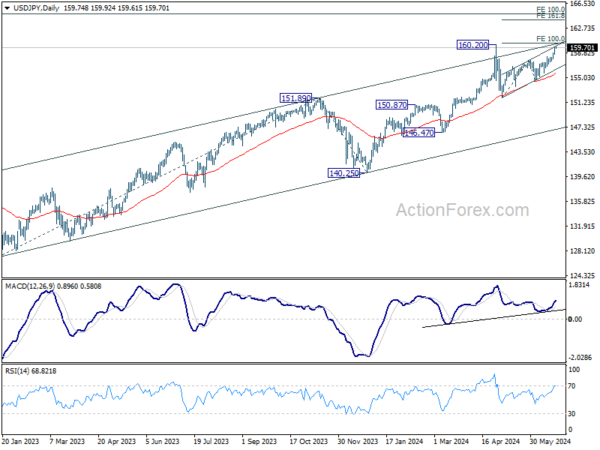

In the bigger picture, there is no sign of long term trend reversal yet. Further rally is expected as long as 150.87 resistance turned support holds. Decisive break of 160.02 will target 100% projection of 127.20 to 151.89 from 140.25 at 164.94.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) May | 204M | 155M | 91M | -3M |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 08:00 | EUR | Germany IFO Business Climate Jun | 89.7 | 89.3 | ||

| 08:00 | EUR | Germany IFO Current Assessment Jun | 88.4 | 88.3 | ||

| 08:00 | EUR | Germany IFO Expectations Jun | 91 | 90.4 |