Yen is showing broad-based recovery today, although the momentum remains weak, following its decline to the lowest level against Dollar since 1986. Japan has finally stepped up its verbal intervention efforts again, with Finance Minister Shunichi Suzuki expressing a “high sense of urgency” regarding Yen’s depreciation. Suzuki pledged to “take necessary action as needed” and reiterated his “strong concern” over one-sided currency moves and their impact on the economy.

Despite this, Yen remains the second worst performer of the week, showing minimal signs of a lasting bottom. Conversely, Dollar is the second strongest currency, trailing only Australian Dollar. Even if Japan intervenes in the markets, such efforts alone may not be sufficient to reverse USD/JPY trend unless Dollar also weakens against other major currencies.

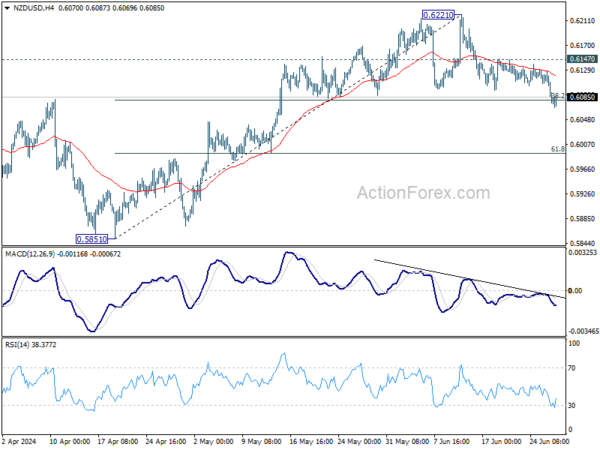

Technically, NZD/USD’s fall from 0.6221 short term top extended lower today and it’s now pressing 38.2% retracement of 0.5851 to 0.6221 at 0.6080. Strong bounce from current level, followed by break of 0.6147 resistance, will retain near term bullishness, and bring resumption of the rise from 0.5851 through 0.6221 at a later stage. However, sustained trading below 0.6080 will raise the chance of reversal and target 61.8% retracement at 0.5992 and possibly below.

In Asia, at the time of writing, Nikkei is down -1.06%. Hong Kong HSI is down -2.04%. China Shanghai SSE is down -0.51%. Singapore Strait Times is up 0.27%. Japan 10-year JGB yield is up 0.0441 at 1.069. Overnight, DOW rose 0.04%. S&P 500 rose 0.16%. NASDAQ rose 0.49%. 10-year yield rose 0.078 to 4.316.

NZ ANZ business confidence falls to 6.1, inflation pressure eases further

New Zealand ANZ Business Confidence fell from 11.2 to 6.1 in June. Despite this decrease in overall confidence, there was a slight improvement in the own activity outlook, from 11.8 to 12.2.

Cost expectations decreased from 72.6 to 69.2, while pricing intentions dropped significantly from 41.6 to 35.3, signaling easing price pressure in the business environment. Furthermore, inflation expectations continued their steady descent, moving from 3.59% to 3.46%.

ANZ noted that “the economy is clearly weak, as the RBNZ intended.” More importantly, there appears to be “renewed meaningful progress on bringing inflation pressures down.” This fosters optimism that RBNZ might be able to lower the Official Cash Rate considerably earlier than the currently projected August next year.

Looking ahead

Eurozone M3 money supply will be released in European session. Later in the day, the US calendar is busy with Q1 GDP final, durable goods orders, goods trade balance, jobless claims and pending home sales featured.

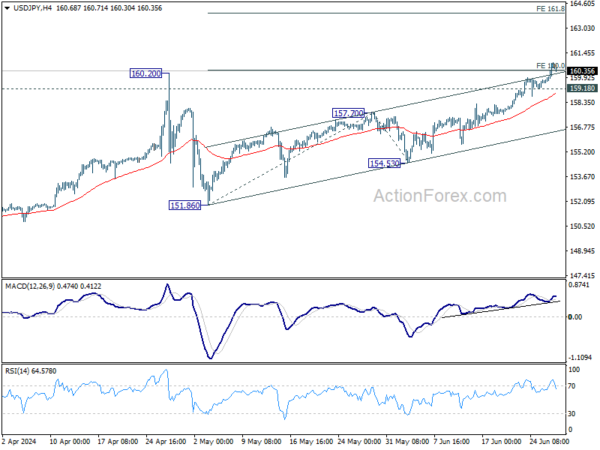

USD/JPY Daily Outlook

Daily Pivots: (S1) 160.00; (P) 160.43; (R1) 161.26; More…

Intraday bias in USD/JPY remains on the upside at this point. Sustained trading above 100% projection of 151.86 to 157.70 from 154.53 at 160.37 will pave the way to 161.8% projection at 163.97. On the downside, below 159.18 minor support will turn intraday bias neutral again first. But outlook will stay bullish as long as 157.70 resistance turned support holds.

In the bigger picture, there is no sign of long term trend reversal yet. Further rally is expected as long as 151.86 support holds. Decisive break of 160.02 will target 100% projection of 127.20 to 151.89 from 140.25 at 164.94.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y May | 3.00% | 2.00% | 2.40% | 2.00% |

| 01:00 | AUD | Consumer Inflation Expectations Jun | 4.40% | 4.10% | ||

| 01:00 | NZD | ANZ Business Confidence Jun | 6.1 | 11.2 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y May | 1.60% | 1.30% | ||

| 09:00 | EUR | Eurozone Economic Sentiment Jun | 96.3 | 96 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Jun | -9.9 | |||

| 09:00 | EUR | Eurozone Services Sentiment Jun | 6.5 | |||

| 09:00 | EUR | Eurozone Consumer Confidence Jun F | -14 | -14 | ||

| 12:30 | USD | Initial Jobless Claims (Jun 21) | 230K | 238K | ||

| 12:30 | USD | Durable Goods Orders May | -0.10% | 0.60% | ||

| 12:30 | USD | Durable Goods Orders ex Transport May | 0.10% | 0.40% | ||

| 12:30 | USD | Goods Trade Balance (USD) May P | -96.0B | -99.4B | ||

| 12:30 | USD | Wholesale Inventories May P | 0.20% | 0.10% | ||

| 12:30 | USD | GDP Annualized Q1 F | 1.30% | 1.30% | ||

| 12:30 | USD | GDP Price Index Q1 F | 3.00% | 3.00% | ||

| 14:00 | USD | Pending Home Sales M/M May | 0.60% | -7.70% | ||

| 14:30 | USD | Natural Gas Storage | 53B | 71B |