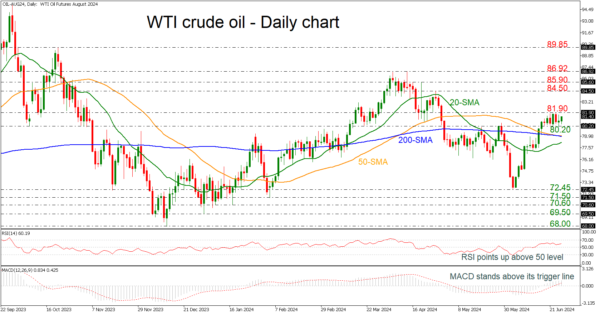

- WTI crude oil fails to rally above 81.90

- RSI and MACD remain above mid-levels

WTI crude oil has been on the sidelines for the most part of the week as the 81.90 level seems to be a real struggle for the bulls. Technically, the price could gain some ground in the short-term as the RSI is changing direction to the upside and holds above the 50 neutral mark, while the MACD is standing above its trigger and zero lines.

A move above the 81.90 resistance could keep the price on the uptrend in the short term started from the rebound off 72.45. Should the price overcome this level, the price could run up to the 84.50 barrier. Higher, the 85.90 and 86.92 lines could next come in focus.

Alternatively, a decline under 80.20 could meet a strong bar near the 50- and the 200-day simple moving averages (SMAs) at 79.00 ahead of the 20-day SMA at 78.30. Even lower, the 72.45 support could take control again.

In the short-term picture, oil prices have gently pointed up over the past three weeks, framing a positive profile. A strong rally above 86.92 would extend the upward pattern, making the outlook even more bullish, while a decisive close below 72.45 would confirm the start of a downtrend.