Removal of the contentious angel tax for startups may be part of the Union Budget announcement, as per the recommendations from the Department for Promotion of Industry and Internal Trade (DPIIT).

DPIIT secretary Rajesh Kumar Singh confirmed on Thursday that the department has called for the removal of angel tax.

ET breaks down the what and what-ifs of the controversial tax:

What is angel tax?

angel tax refers to the income tax levied by the government on funding raised by unlisted companies, or startups, if their valuation exceeds the company’s fair market value. The tax impacts angel investment the most and therefore is called the angel tax.

Under Section 56(2) VII B of the Income Tax Act, the premium received on the sale of shares to a foreign investor is considered “income from other sources” and therefore, taxed accordingly.

When was it first introduced and why?

The tax was first introduced in the 2012 Union Budget by then finance minister Pranab Mukherjee under the UPA-II regime to arrest the laundering of funds.

The government issued a notification in April 2018 to give exemption to startups under Section 56 of the Income Tax Act in cases where the total investment including funding from angel investors did not exceed Rs 10 crore.

For the exemption, startups were also required to get approval from an inter-ministerial board and a certificate of valuation from a merchant banker.

Why has DPIIT pitched for repeal of the angel tax?

DPIIT secretary said the recommendation was made after “consultations with the startup ecosystem.”

“Ultimately, the integrated view will be taken by the finance ministry on angel tax. It’s just an input from our side. We have done it several times,” Singh said, adding that the department has passed on the written inputs from industry associations to the finance ministry.

The industry has long lobbied for the removal of angel tax stating that the step “would greatly aid capital formation in the country”.

Shot in the arm for startups

If repealed, the move will be a big boost for over 1,41,000 DPIIT-registered startups in the country, who claim that the high tax rates make investing in startups “unattractive” to angel investors.

According to founders, angel tax wipes away a major part of the investible surplus of startups raising funds, thereby hurting their growth prospects.

Earlier, the Confederation of Indian Industry (CII) had urged the government to rationalise the angel tax to further nurture innovation and startups in its wish list for the Union Budget 24-25.

Taking to microblogging site X, Dinesh Pai, head of investments at Rainmatter, the startup investment arm of stock-broking major Zerodha, said, “Given the slowdown in VC and AIF deployment compared to 2021 and 2022, this is a great step, ‘IF’ it happens.”

“The terror and overhang of #Angeltax is something that the startup ecosystem has constantly spoken against, for how it makes our startups unattractive to angel investors,” Pai wrote.

Startup funding slowdown

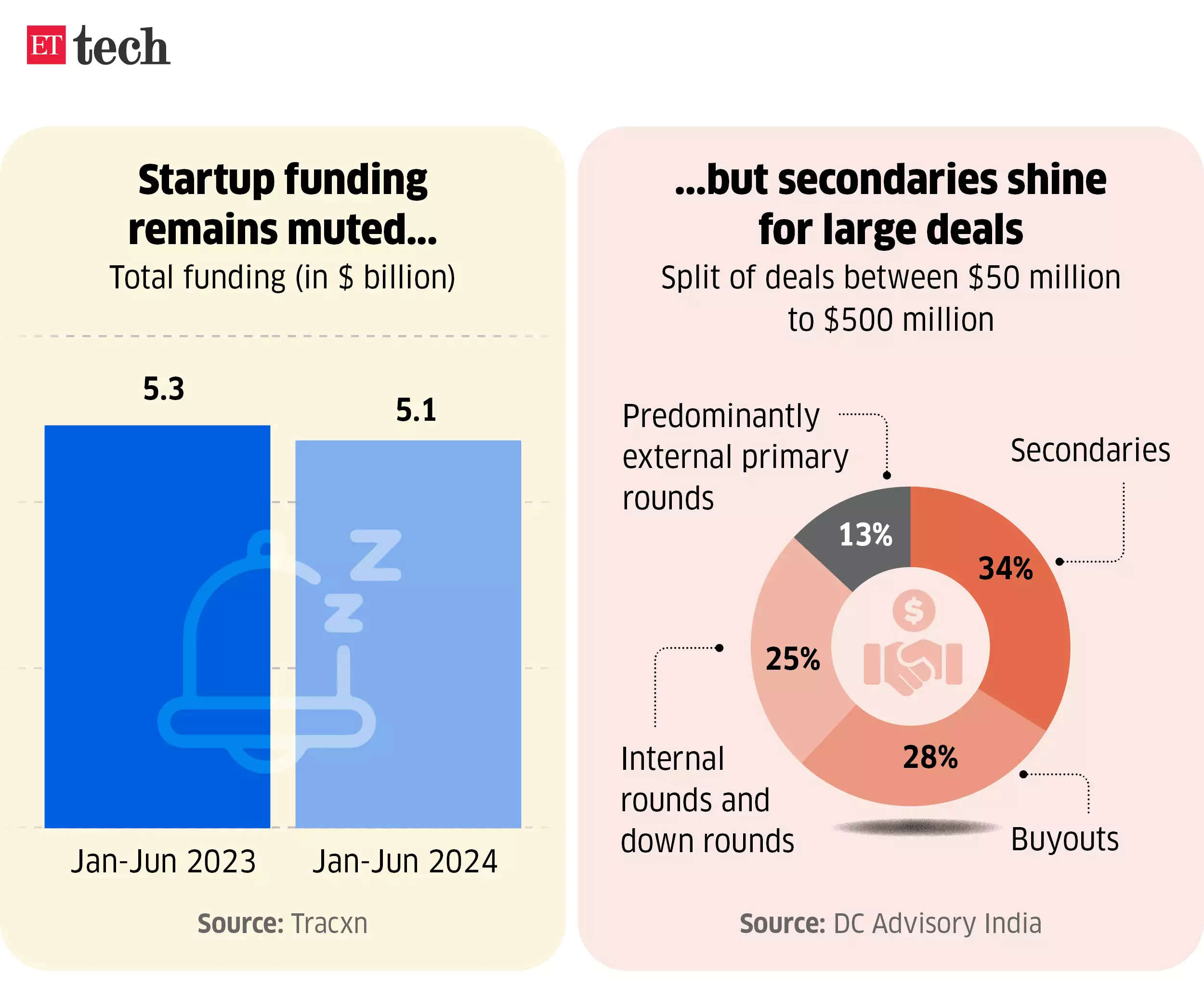

Even as funding winter showed signs of thawing, total fundraising by startups fell by 3.8% to about $5.1 billion in the first half of 2024, compared with $5.3 billion in the same period in 2023, ET reported on July 5, citing data from Tracxn.

Data from investment banking firm DC Advisory India showed that 62%, or 23, of the 37 deals in the $50-500 million range during the January-June period were secondary transactions or buyouts, with external primary investment rounds making up only 13%.

External primary capital mainly came into deals sized in the $15-50 million range, as per the data.

Lately, Indian startups have been hit majorly by valuation markdowns with international fund managers slashing the value of unicorns. Byju’s, ShareChat, Udaan and PharmEasy are among new-age companies that have seen a significant downward revision of their valuations.

Many have even raised fresh capital at a significantly lower valuation than their previous round, highlighting the challenging funding environment for new-age tech startups.