- Soft US economic data, including lower-than-expected job growth, has increased market expectations for a September rate cut.

- The week ahead features important data releases, including US inflation figures and Chinese inflation data.

- US Inflation holds the key to a September rate cut. A decline in inflation could see significant changes to rate cut probabilities.

- Chart of the Week: US Dollar index (DXY)

Week in Review: Slowing Payroll Growth Fuels Speculation of September Rate Cut

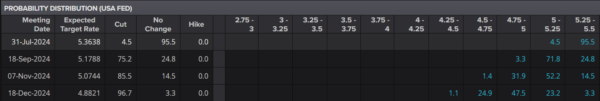

A significant week for markets ended on Friday with a lackluster US jobs report, consistent with most of the US data from this week. This has increased speculation that the Federal Reserve may cut rates in September, with market expectations now reflecting a higher likelihood of such a move.At the beginning of the week, the probability for a September rate cut stood around the 60% mark which increased to around the 75% mark post the NFP and jobs report release.

Interest Rate Probability – US Federal Reserve, July 5, 2024

Source: LSEG

The slow growth of 136,000 private payrolls in June, along with the large downward revision of May’s numbers from 272,000 to 193,000, makes a September rate cut likely. As in recent months, the overall increase in payrolls was largely due to big gains in government and private healthcare jobs, up by 70,000 and 82,000 respectively.

Private payrolls, excluding private education and healthcare, grew by only 54,000, much lower than the six-month average of 101,000. Additionally, there have been consistent downward revisions—the latest estimates show that payroll growth from month to month over the past 12 months to May is on average 24,000 lower than initially reported—indicating that June’s data could look significantly worse in a few months.

The increase in speculation around rate cuts weighed on the USD for the majority of the week, allowing commodities and equities to rise once more. The S&P 500 and the Nasdaq 100 both printed fresh highs multiple times during the week.

The UK election did not throw up any surprises and the Labour Party performed even better than expected. The result saw an early rally for FTSE before a pullback Friday afternoon while the GBP advanced and gained significant ground against the weaker US dollar following the NFP and jobs report release.

On the commodities front gold (xau/usd) and silver (xag/usd) surged higher on Friday with oil prices on course for a fourth successive week of gains. Falling inventories and supply concerns continue to prop up oil prices as the European and US summer season gets into full swing.

The Week Ahead – EU, US and ASIA

Europe + UK

The UK election finished with Keir Starmer’s Labour Party achieving a decisive victory. While markets had anticipated a significant win, the outcome exceeded expectations, even for the most dedicated Labour supporters. Prime Minister Starmer has committed to rebuilding Britain after years of turmoil but cautioned that progress would require time.

Looking ahead to next week, markets will be closely observing any actions by the incoming Prime Minister. Speeches from the newly appointed Finance Minister Rachel Reeves will also be under scrutiny, as maintaining a tight fiscal policy is crucial for controlling the UK’s debt levels. In the short-term, financing the NHI looks to be a Labour priority, but beyond that Chancellor Reeves will have to walk a tightrope.

Looking toward Europe, it is a quiet week in terms of high impact data releases. All eyes will likely be fixed on the French election as round two gets underway. Despite the first round win for Marine Le Pen’s far-right National Rally party (RN), the lack of a majority put markets at ease.

Throughout the week, various polls have been conducted. The consensus among them is that a majority for the National Rally party is highly unlikely. However, if a surprise majority win does occur, it could unsettle markets, potentially leading to an increase in French bond yields similar to what we saw before the elections. This is definitely something to keep an eye on as the week begins.

ASIA PACIFIC

Looking at the Asia Pacific region, the biggest data releases next week come in the form of Chinese inflation and the Reserve Bank of New Zealand (RBNZ) interest rate decision.

The RBNZ rate decision is likely to be uneventful, as a move from the Central Bank seems improbable. With data remaining inconclusive, holding rates steady aligns with market expectations. Additionally, this meeting will not feature an update to economic projections, which is scheduled for the August 14 meeting.

US

In the US, inflation data will be released as CPI and PPI reports. With indications this week that price pressures are easing, a decline in inflation next week could bolster market participants’ hopes for a September rate cut.

Chart of the Week

The chart I will be focusing on this week is the US Dollar Index (DXY). Following softer data in the US, the DXY has returned to the psychological 105.00 level. The long-term ascending trendline is now back in focus ahead of the US inflation data, making it a key area to watch.

Any indication that inflation is continuing its downward trajectory could facilitate a break of the trendline, putting further downward pressure on the US dollar. Such a scenario could have widespread market implications. Currently, markets are pricing in a 75% chance of a rate cut in September, which could increase if inflation continues to decline.

Conversely, a rise in inflation could help the DXY move away from the 105.00 level and the ascending trendline, potentially reaching 106.00 or even 107.00.

US Dollar Index Daily Chart – July 5, 2024

Source:TradingView.Com (click to enlarge)

Key Levels to Consider:

Support:

- 104.75

- 104.50

- 104.00

- 103.00

Resistance:

- 105.63

- 106.00

- 106.39

- 107.00