Euro dips mildly a in Asian session after French parliamentary elections on Sunday delivered unexpected results. The markets had anticipated a challenging outcome for centrist President Emmanuel Macron, including a hung parliament. Yet, the outcome was particularly surprising for Marine Le Pen’s National Rally. Despite being a frontrunner, her party only secured the third spot. The leftist New Popular Front alliance claimed the top position with over 180 seats. However, no party achieved the absolute majority of 289 seats required to govern alone.

For investors, the fact that a far-right government did not emerge in France is a relief. However, the resulting hung parliament means political gridlock is likely to continue. Macron’s strategy of calling snap elections, following the European parliamentary results, did not deliver the desired outcome. His party remains in a precarious position, lacking the necessary support to advance significant legislative proposals, which adds to the political uncertainty in France.

As the political scene in France unfolds, market’s attention will shift to the US this week. Fed Chair Jerome Powell’s testimony is eagerly awaited, particularly for insights into Fed’s readiness for monetary easing. Additionally, US CPI report due on Thursday is crucial. RBNZ rate decision is another highlight of the week while UK will also publish GDP data.

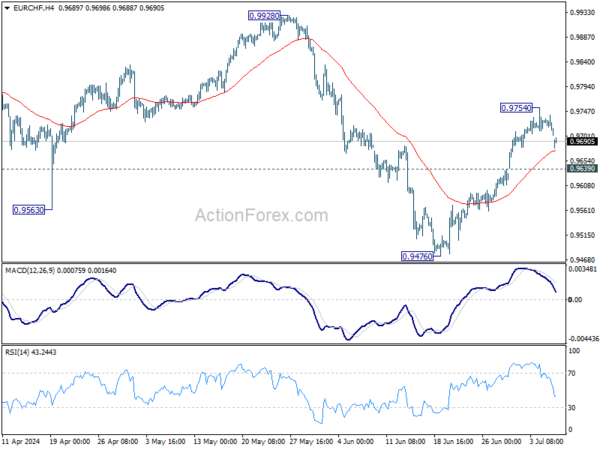

Technically, while EUR/CHF gaps lower as the week starts, selling momentum is limited so far. As long as 0.9639 minor support holds, rise from 0.9476 is still in favor to extend through 0.9754 at a later stage. However, firm break of 0.9639 will argue that the rebound is over, and bring retest of 0.9476 low.

In Asia, at the time of writing, Nikkei is up 0.16%. Hong Kong HSI is down -1.34%. China Shanghai SSE is down -0.53%. Singapore Strait Times is down -0.22%. Japan 10-year JGB yield is up 0.0163 at 1.086.

Japan’s nominal wages rises 1.9% yoy, highest in 11months

Japan’s nominal labor cash earnings increased by 1.9% yoy in May, up from April’s 1.6% growth. Despite this being the 29th consecutive month of growth and the most substantial increase in 11 months, it fell short of the expected 2.1% yoy.

Regular pay saw a notable rise of 2.5% yoy, marking the best pace since January 1993, while overtime pay rebounded by 2.3% yoy, its first increase in six months.

However, these gains in nominal wages are overshadowed by the continued decline in real wages, which fell by -1.4% yoy, marking the 26th consecutive month of decline. This is also a deterioration from the -1.2% yoy drop recorded in April.

Fed Powell’s testimony, US CPI, RBNZ Rate Hold, and UK GDP

This week’s economic calendar, while not overloaded with events, includes several critical occurrences that could significantly influence financial markets across the spectrum, from stocks and bonds to currencies. Among these, the testimony of Fed Chair Jerome Powell and US CPI report are particularly noteworthy.

Powell’s recent comments have indicated that inflation is back on a downward path. However, he emphasized the need for more consistent progress before Fed considers lowering interest rates. This stance will be under intense scrutiny, especially following last week’s weak economic data, which pointed to notable cooling of the US economy. Investors are particularly interested in whether Powell believes Fed is ready to start lowering interest rates by September.

The June CPI data, set for release on Thursday, will further clarify the inflation outlook. Expectations are for the headline CPI to decrease from 3.3% to 3.1%, while core CPI is predicted to remain steady at 3.4%. Any upside surprises could prompt Fed officials to maintain their current cautious stance on policy easing. Additionally, PPI and the University of Michigan Consumer Sentiment Index will be key indicators to watch.

Also on the central bank front, RBNZ will announce its rate decision on Wednesday. The market widely expects the OCR to remain at 5.50%. Despite deepening economic slowdown in New Zealand, RBNZ is unlikely to adjust rates yet, as inflation remains high at 4% in Q1. The central bank’s forecasts do not predict a reduction in the OCR until Q3 2025. There is prospect of RBNZ signaling an early cut, but only after next week’s Q2 CPI release, not at this meeting.

In the UK, GDP data will be a highlight this week, especially following Labour’s landslide victory in last week’s general election. With the political scene now settled, BoE) is poised to deliver its first rate cut of the cycle next month. Markets are currently pricing in more than a 60% chance that BoE will move at its next meeting on August 1. The decision on whether there will be one or more rate cuts this year will hinge on the evolving economic conditions and inflation trends.

Here are some highlights for the week:

- Monday: Germany trade balance; Eurozone Sentix Investor confidence.

- Tuesday: Australia Westpac consumer sentiment, NAB business confidence; Japan machine tool orders.

- Wednesday: Japan PPI; China CPI, PPI; RBNZ rate decision; Italy industrial production.

- Thursday: Japan machine orders; Germany CPI final; UK GDP, production, trade balance; US CPI, jobless claims.

- Friday: New Zealand BNZ manufacturing; China trade balance; Canada building permits; US PPI, U of Michigan consumer sentiment.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 173.79; (P) 174.14; (R1) 174.57; More…

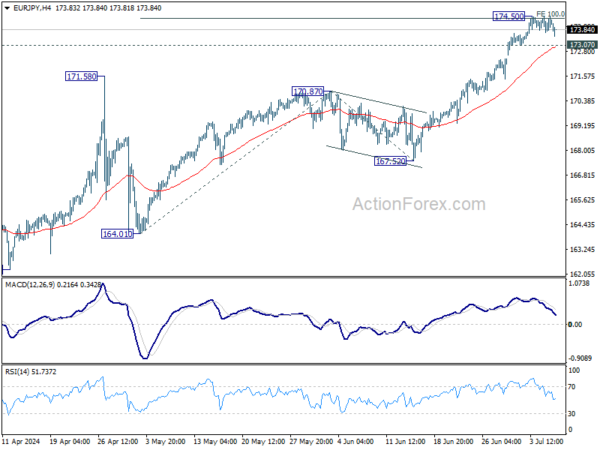

EUR/JPY dips mildly today but stays above 173.07 minor support. Intraday bias remains neutral for the moment. More sideway trading could be seen first. On the upside, firm break of 174.50 will resume the larger up trend and target 138.2% projection of 164.01 to 170.87 from 167.52 at 177.00. On the downside, however, break of 173.07 will turn bias to the downside for deeper pullback.

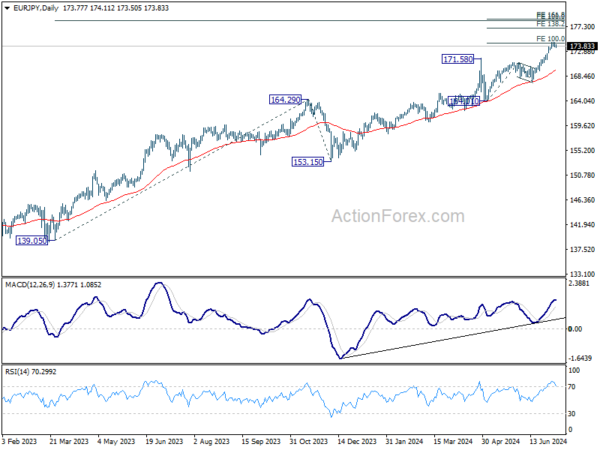

In the bigger picture, long term up trend is still in progress. Next target is 100% projection of 139.05 to 164.29 from 153.15 at 178.38. For now outlook will stay bullish as long as 170.7 resistance turned support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y May | 1.90% | 2.10% | 1.60% | |

| 23:50 | JPY | Bank Lending Y/Y Jun | 3.20% | 3.10% | 3.00% | |

| 23:50 | JPY | Current Account (JPY) May | 2.41T | 2.13T | 2.52T | |

| 05:00 | JPY | Eco Watchers Survey: Current Jun | 47.0 | 46.3 | 45.7 | |

| 06:00 | EUR | Germany Trade Balance (EUR) May | 19.9B | 22.1B | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jul | 0 | 0.3 |