Dollar weakened notably against Sterling and Aussie overnight, but held steady against other currencies. Market focus is now on the upcoming US consumer inflation data, with expectations of a slowdown in the headline CPI and steady core CPI. Fed Chair Jerome Powell’s testimony this week boosted risk sentiment, driving US stocks to record highs. However, the bullish market trend faces a crucial test with today’s inflation data. It’s clear that Fed remains cautious about prematurely cutting rates to guard against inflation resurgence.

Sterling has emerged as the strongest performer this week, propelled by comments from BoE Chief Economist Huw Pill. Pill warned of “uncomfortable strength” in underlying inflation, signaling that an August rate cut is far from certain. The Monetary Policy Committee’s decisions will still hinge heavily on upcoming data.

Elsewhere in the currency markets, Canadian dollar is the second strongest this week so far. Australian Dollar follows as the third strongest, supported by a healthy risk appetite among investors. In contrast, New Zealand dollar remains the weakest, impacted by RBNZ’s dovish stance. Yen is the second weakest, continuing its inverse correlation with Nikkei, which has soared past 42k to new record highs. Swiss franc is the third weakest, facing additional pressure from reversals against other European majors, while Euro and Dollar are positioned in the middle.

Technically, GBP/CHF’s extended rally this week argues that corrective fall from 1.1675 has completed at 1.1216 already. Further rise will now be in favor as long as 1.1448 support holds, for retesting 1.1675 high. Firm break there will resume whole rise from 1.0634 and target 61.8% projection of 1.0634 to 1.1675 from 1.1216 at 1.1859.

In Asia, at the time of writing, Nikkei is up 1.19%. Hong Kong HSI is up 1.64%. China Shanghai SSE is up 0.86%. Singapore Strait Times is up 0.44%. Japan 10-year JGB yield is p 0.0042 at 1.093. Overnight, DOW rose 1.09%. S&P 500 rose 1.02%. NASDAQ rose 1.18%. 10-year yield fell -0.02 to 4.280.

BoE’s Mann foresees inflation bounce after touching 2%

BoE MPC member Catherine Mann, known for her hawkish stance, expressed caution in a speech overnight. Although headline inflation has fallen to 2%, Mann described this as a “touch and go,” predicting that “we’re going to be above 2% for the rest of the year.”

Mann emphasized the need to see a “sustained deceleration” in services inflation, signaling her reluctance to support interest rate cuts at this stage. Her comments suggest she remains committed to resisting rate cuts despite recent data showing headline inflation at the BoE’s 2% target.

Fed’s Cook optimistic on soft landing, pledges vigilance on labor market dynamics

Speaking at an event in Australia today, Fed Governor Lisa Cook expressed optimism about the US economy’s prospects, noting that the data so far appears to be “consistent with a soft landing”. She highlighted that inflation has dropped significantly from its peak levels, and while the labor market has “cooled but remains strong”.

Cook also pointed out that the ratio of job vacancies to unemployment has returned to pre-pandemic levels, and fewer workers are voluntarily quitting their jobs, indicating less confidence in finding better employment opportunities. “My baseline forecast (and that of many outside observers) is that inflation will continue to move toward target over time, without much further rise in unemployment,” she said.

However, Cook underscored Fed’s attentiveness to changes in the unemployment rate, noting that the situation could shift rapidly and that Fed would be “responsive” to such changes.

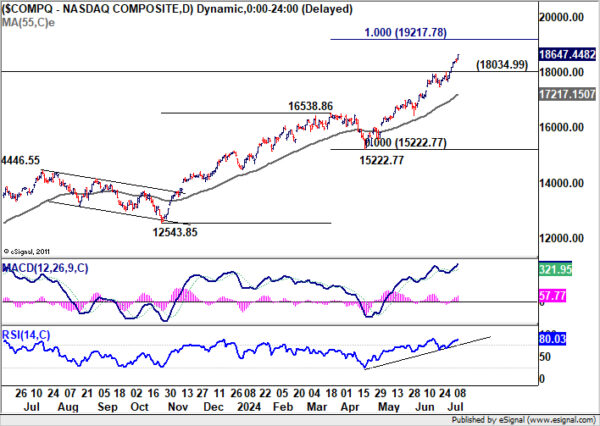

NASDAQ eyes 20k after Powell’s balanced risk remarks

US stocks soared overnight, with NASDAQ and S&P 500 both extending their record runs with gains exceeding 1%. Investors responded positively to Fed Chair Jerome Powell’s two-day semiannual testimony, even though forex markets remained relatively unchanged.

Powell refrained from hinting at the timing of Fed’s first rate cut but acknowledged that the risks to the economy are now more balanced. He emphasized that “elevated inflation is not the only risk,” reinforcing expectations that Fed would move quickly to ease policy if economic and job market conditions show significant signs of cooling.

Technically, near term outlook in NASDAQ will stay bullish as long as 18034.99 resistance turned support holds. Next target is 100% projection of 12543.85 to 16538.86 from 15222.77 at 19217.78.

Or, NASDAQ might be targeting long term target of 100% projection of 6631.42 to 16212.22 from 10088.82 at 19669.62. Or it’s actually targeting 20k psychological level.

In summary, if NASDAQ can stay above 18k mark, a rapid move to 20k could be on the horizon.

Looking ahead

UK GDP is the major focus in European session while production and trade balance will also be released. Germany will release CPI final. Later in the day, US CPI will take center stage along with weekly jobless claims.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6735; (P) 0.6744; (R1) 0.6755; More…

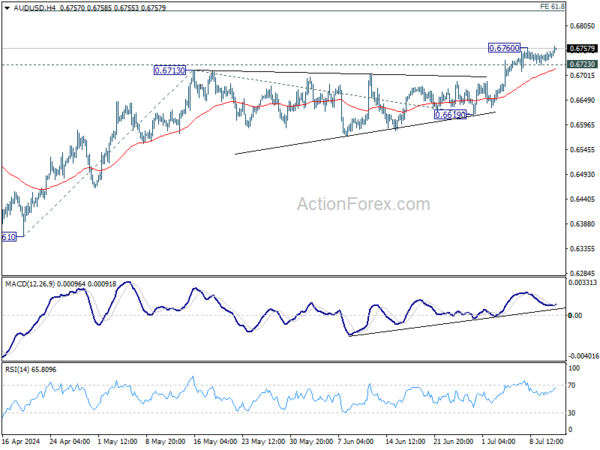

Intraday bias in AUD/USD is back on the upside with breach of 0.6760 temporary top. Rise from 0.6361 is resuming and should target 61.8% projection of 0.6361 to 0.6713 from 0.6619 at 0.6837. On the downside, however, break of 0.6723 minor support will turn bias back to the downside for deeper pullback.

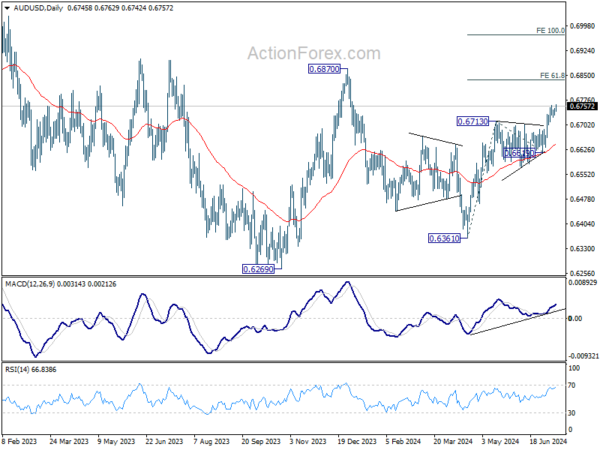

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could have completed at 0.6269 already. Rise from there is seen as the third leg which is now trying to resume through 0.6870 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Jun | -17% | -14% | -17% | |

| 23:50 | JPY | Machinery Orders M/M May | -3.20% | 1.00% | -2.90% | |

| 01:00 | AUD | Consumer Inflation Expectations Jul | 4.30% | 4.40% | ||

| 06:00 | EUR | Germany CPI M/M Jun F | 0.10% | 0.10% | ||

| 06:00 | EUR | Germany CPI Y/Y Jun F | 2.20% | 2.20% | ||

| 06:00 | GBP | GDP M/M May | 0.20% | 0.00% | ||

| 06:00 | GBP | Industrial Production M/M May | 0.30% | -0.90% | ||

| 06:00 | GBP | Industrial Production Y/Y May | 0.60% | -0.40% | ||

| 06:00 | GBP | Manufacturing Production M/M May | 0.30% | -1.40% | ||

| 06:00 | GBP | Manufacturing Production Y/Y May | 1.20% | 0.40% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) May | -16.1B | -19.6B | ||

| 12:30 | USD | Initial Jobless Claims (Jul 5) | 239K | 238K | ||

| 12:30 | USD | CPI M/M Jun | 0.10% | 0.00% | ||

| 12:30 | USD | CPI Y/Y Jun | 3.10% | 3.30% | ||

| 12:30 | USD | CPI Core M/M Jun | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Core Y/Y Jun | 3.40% | 3.40% | ||

| 14:30 | USD | Natural Gas Storage | 56B | 32B |