Dollar tumbled sharply in early US session following lower-than-expected consumer inflation readings. Headline CPI showed its first month-over-month decline since early 2023, while core CPI annual rate unexpectedly slowed to its lowest level since April 2021. Now, a September Fed rate cut is becoming a realistic possibility. Fed fund futures are quick to react and are pricing in near 90% chance of that. Indeed, Fed policymakers might start to rethink whether there would be one rate cut or two rate cuts this year.

Simultaneously, Yen surged across the board following US CPI data. The scale of Yen’s rally against other currencies suggests that Japan might be capitalizing on the current Dollar weakness to intervene and reverse some of Yen’s extended depreciations. Japan has been clear about its readiness to intervene at any time of the day. Also, it has record of acting in the markets strategically, and today’s US CPI data gives it a golden opportunity to act. Now, focus is on whether Yen’s rebound would spiral further higher with other market participants joining in.

Elsewhere in the currency markets, Sterling is currently the second strongest performer. The pound initially led the pack with a rally on stronger-than-expected UK GDP data but has been overshadowed by the ultra-strong Yen. Dollar is the weakest, followed by Canadian Dollar. Other major currencies are finding their positions amid the current high volatility.

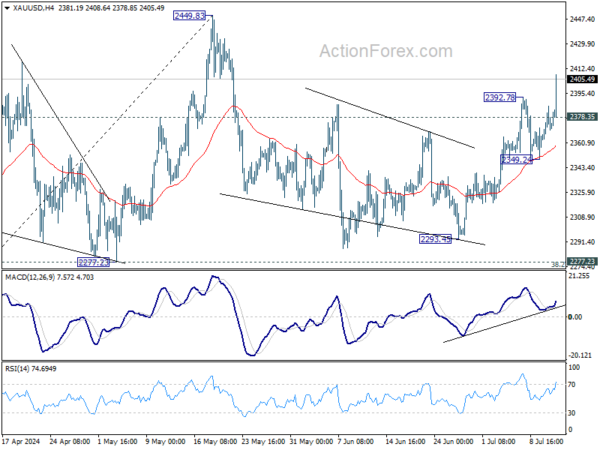

Technically, Gold rally from 2293.45 resumed by breaking through 2392.78 resistance. Current development affirms that case that correction from 2449.83 has completed. Further rise is expected as long as 2378.35 minor support holds. Decisive break of 2449.83 will confirm larger up trend resumption.

In Europe, at the time of writings, FTSE is up 0.36%. DAX is up 0.72%. CAC is up 0.86%. UK 10-year yield is down -0.037 at 4.097. Germany 10-year yield down -0.046 at 2.490. Earlier in Asian, Nikkei rose 0.94%. Hong Kong HSI rose 2.06%. China Shanghai SSE rose 1.06%. Singapore Strait Times rose 0.44%. Japan 10-year JGB yield fell -0.0039 to 1.084.

US core CPI slows to 3.3%, lowest since Apr 2021

In June, US CPI fell -0.1% mom, versus expectation of 0.1% mom rise. Core CPI (all items less food and energy) rose 0.1% mom, below expectation of 0.2% mom rise. Energy index fell -2.0% mom while food index rose 0.2% mom.

For the 12-month period, headline CPI slowed from 3.3% yoy to 3.0%yoy, below expectation of 3.1% yoy. Core CPI slowed from 3.4% yoy to 3.3% yoy, below expectation of being unchanged at 3.4% yoy. Core CPI was also the lowest since April 2021. Energy index was up 1.0% yoy while food index was up 2.2% yoy.

US initial jobless claims falls to 222k vs exp 239k

US initial jobless claims fell -17k to 222k in the week ending July 6, below expectation of 239k. Four-week moving average of initial claims fell -4k to 233.5k.

Continuing claims fell -4k to 1852k in the week ending June 29. Four-week moving average of continuing claims rose 10k to 1840k, highest since December 4, 2021.

UK GDP grows 0.4% mom in May, driven by services

UK GDP grew by 0.4% mom in May, surpassing expectations of 0.2% mom increase. The primary driver of this growth was a 0.3% mom rise in services output, which significantly contributed to the overall monthly GDP increase. Additionally, production output grew by 0.2% mom , while construction output saw a substantial jump of 1.9% mom.

On a broader scale, real GDP is estimated to have grown by 0.9% in the three months leading up to May compared to the previous three months ending in February. This growth was predominantly driven by a 1.1% increase in services output. However, production remained stagnant with no growth, and construction output declined by -0.7%.

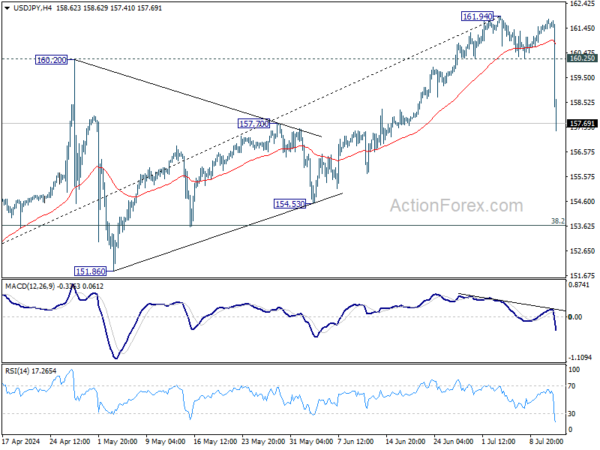

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 161.38; (P) 161.59; (R1) 161.93; More…

USD/JPY declines sharply in early US session and breaks 160.25 support decisively. Considering bearish divergence condition in D MACD, fall from 161.49 might already be correcting the whole five-wave rally from 140.25. Intraday bias is back on the downside. Sustained break of 55 D EMA (now at 157.62) will affirm this bearish case. Next target will be 38.2% retracement of 140.25 to 161.94 at 163.65. Meanwhile, rise will now stay on the downside as long as 160.25 support turned resistance holds, in case of recovery.

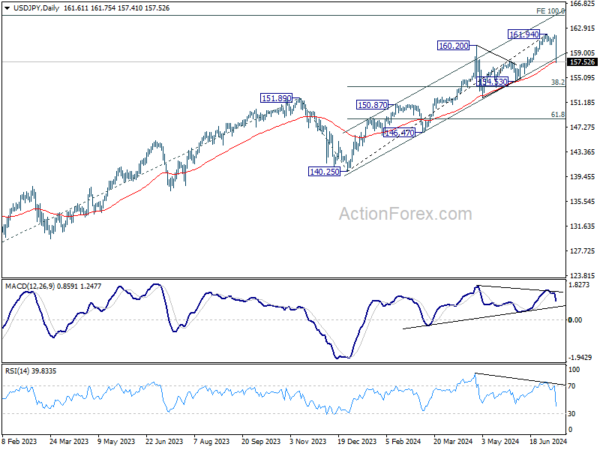

In the bigger picture, long term up trend is still in progress. Further rise is expected as long as 154.53 support holds. Next target is 100% projection of 127.20 (2023 low) to 151.89 (2023 high) from 140.25 at 164.94. However, sustained break of 154.53 will raise the chance of larger scale correction and target 140.25/151.89 support zone.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Jun | -17% | -14% | -17% | |

| 23:50 | JPY | Machinery Orders M/M May | -3.20% | 1.00% | -2.90% | |

| 01:00 | AUD | Consumer Inflation Expectations Jul | 4.30% | 4.40% | ||

| 06:00 | EUR | Germany CPI M/M Jun F | 0.10% | 0.10% | 0.10% | |

| 06:00 | EUR | Germany CPI Y/Y Jun F | 2.20% | 2.20% | 2.20% | |

| 06:00 | GBP | GDP M/M May | 0.40% | 0.20% | 0.00% | |

| 06:00 | GBP | Industrial Production M/M May | 0.20% | 0.30% | -0.90% | |

| 06:00 | GBP | Industrial Production Y/Y May | 0.40% | 0.60% | -0.40% | -0.70% |

| 06:00 | GBP | Manufacturing Production M/M May | 0.40% | 0.30% | -1.40% | -1.60% |

| 06:00 | GBP | Manufacturing Production Y/Y May | 0.60% | 1.20% | 0.40% | -0.40% |

| 06:00 | GBP | Goods Trade Balance (GBP) May | -17.9B | -16.1B | -19.6B | -19.4B |

| 12:30 | USD | Initial Jobless Claims (Jul 5) | 222K | 239K | 238K | 239K |

| 12:30 | USD | CPI M/M Jun | -0.10% | 0.10% | 0.00% | |

| 12:30 | USD | CPI Y/Y Jun | 3.00% | 3.10% | 3.30% | |

| 12:30 | USD | CPI Core M/M Jun | 0.10% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Core Y/Y Jun | 3.30% | 3.40% | 3.40% | |

| 14:30 | USD | Natural Gas Storage | 56B | 32B |