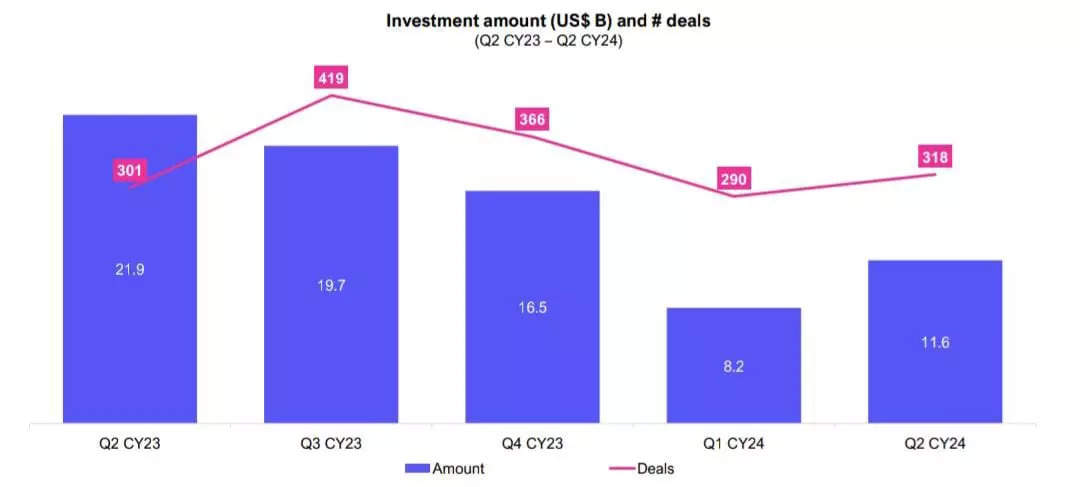

Investments in the second quarter of CY24 have surged, breaking the decline from Q3 CY23 to Q1 CY24. A total of USD 11.6 billion investments were made through 318 deals in Q2 CY24 compared to USD 8.2 billion investments through 290 deals in Q1 CY24, revealed a latest report by 1Lattice.

A total of investments worth USD 21.9 billion was made through 301 deals in the same quarter the previous calendar year (Q2 CY23), while the third and fourth quarter of CY23 saw investments worth USD 19.7 billion through 419 deals and USD 16.5 billion through 366 deals respectively.

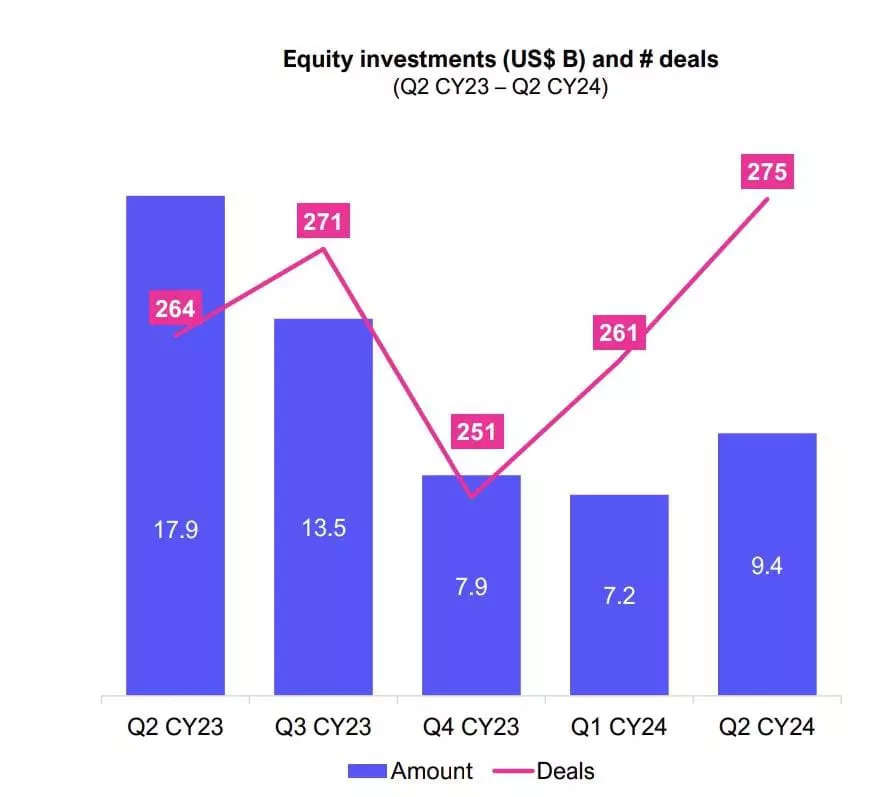

The report further highlighted that USD 9.4 billion was raised through equity investments, while USD 2.2 billion through debt deals in Q2 CY23.

The second quarter of CY24 saw USD 9.4 billion worth equity investments through 275 deals, which is significantly less in value compared to the same quarter last year, recording USD 17.9 billion worth equity investments through 264 deals in Q2 CY23.

ALSO READ: FinTech Funding June 2024: Total $587 mln raised by Indian FinTechs

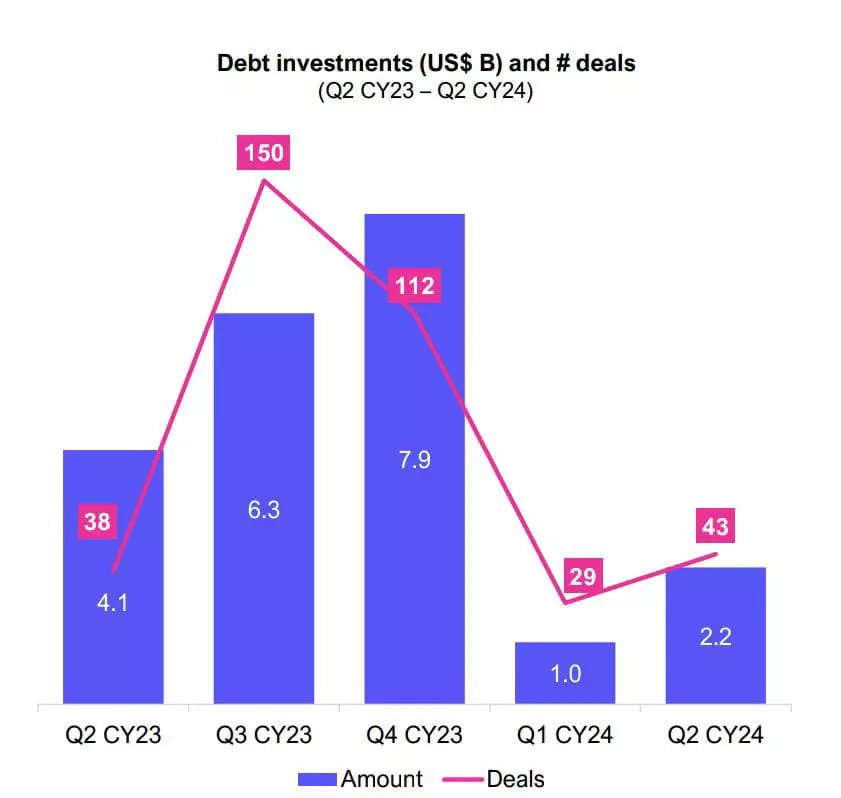

Debt deals across stages

About USD 2.2 billion worth of investments were made through 43 debt deals in Q2 CY24 which is almost half the amount invested in the same quarter the previous year, with investments worth about USD 4.1 billion across 38 debt deals.

Debt deals witnessed a spike from USD 1 billion to approximately USD 2.2 billion compared to the previous quarter, and it is further highlighted by the report that Late-stage deals amounted to about USD 2.1 billion in Q2 CY24.

While there was USD 2.2 billion worth of debt investment deals, about USD 0.8 billion worth investments were made in early stage rounds, USD 1.9 billion worth investments in growth stage rounds, USD 2.1 billion worth investments in late stage rounds and USD 4.5 billion in buyouts or PIPE in Q2 CY24, said the report.

ALSO READ: India ranks 3rd globally for fintech funding despite a slump in H1 FY24: Report

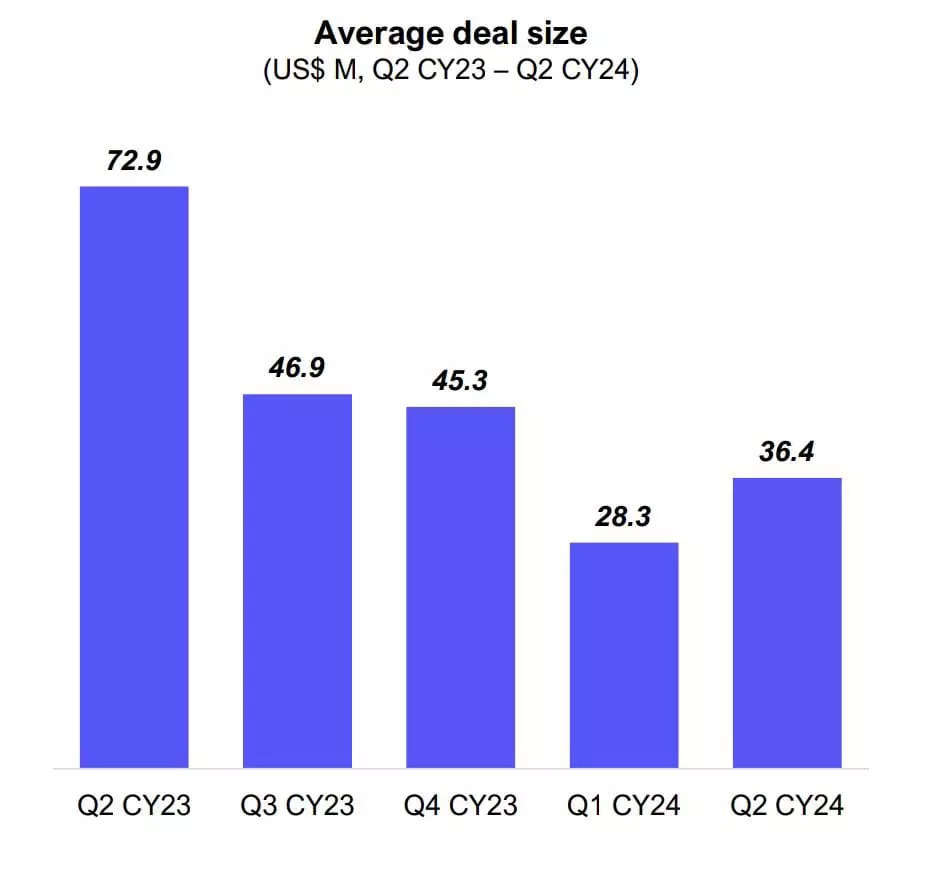

Average deal sizes across quarters

Average deal size rose to USD 36 million from USD 28 million with total deals jumping to 318, up from 290 in Q1 CY24.

The average deal size in Q2 CY24 was USD 36.4 million, up from USD 28.3 million the previous quarter but significantly low from the same quarter last year, with average deal size at USD 72.9 million in Q2 CY23, the report added.

However, the average deal size recorded in the third and fourth quarter of CY23 was USD 46.9 million and USD 45.3 million respectively.