- ECB is not expected to cut in July but will it signal one for next meeting?

- Retail sales will be the main highlight in the United States

- UK CPI report will be vital for BoE’s August decision

- China GDP data to kickstart busy week

ECB meets amid sticky inflation

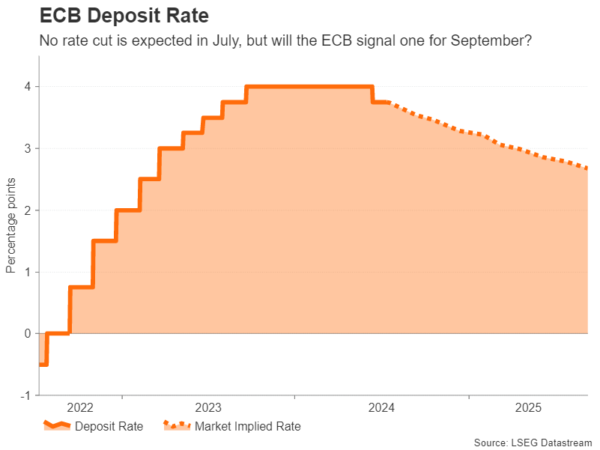

The European Central Bank concludes its two-day policy meeting on Thursday but no change in interest rates is anticipated after trimming them by 25 basis points at last month’s gathering. The June decision proved to be somewhat controversial, as policymakers inadvertently locked themselves into cutting rates before all the data was in. An uptick in both inflation and wage growth right before the meeting was not something that the Governing Council wanted to see, but not cutting rates would probably have been even more embarrassing.

The ECB justified its decision by pointing out the risk of undershooting its inflation target if it waited too long. Since then, inflation has fallen back marginally and there’s indications that pay pressures are cooling even though wage growth remains elevated.

Hence, there seems to be a strong majority for at least one more cut in 2024, but views vary about a third reduction. However, this is a debate for another day and policymakers are almost certain to keep rates unchanged on Thursday and reassess the risks when they regroup in September.

Markets are not fully convinced about a third cut either and if President Lagarde refrains from providing any explicit forward guidance, the euro could extend its recent gains. But should she commit to a cut in September, that would be negative for the single currency.

Markets are not fully convinced about a third cut either and if President Lagarde refrains from providing any explicit forward guidance, the euro could extend its recent gains. But should she commit to a cut in September, that would be negative for the single currency.

Also to keep an eye on next week are the ZEW economic sentiment survey out of Germany on Tuesday, and the final estimates of Eurozone CPI for June on Wednesday.

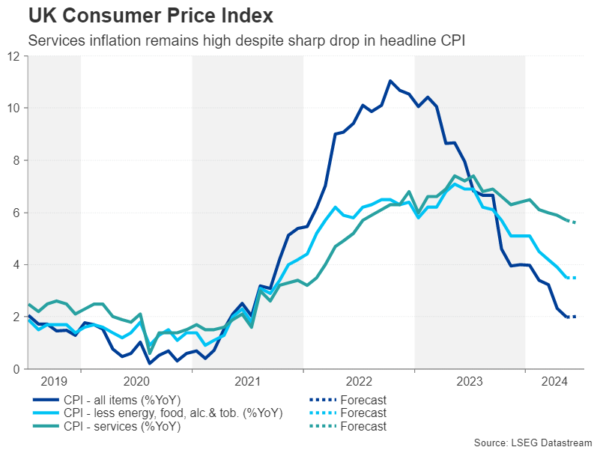

Pound bulls face CPI test

The British pound has been enjoying a sizeable rally in July, helped by a softer US dollar as well as by Labour winning a large majority in the UK general election, ending years of a turmoil under the Tories. But that’s not all. Despite headline inflation falling to the Bank of England’s 2% target in June, services inflation remains too high for comfort at 5.7%, something that the Bank’s chief economist Huw Pill stressed just this week. In addition, with the British economy seeing a revival in growth momentum, there isn’t a very strong urgency to lower rates imminently.

With markets split 50/50 about an August cut and policymakers probably undecided too, next week’s updates on inflation, employment and retail sales could be decisive.

The June CPI report is out first on Wednesday, labour market stats for May will follow on Thursday, and retail sales for June are due on Friday.

Any further moderation in core and services CPI, as well as in wage growth, could seal the deal for an August rate cut, potentially knocking sterling lower. Yet, given the euro’s and yen’s woes, plus the improving outlook for the UK economy, further progress on the inflation front that gives the BoE the green light to cut rates soon might not be too catastrophic for the pound.

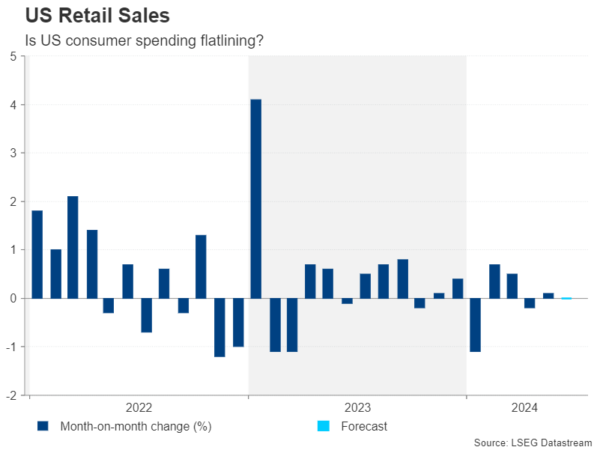

Are US consumers tightening their belts?

Over in the US, the Federal Reserve is also not in a hurry to start slashing rates, but investors are increasingly confident about a move in September. Inflation is edging down again after stalling earlier in the year, while Chair Powell noted that the labour market has cooled lately. Consumer spending also appears to be slowing and there could be more evidence of this in Tuesday’s retail sales figures.

Retail sales are expected to have stayed unchanged at 0.0% m/m in June after rising by just 0.1% in May. Any unexpected bounce back in retail sales could bring a halt to the dollar’s slide.

Investors will also be tracking manufacturing gauges from the New York and Philadelphia Feds on Monday and Thursday, respectively, while on Wednesday, there will be a flurry of releases, including building permits, housing starts and industrial production.

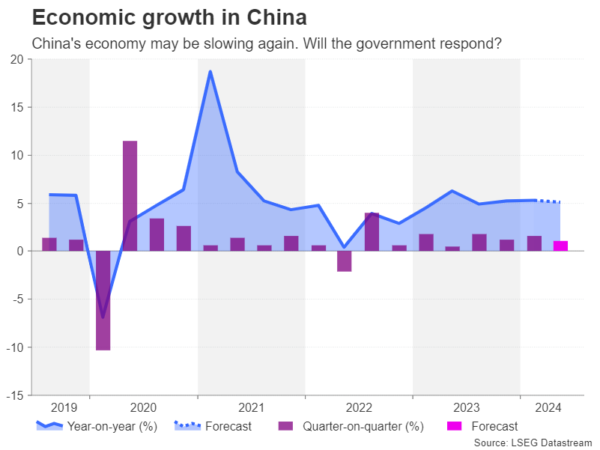

China’s economy likely slowed in Q2

Despite numerous efforts to boost the flagging economy, the Chinese government has been unable to turn things around. Although the downturn in the property market has started to ease, the crisis is far from being over, and the stock market is struggling to recover from a three-year slump.

Investor and consumer confidence therefore remain low, weighing on business and household spending. Industrial production has started to show some signs of life this year, but retail sales have been sluggish. The June readings for both will be watched on Monday alongside the GDP estimate for the second quarter.

China’s economy likely grew by 1.1% on a quarterly basis in the three months to June, a slowdown from the 1.6% pace in the first quarter. The year-on-year rate is also forecast to have eased from 5.3% to 5.1%.

Whilst investors have come to expect less-than-spectacular GDP numbers out of China in recent quarters, a downside surprise could still hurt market sentiment at the start of the trading week, hitting regional stocks and risk-sensitive currencies such as the Australian dollar.

However, a bad set of figures might prompt policymakers to come up with bolder measures. The country’s Communist Party leaders meet on July 15-18 for what is called the Third Plenum, which is typically held every five years, usually in the autumn but was delayed in 2023. The meeting focuses on long-term economic reforms and goals but it’s unclear if it will be followed by any immediate policy responses.

Meanwhile, aussie traders will additionally be monitoring domestic employment numbers on Thursday.

Canada, Japan New Zealand also awaiting CPI data

Inflation in Canada unexpectedly ticked higher in May, dampening hopes for a back-to-back rate cut in July. Unless the June report that’s out on Tuesday points to some easing in price pressures, the Bank of Canada will likely stay on hold at least until September. On the other side of the argument is the weakening of the labour market, which is limiting the loonie’s upside amid the greenback’s broad selloff.

The BoC’s survey on the business outlook due on Monday and Friday’s retail sales data might shed more light on the state of economy but the focus will primarily be on the CPI readings.

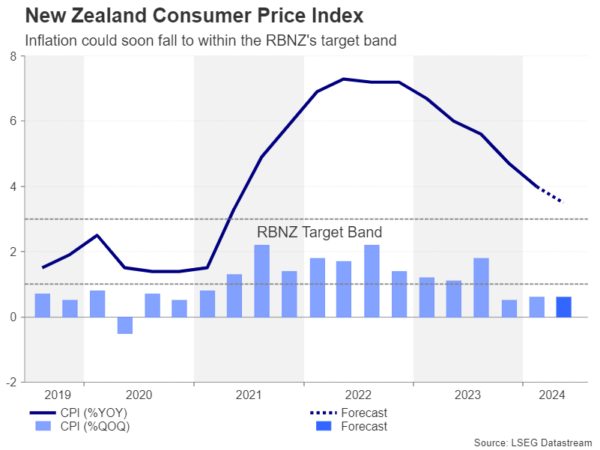

In New Zealand, the quarterly CPI publication on Wednesday will be just as crucial for rate cut bets. The Reserve Bank of New Zealand leaned to the dovish side at its latest meeting, sounding upbeat about the prospect of inflation hitting its 1-3% target band in the second half of the year. The kiwi could face fresh selling pressure if the Q2 CPI print takes the RBNZ one step closer to its target range.

Wrapping up the week on Friday will be Japan’s CPI numbers. As the Bank of Japan’s July 31 meeting approaches, the CPI data will be scrutinized for final clues as to whether a rate hike is likely this month. The BoJ has hinted that the expected announcement on bond tapering at the next gathering should not be seen as putting the rate hike decision on hold. But investors are still not convinced there’s a strong enough case to raise rates further, so any upside surprises in June CPI could lift the yen.